Hot Weather, Hot LNG Markets

We present this month, insights and commentary covering North America and the Global Natural Gas market in this new edition of our newsletter.

The summer months are upon us in the North and with hot weather comes high demand for natural gas and LNG for power. We present diverse commentary primarily covering the market in the United States as well as both Europe and Asia.

We have a quick brief on natural gas consumption trends during the summer within the United States; a new episode of Global Gas & LNG Insights in partnership with Natural Gas World; analysis of what markets in Europe and Asia are facing in the short-term; the case of Utah and its soaring natural gas withdrawals; the role of LNG in a realistic energy transition, and takeaways from the successful LNG seminar RBAC held in collaboration with JLC in Singapore.

We hope you enjoy these articles and interviews, and they give you greater insight into the energy market and industry, all with the goal of increasing your knowledge and helping you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief – Summer Gas Consumption Trends in the U.S.

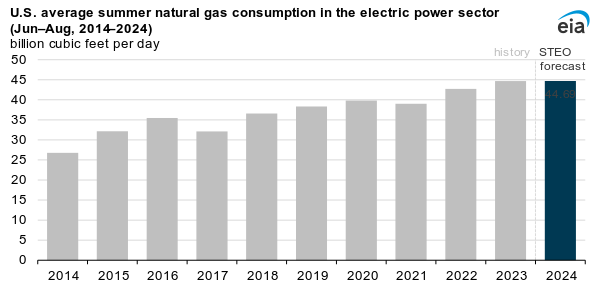

Natural gas consumption for power generation during the summer months has been steadily rising in the U.S. since 2014.

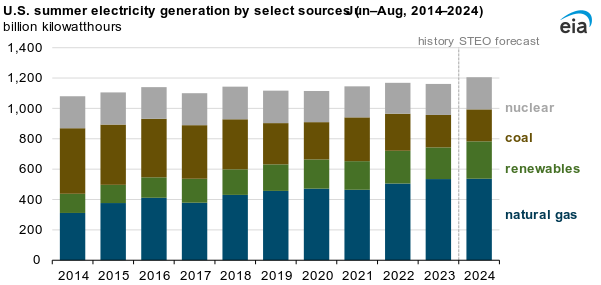

It is expected that the demand records that were set in 2023 will again be matched in 2024. However, despite overall growth in the total electricity generated across the entirety of the United States during the summer, natural gas itself is not expected to see a larger presence in the energy mix compared to 2023.

The sources of electricity generation for the United States have steadily been shifting towards a higher presence of both renewables and natural gas while the usage of coal has been on the decline.

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

Global Gas & LNG Insights: Where Are Asia’s Top LNG Markets Heading?

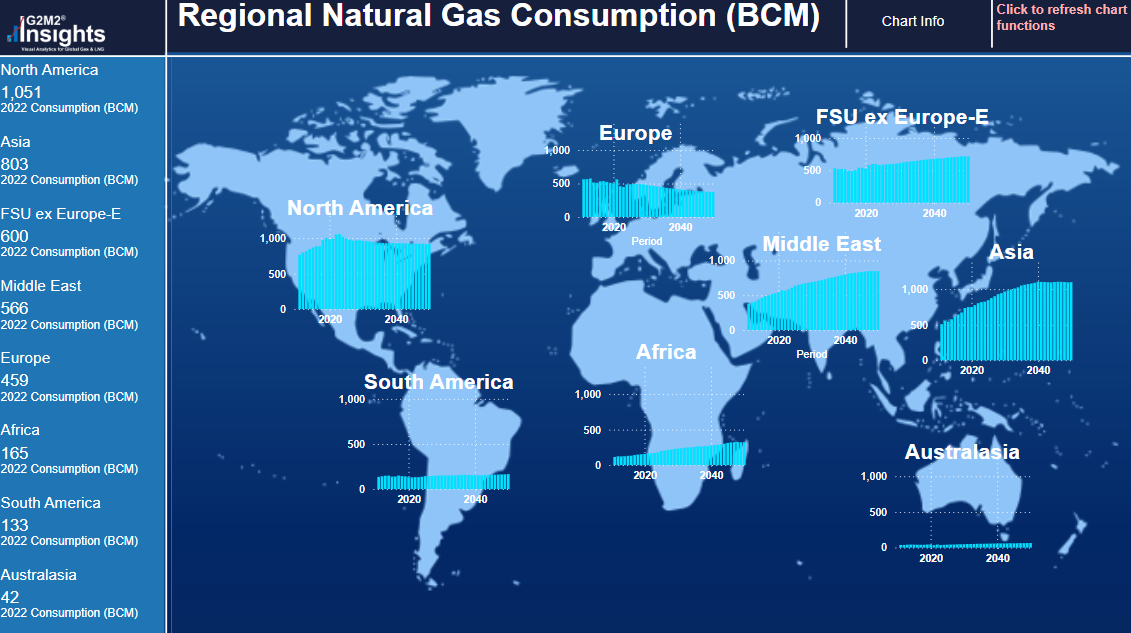

Dr. Robert Brooks Ph.D met with Natural Gas World to discuss how the top LNG markets of Asia will shape up in the years to come and how the G2M2® Market Simulator for Global Gas and LNG™ can be used to forecast the future of these volatile markets.

Read: Global Gas & LNG Insights: Where Are Asia’s Top LNG Markets Heading?

Charting New Horizons in LNG Demand and Energy Transitions

What is on the horizon for European and Asian natural gas and LNG markets? With shifts in economic, environmental, and technological circumstances, how do players and regions respond? RBAC, Inc.’s global team presents an in-depth analysis of prevailing market trends, highlighting growth in LNG demand, strategic adjustments in the European market, and impacts of renewable energy integration, and widespread infrastructure and capacity expansions.

Read: Charting New Horizons in LNG Demand and Energy Transitions.

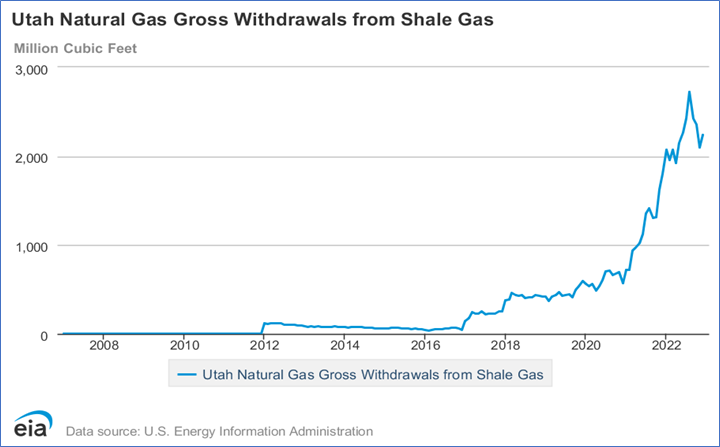

Jazz in the Utah Gas Markets

Shale is on fire! (so to speak). There’s definitely something jazzing up in Utah, though fans may be sad that it’s not the basketball team. Utah’s natural gas market has had a 5000% increase in gross withdrawal of shale gas accompanied with elevated levels of drilling activity leading to more #gasproduction.

LNG’s Role in a Realistic Energy Transition

The global LNG market is rapidly expanding even as investment in renewable energy sources continues to grow. Whilst many nations are calling for faster implementation of energy transition plans, #naturalgas and LNG will continue to make up the foundation of the global energy mix for the foreseeable future.

Insights into Asian LNG Markets

Last month an LNG and Natural Gas seminar took place in Singapore in collaboration with JLC. It was a fantastic event and was great to meet and share insights with leaders in energy from all across Asia. Dr. Robert Brooks Ph.D, David Zhou, and Jiaxin Yang delivered great presentations highlighting the future of these markets both within Asia and abroad.

Read here: Insights into Asian LNG Markets.

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

Global Waves: Navigating the Ripple Effects of China’s Economic Tide on LNG Markets

China is one of the largest economies in the world and one of the largest players in the market when it comes to natural gas and LNG. Changes to China’s economy or energy strategy and their ensuing impacts reverberate through the global LNG market. What would happen if China suffered from a severe economic downturn?

Read the story here.

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Data Centers Driving Demand

Breakthroughs in AI will lead to more data centers which leads to surges in power demand eventually resulting in natural gas being needed to meet the needs of the AI boom.

Read more here.

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.