LNG Action Around the Globe

We present this month insights and commentary covering North America and the Global Natural Gas market in this new edition of our newsletter.

With geopolitics flaring in various areas around the world, all eyes have been on the global market. Whatever risks near the Strait of Hormuz, the LNG market has weathered the near storm conditions and carried on. A bit further south, several LNG supply deals sealed by Oman LNG L.L.C. with various suppliers. Meanwhile, the markets in Asia were active earlier on in the spot market as they took advantage of lower than usual prices to secure much needed gas supply.

We have a quick brief on the current status of the long awaited Mountain Valley Pipeline; Takeaways from the 30th edition of the FLAME conference; Commentary on Spain’s future role within the energy ecosystems of Europe and Africa; and last but not least discussion on if Vietnam will be able to eventually move away from coal and what this would entail for its overall energy mix.

We hope you enjoy these articles and interviews, and they give you greater insight into the energy market and industry all with the goal of increasing your knowledge and helping you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief – Mountain Valley Pipeline New Approval Request

Mountain Valley Pipeline has filed a request with Federal Energy Regulatory Commission for approval no later than May 23, 2024, to commence operation. This much anticipated project was designed to transport Appalachian supply into Transco Station 165 with a capacity of 2 bcf/d.

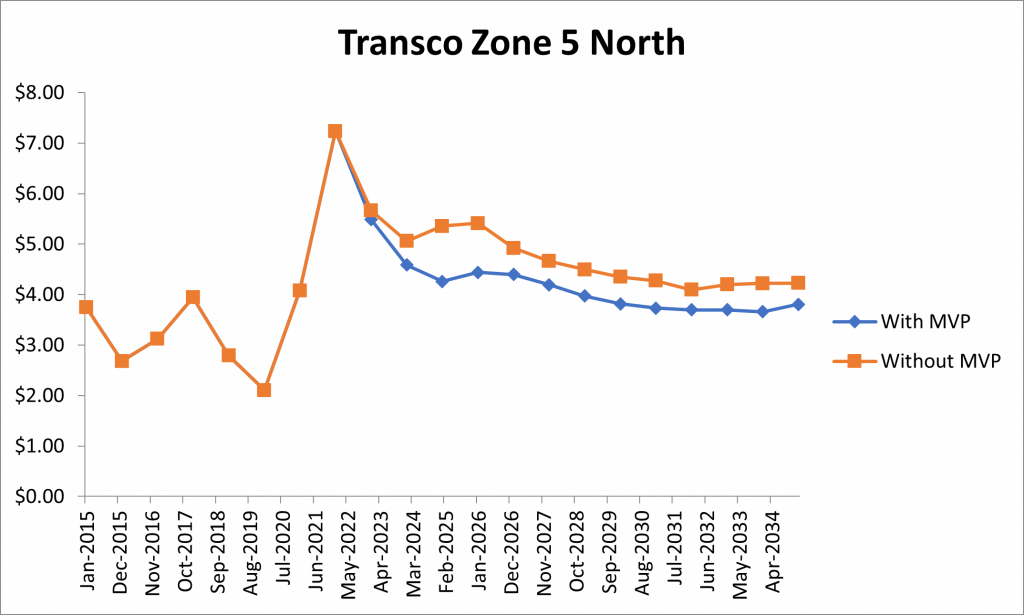

Scenarios ran by Robert Kachmar using GPCM® Market Simulator for North American Gas and LNG™ have shown that prices within Transco Zone 5 North could fall slightly resulting in lower costs for consumers in the region.

In addition to the MVP, there is also the proposed MVP South Gate expansion which, “Promises to pass along similar cost reductions to an even larger population in Virginia and North Carolina.” However, with constant construction delays, court battles, and rising costs of the project, the status of the pipeline is practically always in a state of flux and this new approval appeal is just another hurdle to overcome on the long road to beginning operation.

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

On the Ground at the FLAME Conference

At the 30th anniversary of the FLAME Conference in Amsterdam, RBAC’s COO, James Brooks, met with energy industry colleagues to discuss the state of the energy transition, geopolitics and the role natural gas and LNG will play in a lower carbon future.

Read here: FLAME Conference 2024 Takeaways

Spain’s Role as a Natural Gas Importer and Re-Exporter

Can Spain cement itself as another bridge between Africa and Europe? Can they successfully build upon existing relations with Algeria and foster new opportunities in West Africa to serve as a gateway between these two continents? With increased focus and investments in natural gas and LNG, how will this interplay work out and what will Spain’s place be in the global gas market?

Read here: Spain’s Role as a Natural Gas Importer and Re-Exporter

Can Vietnam Make the Coal-to-Gas Switch?

Vietnam is committed to increasing the presence of natural gas and LNG in their energy portfolio and for these fuels to become the foundation alongside renewables. Even companies such as Mitsui & Co., Ltd. are investing $740 million dollars into Vietnam’s natural gas industry. Where will all this excitement and interest lead? How will Vietnam’s entry into LNG shape not only the regional market in Asia, but the global market as well?

Read here: Can Vietnam Make the Coal-to-Gas Switch?

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Simulation vs Modeling vs Forecasting

Our industry leading GPCM Market Simulator for North American Gas and LNG has allowed users to “model” the natural gas market and “simulate” what could actually happen in the natural gas market under various scenarios and conditions, and using the results of such simulations, analysts can add their market intelligence to produce their outlooks or “natural gas market forecast.”

Naturally then one might ask, what is the difference between “market simulation”, “market modeling”, and “market forecasting”?

Read here.

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Economics and Climate Change

“In particular it will be necessary for African countries to exploit their natural gas reserves if they want to industrialize… And every African government I know has said that they want to develop and want to become less poor and want to industrialize and become sort of part of the modern economy.” Vijaya Ramachandran, Dir for Energy and Development, The Breakthrough Institute.

Read here

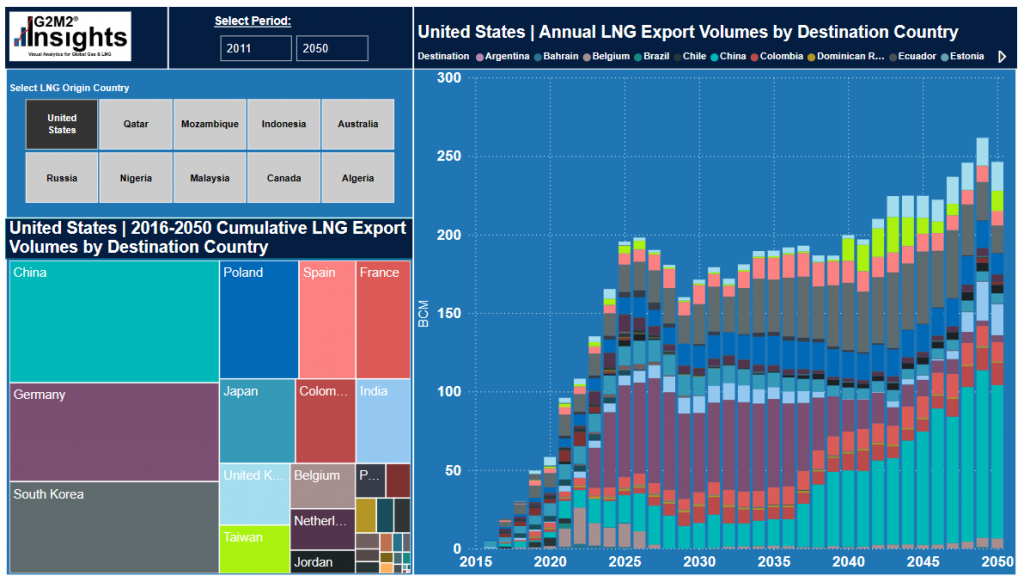

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.