Qatar’s Vast Reserves

It is no secret that Qatar is one of the most important countries in the world when it comes to oil and gas. As of December 2022, Qatar had 843 tcf of estimated proven gas reserves, placing third after Russia and Iran and equaling 11% of the world’s proven reserves.

However, Qatar is in a unique position with these vast reserves, it is a small country with a population of 2.7 million meaning that most of the gas produced in the country is exported elsewhere.

Qatar’s Energy Mix

Qatar is a very interesting country in terms of its energy mix, which is effectively only natural gas and oil at current. However, this may change in the coming years with new directives being set by Qatar’s National Energy Strategy. These new policies set a target for, “18% of renewable energy in the power mix by 2030”, primarily coming from solar. Qatar is also currently in the process of developing a legal framework for the inclusion of nuclear energy.

Solar Energy

Despite having long been powered by natural gas, even Qatar cannot escape the calls for the energy transition. Solar is projected to be the top choice for Qatar’s renewable energy investments with 4 GW of capacity by 2030. Qatar’s renewable implementation strategy also, “Aims to add up to around 200 MW of distributed solar generation by 2030 to enable more localized power generation and reduce strain on centralized grid infrastructure.”

North Field Production

Qatar’s largest gas producing field is the North Dome Field which is not only the largest within the country, but the largest non-associated natural gas field in the world as well. Ownership of this field is shared between both Qatar and Iran, with Iran’s section called the South Pars Field.

This field has been a longstanding workhorse for the natural gas industry in Qatar, responsible for nearly all of the gas produced within the country since it first began production in 1989. The North Field currently produces 77 mtpa which is expected to rise all the way up to 142 mtpa by 2030.

LNG Exports

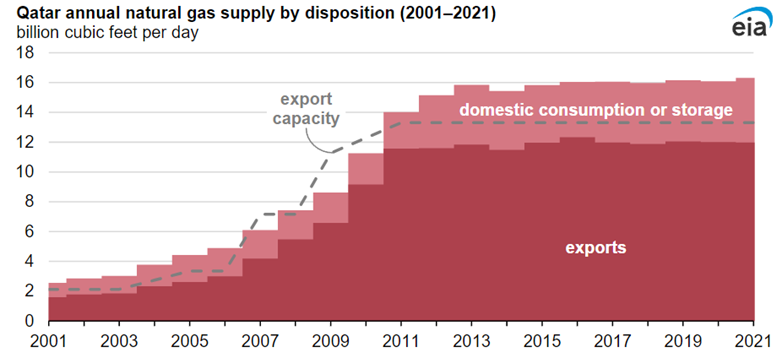

Qatar first began exporting LNG from the North Field in 1997 and has since become one of the largest exporters of the fuel in the world. Despite already being among the major players, Qatar still has plans to even further develop their LNG infrastructure and trade.

Its current LNG production capacity is at 78.2 mtpa and is expected to nearly double in size by 2030.

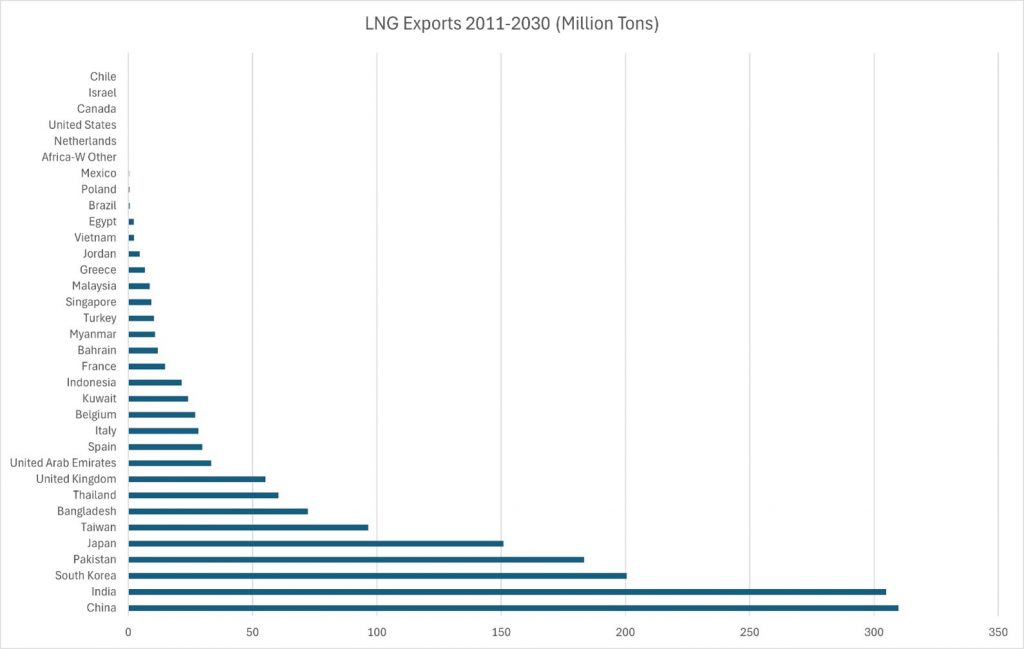

Qatar exports LNG to a variety of consumers primarily located within Europe and Asia. Historically, Asia has been heavily reliant on LNG from Qatar, with 60% of the LNG supply to the region coming from Qatar and Australia. At the recent energy summit in Japan, leaders in energy highlighted the potential risks of over-reliance on any single source could threaten the energy security of several countries. To combat this, it was recommended that alternative sources of supply be found to ensure in the event of a loss of supply that nations were not left as sitting ducks.

China and India are predicted to be the largest buyers of Qatari LNG by 2030 with South Korea taking the 3rd spot.

The announcement of expansions to Qatar’s gas production has brought a frenzy of new long-term LNG contract deals, both for the fuel itself and new vessels to transport the LNG. Qatar has signed new long-term contracts with India, China, Italy, and many other nations. Qatar has also signed deals with both Korean and Chinese shipbuilders for a total of 37 new LNG carriers.

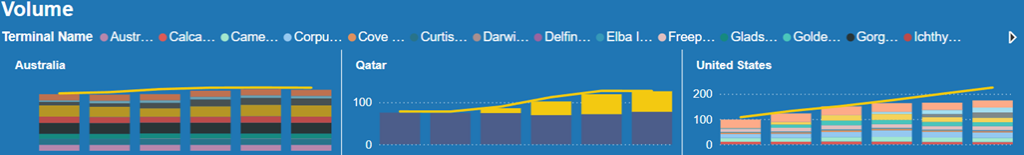

With global demand for LNG expected “to increase more than 50% by 2040,” this additional supply is very needed to help ensure all countries are energy secure and able to provide for their citizens. This also comes at an important crossroads in the market with the United States announcing earlier this year that LNG export project approvals were going to be temporarily paused. With both countries topping the list of largest LNG exporters, any actions they take greatly affect the market.

In addition to LNG, Qatar also exports a substantial amount of gas to neighboring countries through pipelines. The Dolphin pipeline connects Qatar with the United Arab Emirates and Oman. This pipeline has capacity for 3.2 bcfd and has been in operation for nearly 20 years.

Gas to Liquids and Natural Gas Liquids

Qatar has another interesting aspect of its natural gas industry and that is its connection with turning natural gas into other fuels and lubricants. The Pearl GTL (gas-to-liquids) facility is the largest of its kind in the world and has been since it reached max operating capacity in 2012 and, “It will process around 3 billion barrels of oil equivalent over its lifetime.”

Qatar also has facilities to produce, “Feedstock for downstream industries as well as other associated products such as liquefied petroleum gas (LPG), ethane, sulphur and natural gas liquids (NGL).” Natural gas liquids have a wide range of applications across different sectors such as industrial, residential, commercial, and transportation.

Gas to Food

But even more interesting than its gas-to-liquids industry, is Qatar’s use of natural gas in the production of food for livestock. Qatar signed an agreement with Unibio to produce organic protein created with natural gas to replace food derived from fish meal or soy. This will be done through a patented process in which natural gas is converted through continuous fermentation into edible proteins.

Hydrogen and Ammonia

Qatar has also been investing quite heavily into Hydrogen and Ammonia. In 2022, QatarEnergy in collaboration with Industries Qatar QSC and Qatar Fertiliser Co, made plans to construct the world’s largest blue Ammonia plant. This facility is scheduled to be completed in 2026 and is aimed at assisting Qatar’s coals of reducing carbon emissions by capturing and storing the carbon dioxide emitted during conventional Ammonia production. This is yet another way for Qatar to leverage is immense reserves of natural gas.

Conclusion

Qatar currently is and is expected to remain a major player in the global natural gas and LNG market due to its vast reserves coupled with a relatively low rate of domestic consumption. This leads to the majority of its gas being utilized for exports via pipelines and LNG. However, the market is always shifting and disruptions to supply could occur at any moment such as the disruptions in the Persian Gulf. It is with market simulation tools such as the G2M2® Market Simulator for Global Gas and LNG™ that both countries and companies can find the best ways to achieve energy security, both in supply and production, through robust market analysis and better strategic decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

Sources

[1]https://www.eia.gov/international/analysis/country/QAT

[7]https://rbac.com/japans-future-energy/

[8]https://pgjonline.com/news/2024/january/qatar-set-to-sign-cheaper-long-term-lng-deal-with-india

[9]https://www.offshore-technology.com/news/qatarenergy-partners-with-taiwans-cpc/

[10] https://www.eni.com/en-IT/media/press-release/2023/10/eni-signs-long-term-in-qatar.html

[14]htps://www.shell.com/what-we-do/major-projects/pearl-gtl.html

[15]https://www.qatarenergylng.qa/english/operations/onshore

[16]https://www.eia.gov/todayinenergy/detail.php?id=5930

[17]https://www.arabnews.com/node/1849656/business-economy

[20]https://rbac.com/what-would-happen-if-a-major-waterway-were-closed-to-lng-tankers/