RBAC and JLC Give Special Seminar in Singapore

Singapore: the most bustling LNG trading hub in Asia was host to “LNG Market Insights for Asia—Charting the Course: LNG Market Dynamics Unveiled,” a seminar bringing together decades of experience and expertise, and packing the hall with energy industry professionals, executives and decision-makers, all set against the backdrop of the city’s dynamic skyline.

The seminar, orchestrated in partnership with JLC, dove into market trends and dynamics, and painted a vivid picture of the possibilities that lie ahead under various scenarios using RBAC’s market simulation tools. And by all accounts, it was nothing short of a resounding success.

Expertise and Leadership

First to take the stage was Dr. Robert Brooks, who has been in the industry for decades and the CEO of RBAC for over 25 years. His presentation, powered by the innovative G2M2® Market Simulator for Global Gas and LNG™, offered a broad view of key markets across North America, Europe, and Asia.

Dr. Brooks’s presented a comprehensive outlook for the global market spanning both short and long-term horizons, addressing critical topics such as:

- Short-term (up to 2027)

- Gas Supply Demand Balance

- LNG Production and Regasification

- LNG Supply – Demand Balance

- Waterway Use – Effect on Flows of Red Sea Risk

- Hub Prices

- Long-term (up to 2050)

- Gas Production by Region

- LNG Production by Region

- Hub Prices

In terms of how global LNG production is expected to evolve, the United States will likely continue its dominance in the space as the top LNG producer. However, a new second place producer may be crowned as the Middle East is expected to pass Australasia in LNG production by 2026.

Next to take the stage was JLC’s Executive Vice President, David Zhou. Mr. Zhou provided an all-inclusive analysis of China’s natural gas market in 2023 as well as forecasts for 2024 and beyond.

His presentation gave incredible insight into the current state and the future of one of the most important countries to the natural gas and LNG market with a variety of metrics such as:

- Natural Gas Demand by Sector and by Region

- Natural Gas Supply and Production

- LNG Imports and Prices

- LNG Infrastructure

Overall, China’s demand for natural gas is expected to continue rapidly growing with a 28 bcm increase in 2024 compared to 2023.

Finally, Ms. Jiaxin Yang, Senior Global Gas Market Analyst with RBAC rounded out the discussion with an insightful talk on trade across the Pacific.

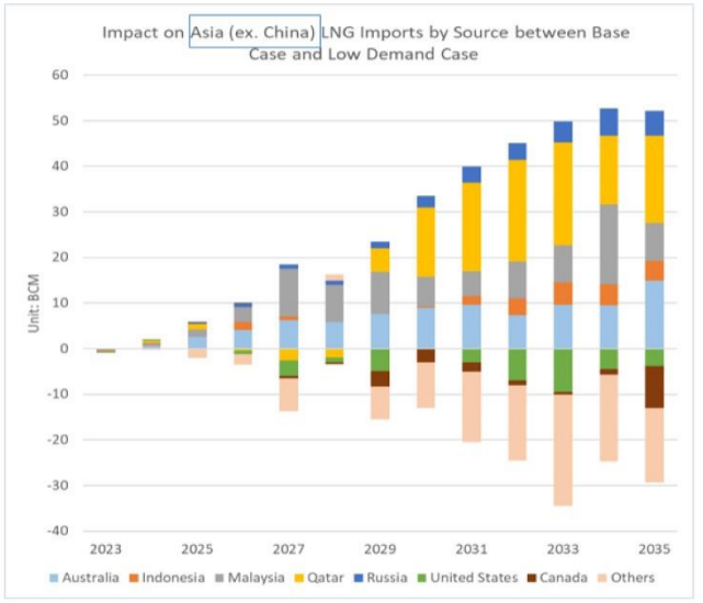

Jiaxin Yang’s presentation zeroed in on the intricate relationship between China and the United States, two titans at opposite ends of the LNG trade, dissecting LNG flows and the factors that affect them, and through various market scenarios using G2M2, exploring their potential ripple effects on supply, demand, prices, and the global flow of LNG:

- The ramifications of a low growth rate in China’s gas consumption

- The global impact if planned U.S. LNG export projects were shelved

- The consequences of disruptions to gas facilities within Ukraine

In the event that China’s LNG demand were to decrease for any reason, LNG that would be going to China would instead flow to other parts of Asia and Europe.

It is with market simulation tools such as G2M2 that both companies and countries can ensure that they are aware of all potential reverberations in the market that could arise from any decisions made related to energy. G2M2 can be used to determine what could happen in the short-, medium-, and long-term as well as to better understand the global natural gas and LNG market as a whole.

Interested in the full presentations from the conference or more information about G2M2?

Contact us with any questions.