Can Iran Catch Up in the Race to Dominate the World's Largest Gas Field?

In 2022 Iran released a 5-year development plan which shaped the overall strategy for the country across a variety of sectors. One of these sectors was energy, and specifically oil and gas. Taking advantage of some of the largest gas fields in the world, Iran is committing $120 billion USD towards increasing oil and gas production capacity. A majority of this budget is going towards natural gas developments in the South Pars field. Iran is well known for oil production, but could it become a player in global LNG? Adding another major producer/exporter of natural gas could shake up the market, but the question is, by how much?

At present, despite possessing vast reserves of gas, Iran has not been making the most out of it for domestic use or export. And it’s looking to change that—though it may not be so easy.

The South Pars/North Dome gas field is by far the largest gas field in the world with ownership of the area shared between Iran and Qatar. (See figure 1 below, map of Iran’s oil and gas pipeline network and the location of its oil and gas fields.)

One important part of Iran’s energy infrastructure that may have contributed to the frequent shortages is the overall structure of its pipeline network. Major population centers are both far away from the major producing fields and lack the connections to consistently meet the demand for gas within these cities. With plentiful reserves available, a more robust pipeline network coupled with increased production from its natural gas fields would do wonders to help the country avoid future shortages.

Now, Iran may be taking a leaf out of Qatar’s book in attempts to both stimulate the economy and alleviate energy shortages. Back in February 2024, a mere month after then President Biden announced an “LNG pause” (which was just lifted by President Trump on his first day as president), Qatar announced vast expansion of its LNG capabilities, to almost double their current capacity.

As covered previously, Qatar has spent decades developing these shared gas fields; meanwhile Iran has been lagging behind. Moreover, Iran is geopolitically in a vastly different position than Qatar is.

Both countries aim to utilize the resources within the field to strengthen their economies, but before Iran can look towards the future plans of developing its gas offshore export infrastructure, it must first deal with current energy related issues present within the country.

Despite natural gas being domestically available in large quantities, Iran could soon be forced to become an importer due to rampant power blackouts and industrial shutdowns caused by shortages of natural gas. Unfortunately, blackouts aren’t new for Iran and they have been occurring regularly over the last few years. And this is a cause of concern for the administration considering the consequences of such in Syria, Egypt, et al.

Iran’s Domestic Gas Production and Demand

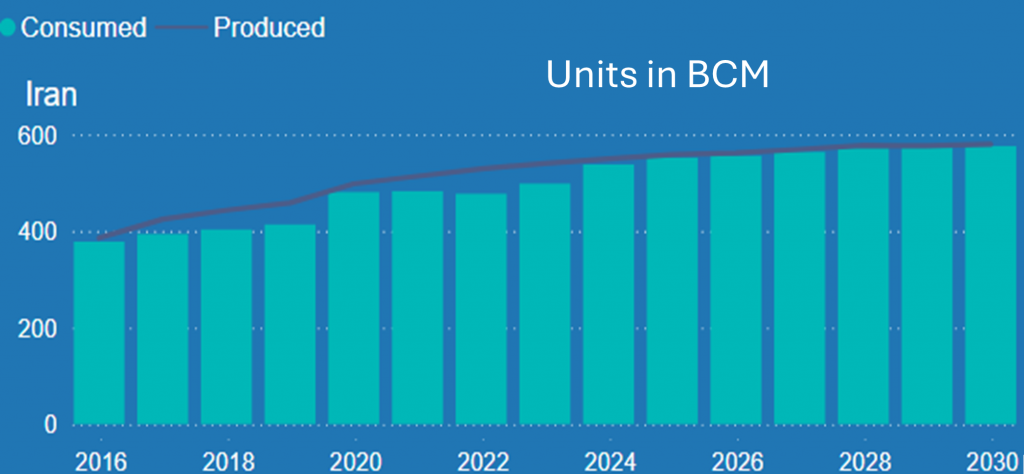

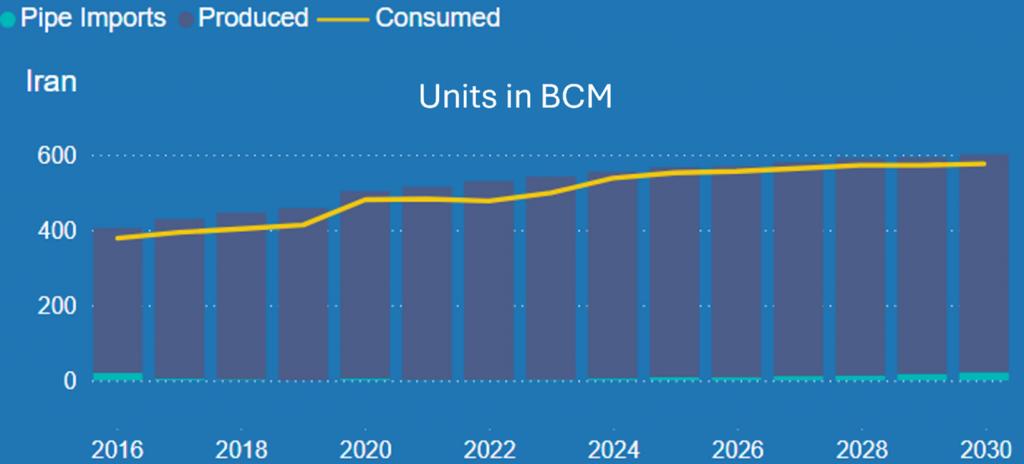

Though Iran’s gas production has been increasing steadily over the past 20 years, demand is quickly outpacing supply.

Production in 2023 only exceeded consumption by 20 bcm and in 2024 this gap is expected to drop to just 4 bcm. This effectively leaves little room for any unexpected surges in demand. Despite massive reserves available, Iran is potentially exposed to risk and would have to resort to imports from either pipelines or LNG. However, Iran does not currently have any LNG import infrastructure in place nor does it have plans to construct any.

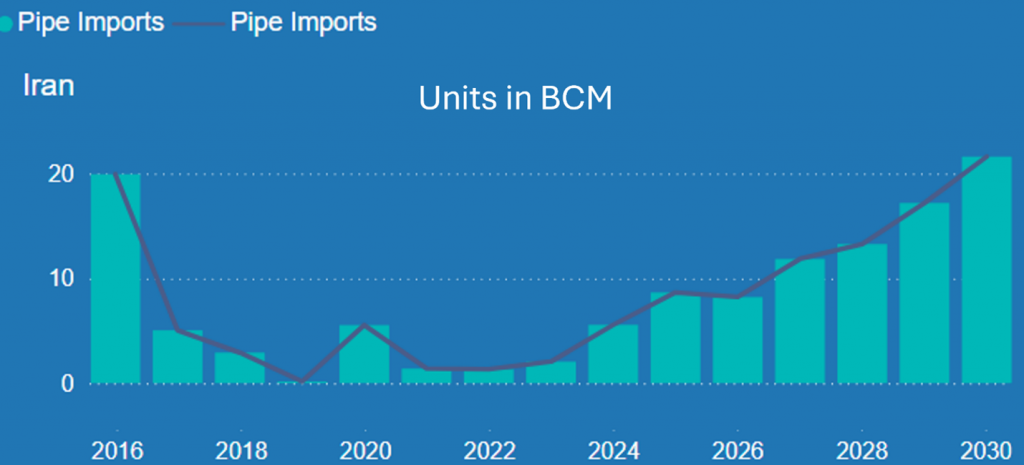

Iran had been tapering off pipeline imports between 2016 to 2020, but that trend has reversed and if action is not taken, imports are forecast to dramatically increase over the next 5 years to cover a potential shortfall.

Iran is currently importing gas from such countries as Turkmenistan, Russia, Azerbaijan, and Italy. Russia has even proposed a brand-new pipeline to Iran which would have the capacity to deliver up to 55 bcm of gas annually. However, this is still just a proposal at current and no timeframe for the project has been given. In addition to receiving imports, gas transit through Iran also takes place. For example, gas from Turkmenistan enroute to Azerbaijan flows through Iran.

All this importing of natural gas begs the question, why is a country with the second largest proven natural gas reserves importing natural gas? Reports, such as this, say instead of prioritizing infrastructure development, it had other geopolitical priorities for its immense oil revenues.

Be that as it may, it will take time for investments in Iran’s domestic gas production to bear fruit and help alleviate the outages country wide. And it would be of great benefit to Iran for these issues to be resolved as soon as possible, not only for the benefit of its citizens and economy, but also for Iran’s end goal of becoming an LNG exporter.

Iran’s LNG Export Ambitions

Currently, Iran has no LNG export or import capacity, but it does have an export facility under construction and by 2026 is expecting to begin exporting. This terminal is known as the Iran NIOC LNG terminal and has been a proposal for a long time. Construction started in 2007 but was cancelled a few years later due to sanctions at the time affecting the viability of the project.

Fast forward 10 years later, TotalEnergies attempted to negotiate a proposal to buy stake in the facility. However, this negotiation stalled and did not end up happening. In 2023, interest in the project was again revitalized and construction restarted reaching “nearly 50% complete” in September of that year. The project is set to consist of three trains with trains 1 and 2 coming online in 2025 with train 3 in 2026. The first two would have a combined capacity of 10.8 mtpa with the third having 1.5 mtpa.

Despite Iran’s apparent willingness to invest in LNG there are still underlying concerns about domestic production not meeting current demand, leading to frequent outages. But per S&P Global, Iran’s deputy minister for engineering, research and technology at the Ministry of Petroleum said that in addition to export, a “second [reason for LNG] is related to balancing of natural gas in winters in Iran,” and “producing LNG in summer would help the country to use it in winter for heating.”

Still, there is the possibility of further sanctions inhibiting Iran’s ability to export and thus the viability of the project, as has happened frequently in the past. Even if the project is completed, there are no signed contracts for such LNG and its options, barring some ease of sanctions accompanying political détente, are likely to be severely limited.

Yet, Iran does have the potential to be a major supplier of natural gas and LNG in the global market, but first it has to get a handle on its internal domestic market before it can look to begin exporting.

RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is an indispensable tool for modeling and forecasting to anyone looking to see how the potential addition of Iran’s gas supply to the global supply chain would affect LNG flows in regional and global markets.

G2M2 can assist energy professionals, executives, analysts and policy makers to find the best ways to achieve energy security, as well as better investments, both in supply and production, through robust market analysis and better strategic decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.