Those familiar with RBAC may have read we have been in the business of Energy Market Simulation Systems since 1997. Our industry-leading GPCM Market Simulator for North American Gas and LNG has allowed users to “model” the natural gas market and “simulate” what could actually happen in the natural gas market under various scenarios and conditions, and using the results of such simulations, analysts can add their market intelligence to produce their outlooks or “natural gas market forecast.”

Naturally then one might ask, what is the difference between “market simulation”, “market modeling”, and “market forecasting”?

Market Simulation:

“Market simulation” involves creating a mathematical system that is “similar” in operation to that of the market being represented. It has objects which correspond to objects in the marketplace. It has operations similar to those in the actual market. It functions in a similar way to that of the market. It is often used to see what might happen if some change were to be made or to occur in the market.

Market Modeling:

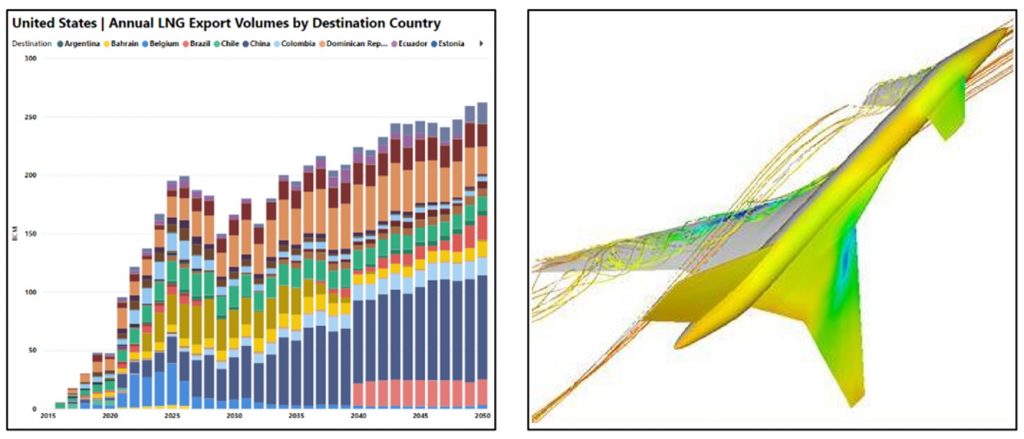

The word “model” is used in a similar fashion to describe something that is like something else. For example, when I was a kid I liked to build model planes and rockets. These often were small replicas of real planes and rockets. We also build a model of a system, such as air flow. Commonly both automotive and aircraft engineers use such models to improve aerodynamics.

Modelling versus Simulation:

Continuing with the aircraft analogy, the airflow models created are then tested and this is simulation. We are trying to simulate real-world conditions. Perhaps surprisingly, we can get even better feedback in this field than in markets because we can build physical models and using a wind tunnel, simulate a much closer approximation to reality.

For natural gas market simulation (and simulation of any other market), we can build that market model and simulate the results. You can see two things: A “market model” then is really a synonym for “market simulator” and “market modeling” is the same action as “market simulation”. And “market simulation” is really emphasizing the action, just like a flight simulator, really simulates flying.

Market Forecasting:

“Market forecasting” is a term that describes attempts to predict the future in some way. It is a broader term than “market simulation” or “market modeling” because it can be done using other methods such as intuition or technical analysis. The latter involves identifying patterns in time series graphs that look like patterns of the past and then predicting that subsequent changes in the things being measured will be similar to those previous changes. But it does not involve development of mathematical models of the operations of the basic elements of the market. In the best case, it would be done after your market research, market simulation and analysis of the two.

Market Forecasting versus Market Simulation:

Market simulation and especially natural gas market simulation and/or modeling typically involves mathematical representation of three important elements: supply, demand, and infrastructure. If these three elements are properly represented and connected to each other, then the simulation or model can be a useful tool in forecasting.

Calibration – The Missing Link:

One challenge that any market simulation system (market simulator) faces is the degree of trust in this model. In other words, if one can demonstrate that the market simulator can reproduce historical results from the system being modeled with a considerable degree of accuracy, then it may very well be able to produce reasonable forecasts of how the system could function in the future.

Market simulation with calibrated models enables you to conduct effective sensitivity studies under various scenarios, such as extreme weather conditions or shut-offs due to geopolitical factors.

Final Word – Market Simulators:

Though more could be said (on Simulation and Optimization, for example), At RBAC we have created natural gas market simulators for regional (GPCM) and global markets (G2M2). They are “simulators” in that they simulate the markets for natural gas, in both gaseous and liquid forms. The term “model” has often been used to refer to overly-simplistic representations of parts of the market rather than of the whole integrated market. Likewise, “forecast” often represents a single point or trajectory for some price or other and glosses over the fact that there is a lot of uncertainty in the various factors that produce prices. These need to be made explicit in scenarios and sensitivity studies in order to better understand how much credence one should give to specific price outlooks.

When we do use the term “market forecasting” and more specifically “natural gas and LNG market forecasting” we are describing the functions and operation of the analytics we use ourselves as well as make available to our customers for licensing.

Bottom line, all three of these terms are useful and have similarity and overlap. We, here at RBAC, are ready to assist you with market simulation and other analytics to help you achieve success in your company, your industry, and society as a whole.

Dr. Robert Brooks, PhD

Founder and CEO, RBAC, Inc.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.