Facing the unprecedented uncertainties in 2020, Refinitiv and RBAC team jointly developed a 24-month forecast, exploring the interconnection between regional markets from both fundamental drivers and weather sensitivities.

Utilizing RBAC’s G2M2® Global Gas Market Modeling System™, Refinitiv and RBAC explored the changing dynamics between US, Europe, and Asia LNG markets in terms of prices and demands through a robust set of weather scenarios based on the past 20 years data.

G2M2 is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage and deliveries across the global gas and LNG market.

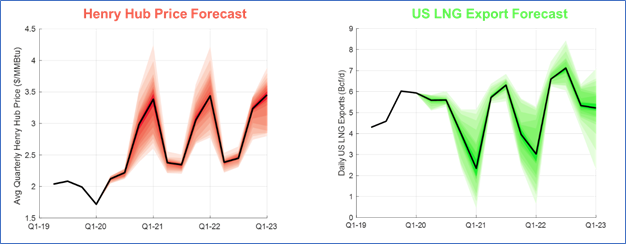

Chart 1 – 2020/2021 Henry Hub Price and US LNG Export Forecast

This project provided a robust process to demonstrate the power of sensitivity analysis for short to medium term market outlook. The simulation results include

- Global gas balance projection

- Regional LNG flows out of US and into Europe and Asia markets

- Regional hub price outlook

Furthermore, as we enter 2020-2021 winter season, we have also benchmarked the current market condition against the projected range of outcomes which provided much insightful perspectives of the evolving market conditions. The study focused on a couple of critical relations of LNG balances between region:

- What is the role of US LNG exports to US domestic market demand and price?

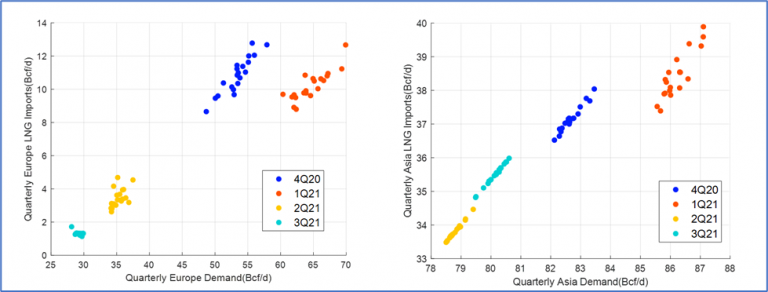

- What is the correlation between LNG imports and domestic demand and prices for Europe and Asia respectively?

Methodology

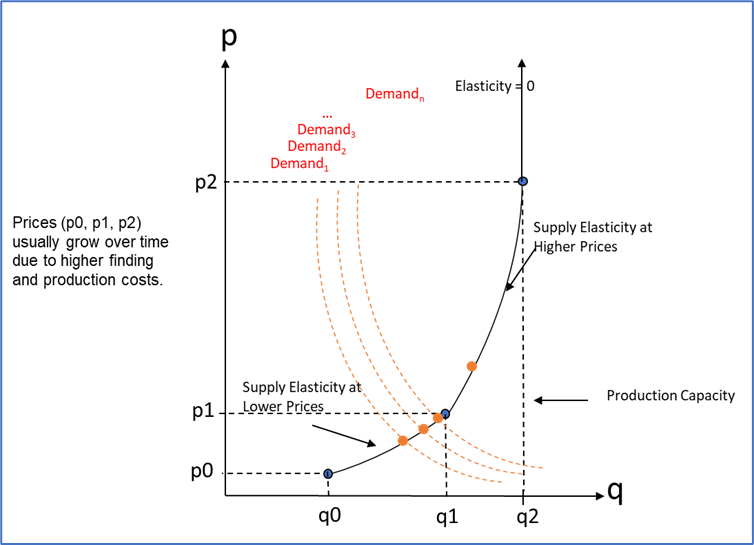

Chart 2 – Weather Scenario Shifts Demand Along Supply Curve

In G2M2, one could define specific demand curve (with price and quantity pairs) for each GPU (geopolitical unit) at each period from 2011 to 2050. This robust setting allows analysts to have the maximum flexibility for creating various demand scenarios. Since the objective of this exercise is short term winter outlook for next two years under various weather conditions. Refinitiv team likes to create a robust range of weather driven demand simulations for next two winters. Based on past 20 year weather patterns for key countries (Europe, Japan, South Korea and US), the simulation inputs are 20 sets of demand curves for a set of selected countries in Europe, Asia and North America to capture the major market dynamics in LNG markets.

With batch run feature, a total of 20 scenarios with 3 year each takes about 6 hours to run after the initial setup. With the dashboard feature in G2M2, it is easy to export a large number of different reports from all 20 scenarios with one click. Through this collaboration, the project team are also able to set up a repeatable and effective process for doing future scenarios and studies with solid learnings from both sides.

Finding:

- Winter demand is likely to be one of the primary drivers for Henry Hub price for 2020 Q4 and 2021 Q1. Strong US winter demand is likely to keep gas at home rather than exporting.

- In a post-COVID world, producers will be forced to be more flexible in managing short-cycle production, rather than outspending cash to achieve more aggressive growth.

- Europe and Asia domestic demand both rely on LNG imports, but influence its regional price differently.

Chart 3 – Drivers for Europe LNG Imports and Asian LNG Imports

Thanks to Dr. Xin Tang from Refinitiv Team, and Dr. Robert Brooks from RBAC team for valuable inputs and support.

This report was published on December 18, 2020 on Refinitiv data service, and it will be available from RBAC upon request by contacting Dr. Ning Lin at ning.lin@rbac.com or James Brooks at james.brooks@rbac.com.