Holidays are Coming, are Natural Gas and LNG Markets Prepared for Winter?

Here in the United States the winter holidays are closing in and the new year is on the horizon. However, the natural gas and LNG markets don’t sleep and massive changes can take place at a moment’s notice.

This month’s issue is shorter than usual as we were busy preparing for our annual user conference (which you can read the highlights from further down), we are also happy to announce that RBAC staff will be attending and speaking at the 2025 World Gas Conference in Beijing.

We hope you enjoy these articles and interviews created to give you greater insight into energy markets and the industry, all with the goal to increase your knowledge and help you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief - Winter Cold Effects on Natural Gas and LNG

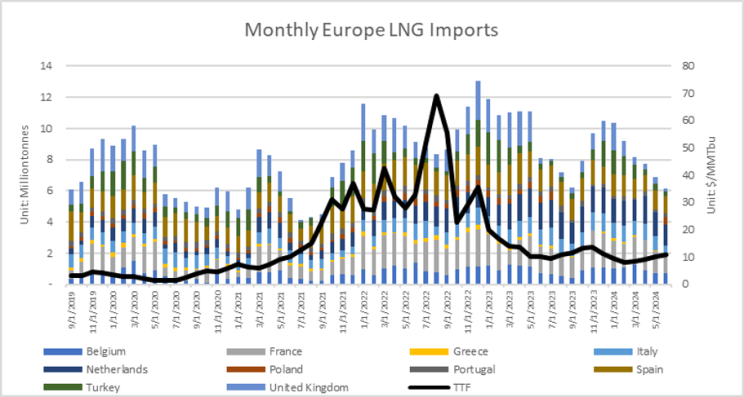

Recent Winters have been warmer than expected which has resulted in the supply of gas remaining generally high and at relatively low prices as a result of decreased demand. The United States has a rather robust supply of natural gas so it is unlikely that this coming Winter will have any effect on the domestic market unless a severe weather event occurs, however regions such as Asia and Europe are a different story. These regions are rather reliant on LNG and extreme weather events can be a major driver in demand volatility leading to seasonal surges in these areas.

For example we have seen record high summer temperatures in China and Japan in summer of 2023 and a mild Winter in Europe in the 2023-2024 Winter. El Niño and La Niña are common weather patterns that can dramatically shift weather expectations towards hot or cold. El Niño periods generally mean warmer than usual weather for both Winter and summer in the Northern Hemisphere and by contrast La Niña leads to colder Winters.

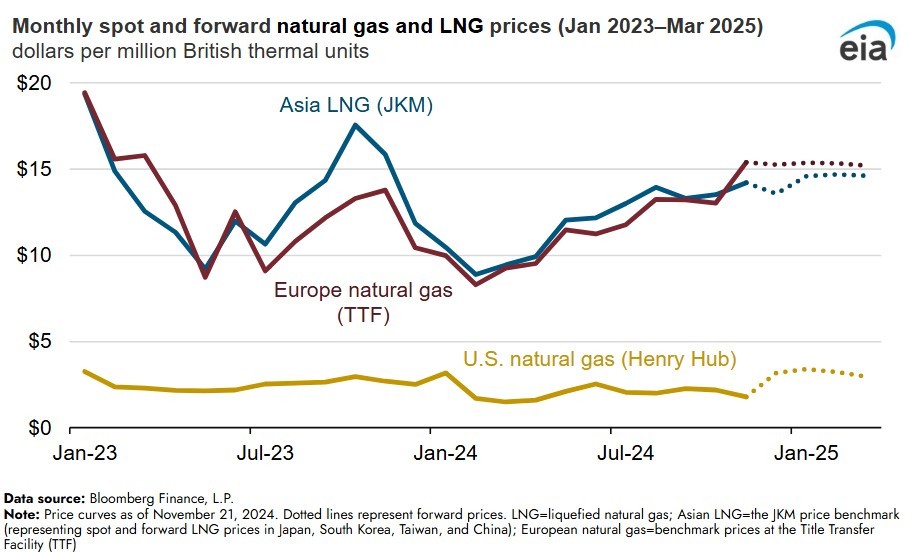

La Niña conditions were expected to develop in a report from the NOAA: National Oceanic & Atmospheric Administration made earlier in the month, which would result in natural gas demand increases for heating. The U.S. Energy Information Administration is forecasting that prices at TTF and JKM will reach ~$15 which is in line with previous Winters.

It remains to be seen how this Winter will end up panning out, but whatever it may be whether it is warmer or colder than expected, it is always important to be prepared for any scenario.

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

Bulls Vs Bears and Natural Gas Prices

How Confident Are You? The Bulls and the Bears faceoff as we head into the 2024/25 winter season. And the natural gas market appears to be staring down the barrel of yet another mild winter and loose Supply/Demand (SnD) balances. However, the El Niño of yesteryear is now replaced by a La Niña and although that could bode well for a more “normal” winter season, the current expectations aren’t playing out that way.

Read here: Natural Gas Price Predictions for 2025: A Bullish or Bearish Market?

2024 Edition of RBAC’s Annual Gas and User Conference

Earlier this month RBAC held another successful conference in beautiful Orlando, Florida and it was incredible to share insights into natural gas and LNG with our users and hear about their experiences.

Read here: https://rbac.com/2024-user-conference-recap/

Dr. Robert Brooks and Dr. Ning Lin speaking at the 29th World Gas Conference (WGC2025)

RBAC’s Dr. Robert Brooks Ph.D and Dr. Ning Lin will have the honor at presenting at the next year’s World Gas Conference.

Dr. Brooks will be presenting the impacts of Hydrogen on natural gas and LNG markets. Dr. Lin will present expectation for developments in the global LNG market through 2035. Both of these presentations will greatly utilize G2M2® Market Simulator for Global Gas and LNG™ to model various scenarios.

Can’t wait for the conference? Contact us now to find out more about energy market simulation.

Contact us here: https://rbac.com/contact/

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Hydrogen Opportunities for the Natural Gas Sector

We have covered at great length how developments in Hydrogen can impact natural gas and LNG, what are the opportunities and challenges that exist within the Hydrogen market?

Read here: https://rbac.com/hydrogen-opportunities-for-the-natural-gas-sector/

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Where will Henry Hub Prices go in 2025?

Some forecasts are saying that the natural gas market within the United States may see a substantial price increase in the coming year, Cyrus Brooks investigates why here.

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.