In the world of natural gas trading, savvy traders look out for and attempt to get on the right side of basis blowouts.

Basis trading is a trading strategy built around the difference between the spot price of a commodity and the price of a futures contract for that same commodity. If a trader expects this difference to grow, they would initiate a trade termed “long the basis”, and conversely, a trader enters “short the basis” when they speculate that the difference will decrease. It can also be the spread between different trading hubs, such as Henry Hub to SoCal. A basis blowout is an unusual and abrupt widening in the spread.

Today, we’re delving into the realm of basis blowouts and exploring how advanced simulation technology, like GPCM Market Simulator for North American Natural Gas and LNG, can reveal hidden opportunities or risks to be aware of. Read on to see the power of predictive modeling and how it has been used to win in the market.

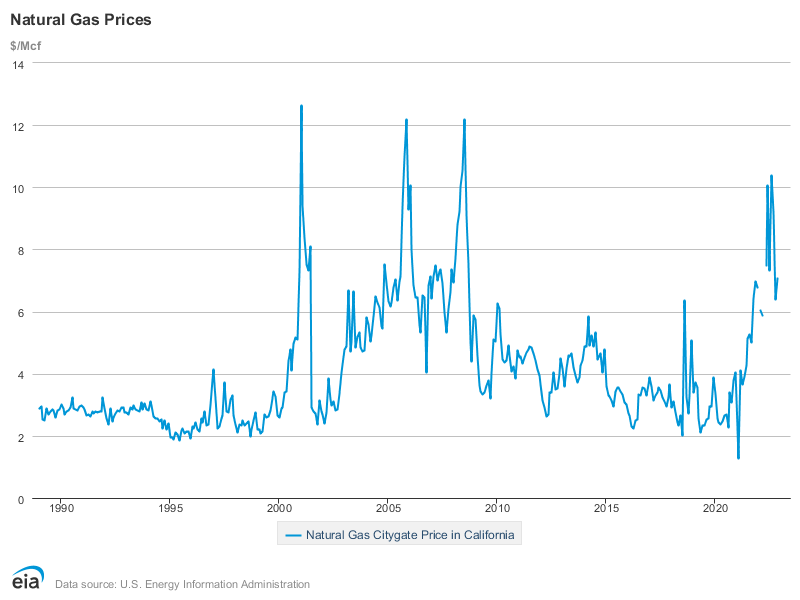

The Early 2000s Energy Crisis

Back in the early 2000s, California and New York City grappled with intense supply and demand imbalances. Prices soared with local pricing points severely disconnected from Henry Hub.

Using GPCM’s cutting-edge tech, traders developed scenarios that simulated changes in supply assumptions across the various basins, including modifications to demand assumptions, such as gas-fired power generation, nuclear plant retirements, and proposed infrastructure additions. The results showed California’s markets were extremely tight and poised for much higher prices than expected. Traders capitalized on this, executing long-biased position structures that yielded several million dollars’ worth of profits.

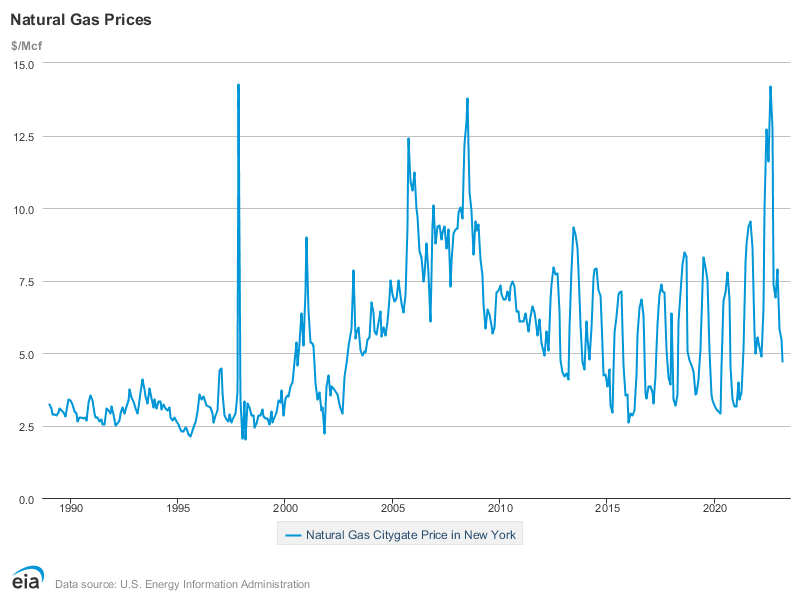

Midcontinent and Northeast

Similarly, in the Midcontinent and Northeast area basis, specifically, Chicago City Gate and New York City or Transco Zone 6 New York. Analysts worked with trading desks to construct scenarios that evaluated alternative assumptions for supply, demand, and infrastructure using GPCM.

The outcome? The simulations revealed a high likelihood of basis blowouts, presenting lucrative and asymmetric trading opportunities. Traders combined GPCM analytics with their proprietary information and expertise to structure and execute long-biased trades.

By optimizing their assets and engaging in profitable speculative trades, they continued to stay one step ahead of the market.

The Evolving Landscape

With recent shifts in supply/demand dynamics due to LNG exports, renewable energy, and energy policy developments, such as the latest EPA power plant regulations, what will the potential be for basis blowouts during the hot summer or later in the winter?

What are the key factors to be aware of? Will planned maintenance or unplanned outages leave California at risk this summer? How about Algonquin city gate’s exposure to LNG import pricing this winter, while existing southeast demand competes fiercely with LNG for supply?

Such questions indicate changes in energy markets that demand a proactive approach, necessitating top-flight predictive analytics.

Furthermore, real-life incidents like the outages at L2000 pipeline or the Freeport’s LNG terminal had knock-on effects throughout the system. These events and maintenance activities can significantly impact prices and basis, making GPCM an invaluable tool for traders to swiftly respond to changes exposing risks and opportunities and adjust and execute their trades accordingly.

Predicting basis blowouts is not mystical, but you do need advanced technology like GPCM. Armed with this powerful market simulation tool, traders can navigate a shifting and complex landscape, uncover hidden opportunities, and optimize their returns.

If you are interested in discovering untapped potential and seizing opportunities in the ever-changing energy market, you need to unleash the power of prediction.

For additional information you can contact to us here.