When Export Desires Yield to Domestic Necessities

Indonesia, long regarded as a dependable player in the global LNG market, is now making waves for a different reason. In 2024, the country diverted roughly 50 LNG cargoes—about 17% of its expected exports—for domestic use due to surging internal demand and declining gas production. This strategic redirection of its own supply, rather than turning to imports, signals a fundamental shift in Indonesia’s role in the LNG landscape. With LNG shipments deferred and uncertainty looming over future exports, the ripple effects across international markets could be significant. How will this disruption reshape global flows—and how can the G2M2® Market Simulator for Global Gas and LNG™ help forecast the consequences?

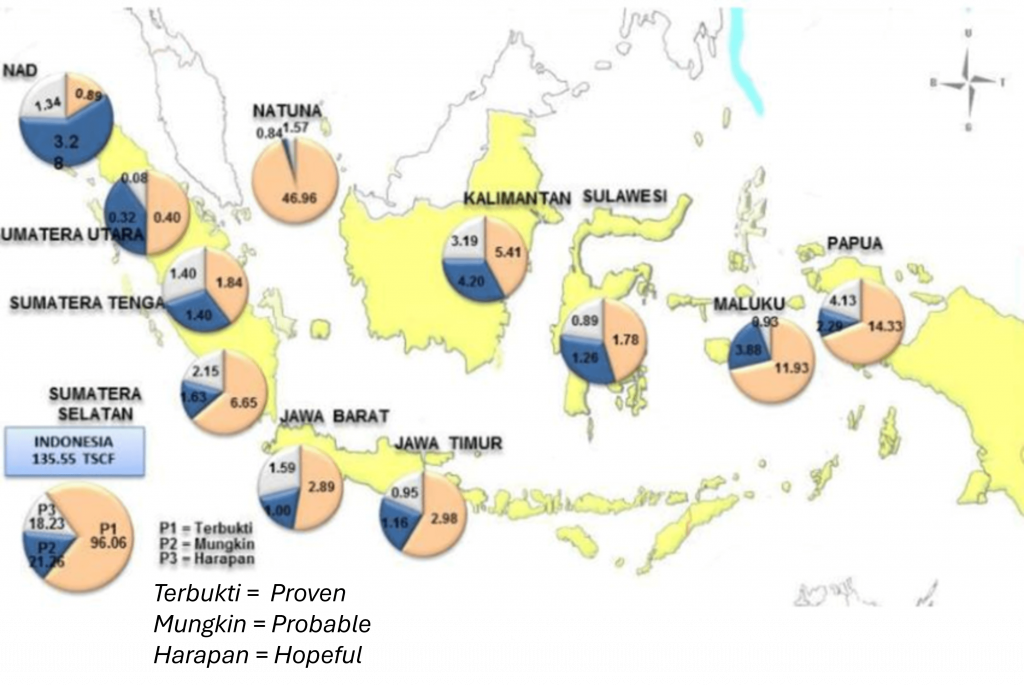

Indonesia’s Energy History

Indonesia is one of the most populous countries in Southeast Asia, currently at 281.19 million. With such a large population, an incredible amount of energy is required to sustain it, and Indonesia has made great progress in increasing energy availability for its citizens. The number of people without reliable access to electricity dropped from 100 million in the year 2000, nearly half the population, to 23 million in 2016, around 9% of the population. This dramatic increase was made possible through government initiatives and increased funding for new infrastructure, though there is still plenty of work to be done for universal access.

This increased access to electricity was also a tricky problem for Indonesian gas producers to solve for the 77 million new customers over a 16-year timeframe. Before new players like the U.S. joined the LNG market, Indonesia was a top 3 LNG exporter making up 9% of the market in 2011. However, Indonesia was running into a major problem: gas production was having difficulty keeping up with both domestic demand and LNG export demand.

Transformation of Indonesia’s LNG Industry

In 2011 the government began implementing new policies to secure supplies for the domestic market. This included a policy that new export terminals would be required to not only provide LNG for the global market, but also to send LNG across the Indonesian islands. One example of this is the Donggi-Senoro LNG terminal receiving government approval only after it was mandated that 30% of its exports were to be for domestic consumption. Similar requirements were made for the Masela FLNG, Bontang LNG, and Arun LNG. Masela FLNG had the same 30% requirement, Bontang LNG was planned to be shifted to cater to the domestic market after a decade of service, and Arun LNG eventually was going to be transformed from an export terminal into an import terminal.

Current State of Indonesia’s Energy Industry

At the end of 2024 and beginning of 2025, Indonesia’s energy industry was faced with a level of domestic demand so high that production could not keep up. This resulted in having to redirect LNG production meant for export to be used for domestic consumption instead. Indonesia also had to import a small amount of LNG, 1.2 BCF, from the United States in 2024. Indonesia and the United States have long had an LNG trade relationship with Indonesia having imported 14.2 BCF since 2016. However, this time around most of Indonesia’s unexpected demand was met through exporting LNG to itself. It was estimated that, “The equivalent of 50 LNG shipments for domestic consumption”, would need to be retained and that this delay in exports could last even longer through 2026. The 50 LNG cargoes would lower the annual amount exported by nearly 17%. In January of 2025, Indonesia was in the process of reviewing LNG exports for the remainder of the year to see how already signed contracts would be impacted by rising domestic needs and production shortages. It currently remains unclear how future exports will be affected and if any more cargo intended for export would need to be diverted to the domestic market.

The current outlook for production isn’t very positive; as the Ministry of Energy and Mineral Resources noted, “natural gas production is predicted to decline due to the natural decline of existing gas wells.”

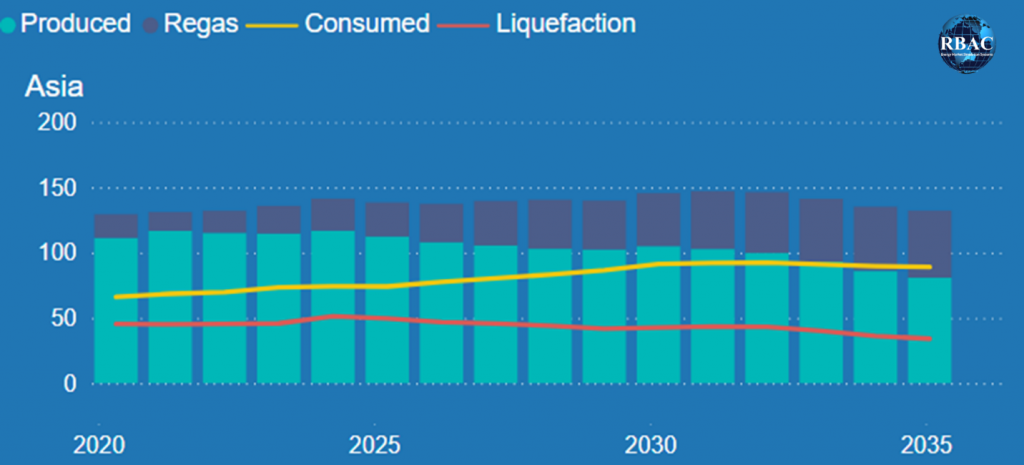

Production further declined in 2024 to 116 BCM and could fall to 80 BCM over the next decade. However, Indonesia’s decreasing production will be supplemented by an increase in LNG imports, which during the same period are expected to rise from 24 BCM to 51 BCM. Consumption is also expected to rise nearly 15 BCM whereas liquefaction falls to 17 BCM.

As part of efforts to solve both domestic and export demand, “The Indonesian government has announced plans to increase oil and gas production in the country, by cutting regulations, reactivating idle wells and enhancing output at already producing assets. The government notably plans to reactivate 5,000 idle wells and increase output by 200 KB/D.” There are also other measures being taken such as new oil and gas blocks being offered to investors over the next few years and cutting the number of permits needed for exploration projects in half. The end goal is to revive not only natural gas production, but also oil and NGLs which have declined at a similar rate.

Increasing Domestic Gas Production

The Gehem and Geng North fields are two new gas fields which ENI is looking to invest in to create a production hub with an output capacity of 2 BCF/D. This is part of what’s known as the Indonesia Deepwater Development (IDD) project. Two other fields being developed are the Gendalo and Gandang fields which are estimated to hold 2 TCF of gas reserves. All of these developments would combine to become a new production hub which would include new pipelines, gas field developments, as well as a new floating production and storage facility. According to ENI, “Processed gas would be transported onshore to the Santan Terminal and the East Kalimantan pipeline network. Some of the gas would be liquefied at the Bontang facility while some would be delivered to the domestic market.”

Current LNG Developments

In conjunction with projects to revitalize natural gas production, there are also several LNG related projects already in the works, such as the Abadi LNG project, which finally seems to be on-track, with FID expected in 2027 and production to start early 2030s if go-ahead is given, and which would add 9.5 MTPA worth of LNG and 150 MCFD of pipeline gas.

There are also efforts in the power sector to replace diesel fueled power with LNG, with the aim of reducing fuel costs and improving energy security. Through a $1.5 billion initiative led by PLN and its subsidiary PLN EPI, the country plans to convert 41 diesel power plants—primarily in eastern Indonesia—with a combined capacity of 2,148 MW to run on LNG. This will be supported by small-scale LNG distribution and regasification infrastructure, expected to be operational between 2026 and 2027. Additionally, PLN has partnered with private energy companies to build LNG infrastructure across Sulawesi and Maluku as apparently the first foray into this larger project of replacing diesel power.

Impact of Recent Tariffs on Indonesian LNG Trade

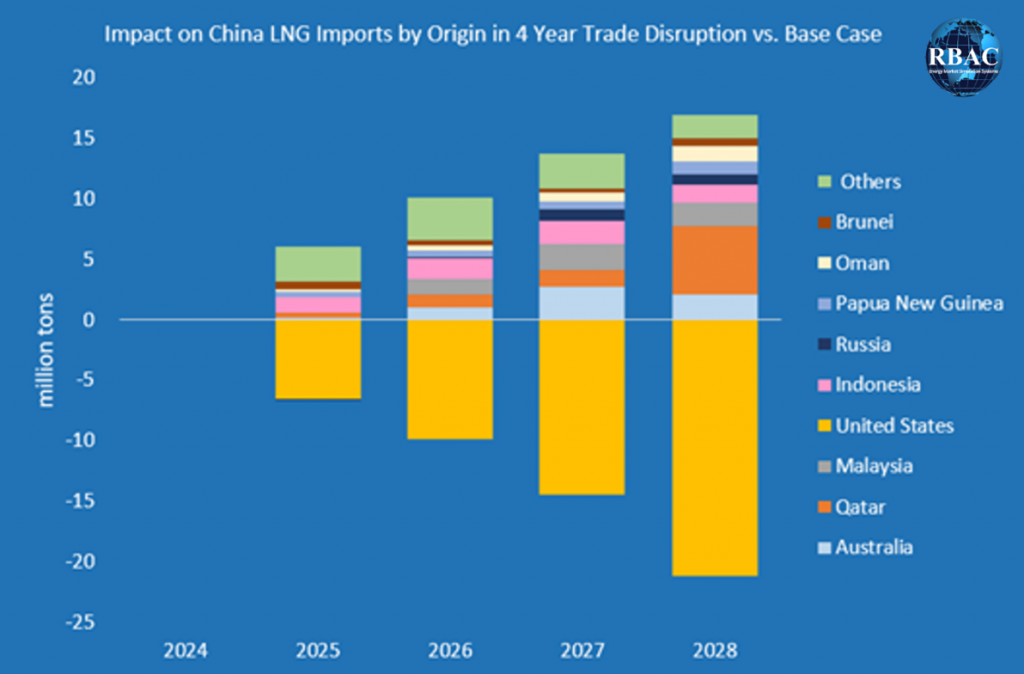

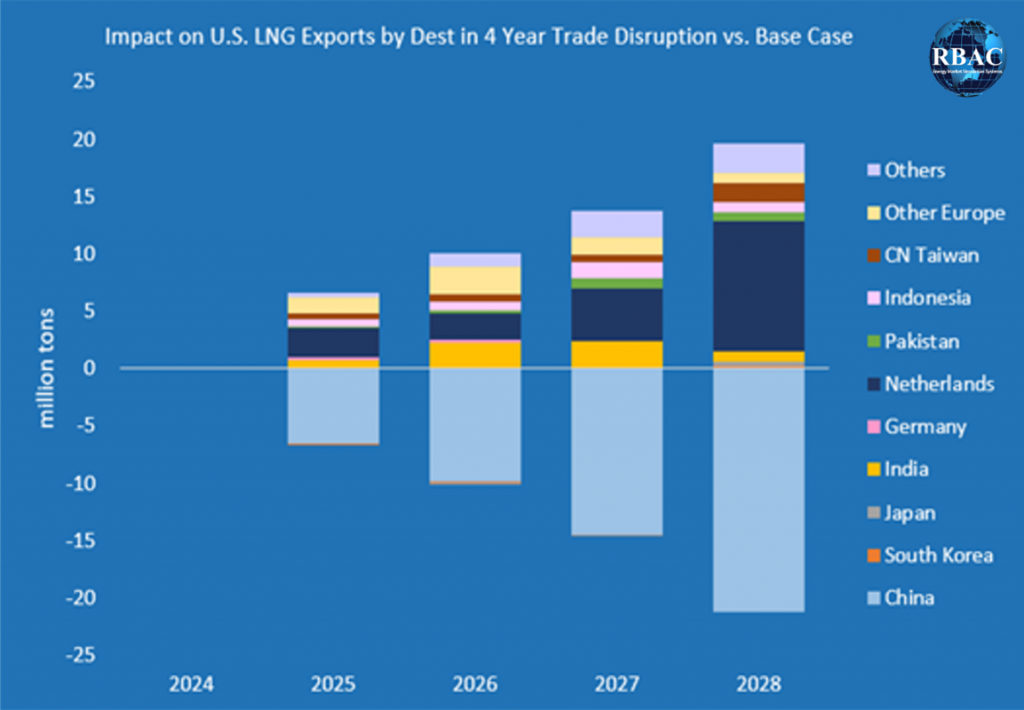

The ongoing trade war between the United States and China has had vast effects on not only LNG trade, but all global trade. As mentioned in a recent article from RBAC covering the LNG trade disruption between these two market powerhouses, Indonesia could potentially benefit from these uncertain times. Scenarios were run utilizing the G2M2® Market Simulator for Global Gas and LNG™ to see where excess U.S. LNG would flow to due to a total halt in U.S. LNG imports into China. Indonesia ended up a winner on both sides of the coin.

Figure 4 above shows countries China would be importing LNG from in the LNG trade disruption scenario. Indonesia would see increased LNG exports to China. Figure 5 below shows where the excess U.S. LNG exports would flow. Some would go to Indonesia, perhaps covering part of its domestic shortfall.

As increasing LNG imports is one of the options Indonesia was already looking at, due to domestic production issues, this could present a great opportunity.

Coal and Natural Gas in the Energy Mix

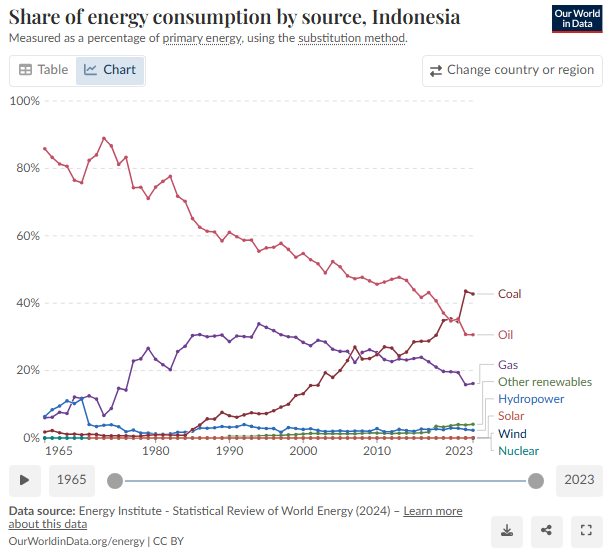

Historically, Indonesia’s energy mix has largely been based on coal, oil, and natural gas. These three fuels comprised nearly 90% of the energy within the country. In recent years, coal usage has increased and became the top fuel source replacing oil in 2021.

Yet, coal may not be king forever with the announcement of plans to phase out coal by 2040. Indonesia does have plans to increase the presence of renewables and has some aggressive goals for the energy transition. However, as we have seen with several other countries, even with large capital investments, unless energy security and energy costs are thoroughly kept in mind, lofty goals can get derailed and progress stymied, especially in a country which still does not have universal access to energy.

Indonesia currently plans to phase out coal in favor of investing in natural gas, LNG, and renewables. It is a common decarbonization strategy where natural gas serves as a bridge between net zero aspirations and higher emission fuels such as coal. Natural gas also has been playing a major role globally in balancing the intermittency of renewables. Time will tell how things end up shaking out, but for now natural gas will continue crucial to the Indonesian energy mix.

Indonesia’s energy outlook in 2025

The outlook for the country of more than 17,000 islands, 6,000 of which are inhabited, is defined by urgent rebalancing, strategic infrastructure development, and assertive state policy. While natural gas (and LNG) remains a core pillar of its energy strategy, shifts in domestic demand, regulatory frameworks, and global market dynamics suggest the next couple of years ahead will be pivotal for Southeast Asia’s largest energy producer. Opportunities will exist for Indonesia as well as global players if they can get their head around the ongoing changes and well understand their impacts.

In Summary

With Indonesia already being a major exporter in the global LNG market, potential production expansions can lead to large shifts in the market. How these shifts can be forecast through scenario analysis must be done with a market model which can simulate the market under these various conditions, and which is trusted by the energy industry.

RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can assist energy professionals, executives, analysts and policy makers to find the best ways to achieve energy security, as well as better investments, both in supply and production, through robust market analysis and better strategic decisions.

Interested in learning more about G2M2? Contact us here for more information and to schedule a free demonstration.

RBAC is the market-leading supplier of global and regional gas and LNG market simulation systems used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG market dynamics and is vital to fully grasp and leverage the interrelationship between the North American and global gas markets.