Ongoing chaos seems to have become the new normal: extreme temperatures rolling through the lower 48 United States, trade disputes with Mexico, LNG Plant explosions and last but certainly not least the ongoing Ukraine/Russia Conflict. Every day there seems to be a new wrinkle throwing energy markets into a spiral, highlighting the need for companies to be flexible and poised to take advantage of the next fold that could occur at any moment. Will we see an end to this chaos? Is there light at the end of the tunnel or is it the front of an oncoming train?

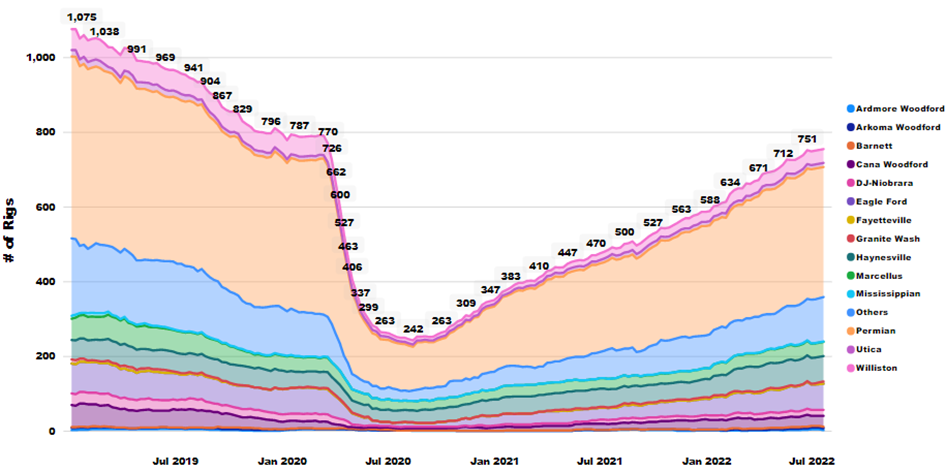

There are several factors that point to an inflection point, a tide turning, a sign of better things to come. The growth in drilling rigs is one such factor. During the pandemic, suppliers depended on DUC (Drilled but Uncomplete wells) inventory to sustain production when prices and demand were both extremely low. As the pandemic subsided, demand resurged outpacing supply, yet again the DUC inventory was there to fill in the gap. 2022 has been a year of supply chain disruptions, but finally it seems like there are enough active drilling rigs to replace supply and begin to replenish the lost DUC inventory. Key production regions lead the way, with the Haynesville, Marcellus, Eagle Ford shales, and the Midland and Delaware plays taking center stage. These basins have been good to both the United States and the world, and depending on how policy progresses, these benefits may only be in the early innings. RBAC’s 22Q2 supply outlook incorporates small but steady rig count growth to continue through the balance of 2022 and into the near- future. The DUC inventory is growing, particularly in the Haynesville, Midland, and Delaware areas with the goal of supporting the plethora of LNG and pipeline export projects slated to come online in 2024. The Marcellus could also benefit should pipeline takeaway capacity eventually increase, predicated upon improved regulatory conditions.

Source: North America Rig Count | Baker Hughes Rig Count (gcs-web.com), RBAC Visual Analytics

Drilling rigs are a very important indicator of future supply availability, but not the only one. Field service giant Halliburton is still experiencing supply chain and labor woes, struggling to add incremental capacity for both equipment and personnel as evidenced by their recent 2Q22 conference call during which Haliburton specifically noted that their crews are booked solid for 2022, with the expectation that 2023 will be more of the same. This appears to be an industry– wide situation. This supports the DUCs inventory accumulation thesis as wells are likely to be drilled more quickly than they can be completed and put into production.

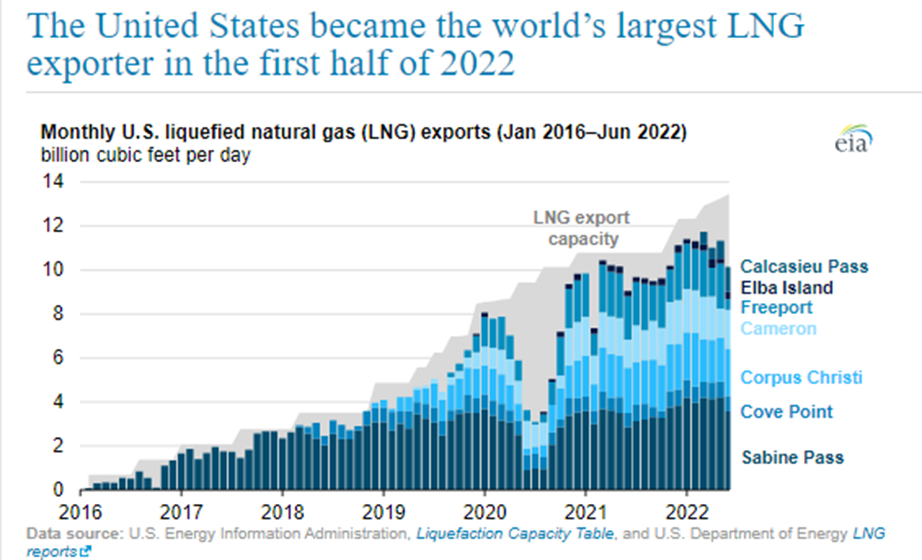

Another inflection factor is the United States taking the title of world’s largest liquefied natural gas exporter, averaging 11.2 bcf/d of LNG exports in the first half of 2022, up 12% from the second half of 2021, per the EIA. This capacity growth has allowed the U.S. to support its allies abroad, with 71% of all exports going to the EU and UK. These increased exports have partially offset reduced pipeline flows from Russia thereby strengthening NATO’s position to support Ukraine.

The EIA projects strong LNG exports in the second half of the year as well, averaging around 10.5 bcf/d, with the decrease driven by the explosion at Freeport LNG, occurring during June 2022 and expected to last through at least the beginning of October 2022. Plaquemines LNG and Golden Pass LNG are coming online in 2024, strengthening the United States’ position as the top LNG exporter, and with it, improving global energy security. This also bolsters the U.S. alliance with NATO countries, as well as its reputation as a dependable LNG trading partner, which the current geo-political climate has shown to be of more and more importance.

Source: U.S. Energy Information Administration – EIA – Independent Statistics and Analysis

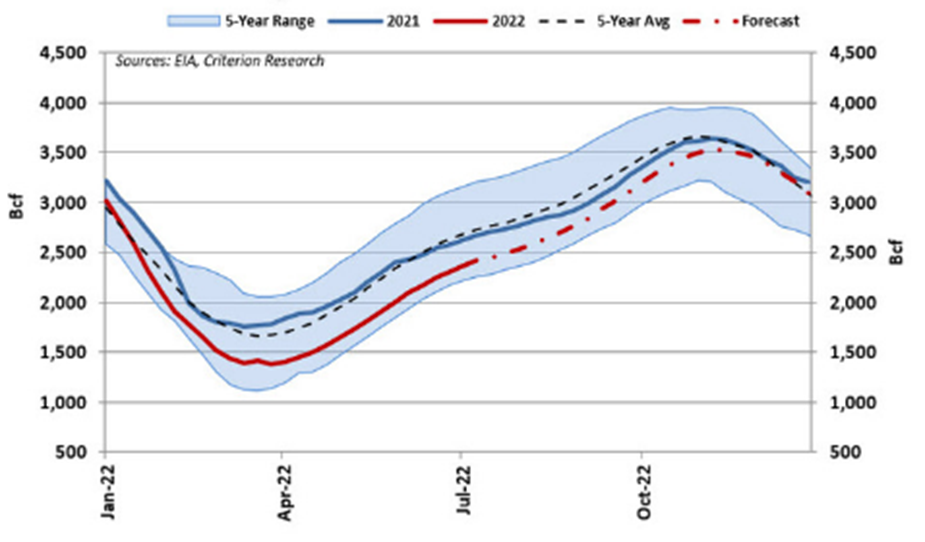

To see the real-world benefits of a strong LNG export industry, look no further than European storage levels, which are currently tracking above same– time last year levels. Europe is in a much better position when compared to last summer, injecting gas into storage at the fastest rate since 2019. Perhaps even in a better position than U.S. storage levels, which hover near the low end of the 5-year average. U.S. Storage injections this summer have been at the mercy of summer weather. With record highs this summer leading to strong gas fired electric generation demand and consequently Henry Hub pricing up around $9.

Source: Long Term Natural Gas Supply & Demand Report (criterionrsch.com)

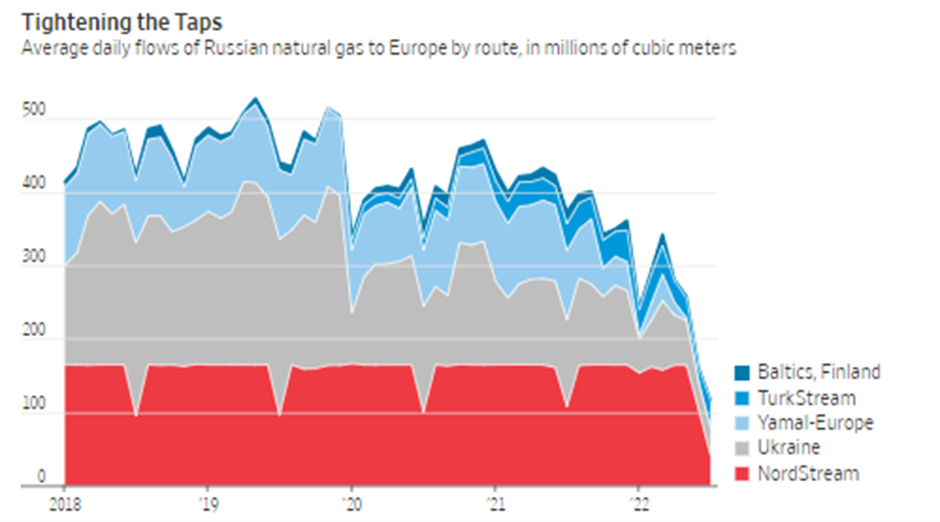

As of this writing, Gazprom has once again adjusted its flows through the Nord Stream 1 pipeline (NS1). Since completing turbine maintenance, flows went from 0% to 40% utilization, back down to 20% (26 Jul 22) with Gazprom citing additional equipment repairs needed. Whether of honest or nefarious intent, these announcements continue to send shockwaves through the European markets and further erode the credibility of Russia’s status as a trading partner. Going forward, we speculate that NS1 utilization will continue to be unreliable and used as a chess piece in Russia’s larger game.

Source: Putin’s Gas Game: Toy With Europe’s Supply and Make Its Leaders Squirm – WSJ

With the high-profile conflict overseas, it may be easy to overlook the conflict on our doorstep. Mexico’s president Andrés Manuel López Obrador has long viewed the opening of the Mexican oil sector to private investment in 2013 as a move only in the best interest of corrupt politicians—even calling it “the theft of the century.” Since taking office President Obrador has instituted nationalistic energy policies, favoring state-run companies over U.S. and international firms, violating the United States-Mexico-Canada Agreement (USMCA) signed in 2018. The U.S. could respond by including tariffs on high profile or socially important exports into the U.S. However, escalating this trade dispute could impact future investment in Mexico’s emerging energy industry, particularly LNG exports, since Mexico’s west coast is ideally situated for LNG shipments to Asia, where multiple projects are under development by Sempra, New Fortress Energy and Mexico Pacific Limited.

RBAC’s 22Q2 outlook foresees continued tightness in the market. With supply lagging behind demand, continued domestic and international political uncertainty keeps the future all but certain.

Out of chaos, comes opportunity. Whether from political, economic or environmental challenges, the energy industry has always been in a state of flux (chaos). Having access to the industry –leading and most dynamic gas and LNG market simulation tool, GPCM® will give you the tools needed to develop your own market insights and, identify the opportunities and risks, and. To create strategies to steering your company safely through the chaos safely to desirable ports.