Last year, RBAC’s James Brooks wrote the article, “Has the Energy Transition Been Cancelled?’[1] about the progress being made towards a global energy transition and whether the various goals outlined by countries around the world would actually be met by their target dates. There he pointed out that despite massive investments into renewable sources of energy, the progress was not happening nearly as fast as proponents had thought.

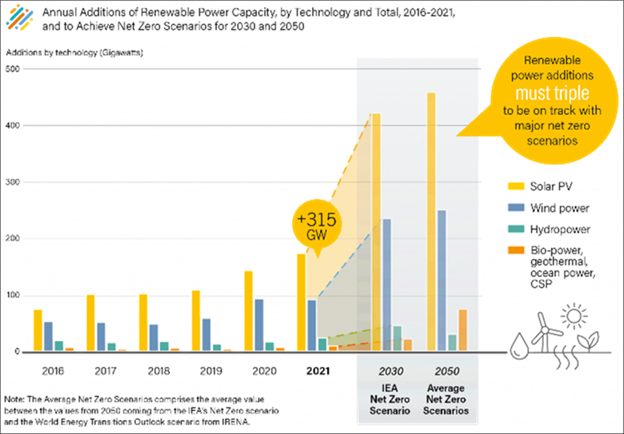

Fast forward to one year later, let’s see if this rush towards renewables is just around the corner, or still far off in the distance. In 2021 it was found that to meet the IEA’s 2030 net zero scenario 315 GW of renewable capacity would need to be added.

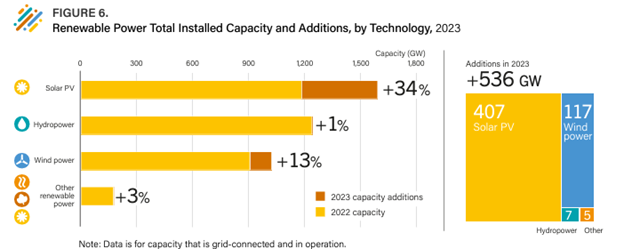

In 2023, 536 GW of capacity was added which should mean we are more than ahead of schedule to meet the goals for 2030.

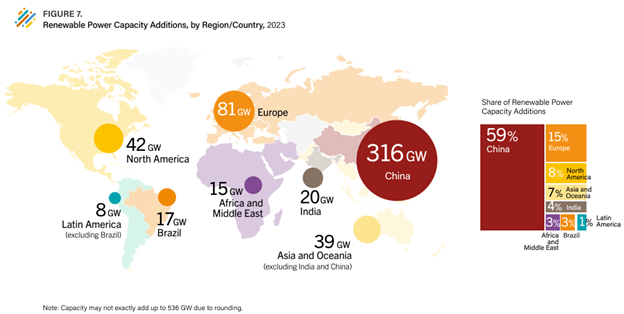

In fact, a vast majority of this capacity was spearheaded by China which alone covered the original target of adding 315 GW. Europe added the next largest capacity at 81 GW and a combination of North America, Asia, Oceania, and India rounded out the top five.

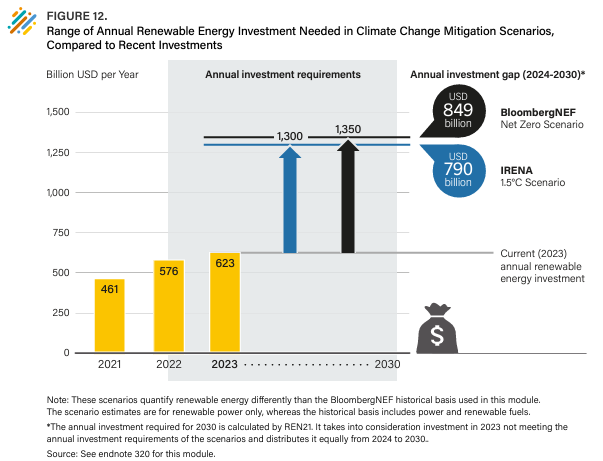

But how much are these additions costing and how much will they continue to cost? Hundreds of billions of dollars are being spent each year towards further integrating renewables into the energy mix. To meet the goals set out for 2030, investment spent annually will need to more than double according to estimates by REN21. According to REN21, an estimated US$623 Billion was spent in 2023 and in the coming years about US$1.3 trillion will need to be spent annually to meet the goal.

However, if we only mentioned such renewable energy additions and how much is being spent, this would be far from the whole story.

Another notable aspect of this tale is about King Coal. Some years ago, it was asserted that the King was dead. Yet, according to Global Coal Plant Tracker, coal-fired power capacity is back on the rise and retirements of already active plants has slowed.

In Europe, which is possibly the most ardent proponent of the energy transition on the global stage, several countries have chosen to restart their coal-fired power plants to meet energy demand.

For example, Germany[2] and France[3] both restarted coal facilities (France in 2022 and Germany in 2023) to avoid shortages during tough winters. Even the United Kingdom[4] had to follow suit in re-integrating coal back into the energy mix after attempting to phase it out. However, the UK also did close its last coal-fired power plant at the beginning of this October, but this is somewhat offset by supplementing its electricity supply with purchases of wood chips from North America.[5] And China which led the charge for renewable power capacity additions, was also responsible for 95% of new coal power construction in 2023.[6] Moreover, India, in its rapid growth, is also consolidating and increasing its reliance on coal with 23.5GW of newly proposed capacity in the first half of 2024.[7]

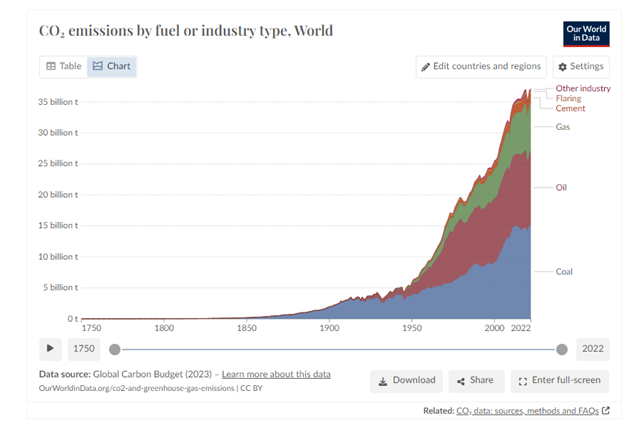

One might well ask, is this effectively taking things, in a sense, back to square one? The primary goal of the energy transition is to reach net zero emissions and of the fuels currently used for energy, coal is among the highest in terms of CO2 emissions.

Now while it is true that renewables emit little to no emissions, this is not true for the process of mining their key components (nor their manufacture, transport and so forth). A recent report published by Bloomberg found that “In order to meet the demands of a net-zero emissions world, BNEF (BloombergNEF) estimates $2.1 trillion is needed in new mining investments by 2050. The report indicates that key energy transition metals such as aluminum, copper and lithium could face deficits in primary supply this decade – some as soon as this year.”[8] The materials needed to support the energy transition could potentially cripple the supply chains for other industries that rely on aluminum, copper and lithium .

Other factors to consider are the time it takes to set up these mines, 18 years on average for new mines,[9] and how long it takes to build wind and solar farms. The construction of a wind farm, with one onshore taking between 4-8 years and the offshore taking between 7-11.[10] Solar farms take drastically less time to get up and running on average 8 to 18 months to complete.[11] But in the end, it must be kept in mind that the mining required for the energy transition also results in not only significant emissions in itself[12] but also has the risk of hindering the supply of precious metals for other uses.

Thus we are left with the ultimate question, “is the energy transition still possible?” The outlined goals are a combination of reducing greenhouse gas emissions and increasing the share of renewable energy sources for that end.[13] Yet, while it may be difficult to meet the required percentage of renewables currently, emissions can be reduced significantly through other means, notably by using lower emissions fuels in existing energy systems, such as with natural gas.

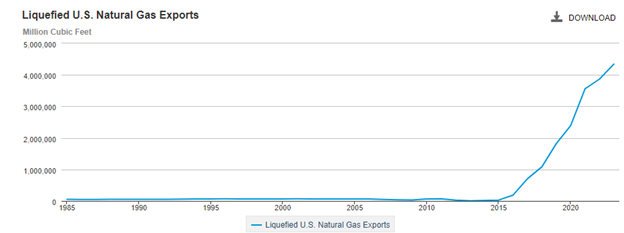

Natural gas and LNG have often been referred to as “bridge” or transition fuels in the sense that compared to other fossil fuels they are significantly cleaner burning. So, what does this mean for LNG, what is its role in a more realistic energy transition?[14]

The natural gas and LNG market has seen tremendous growth since 2015 reaching 4.34 tcf of LNG exports from the United States alone in 2023.

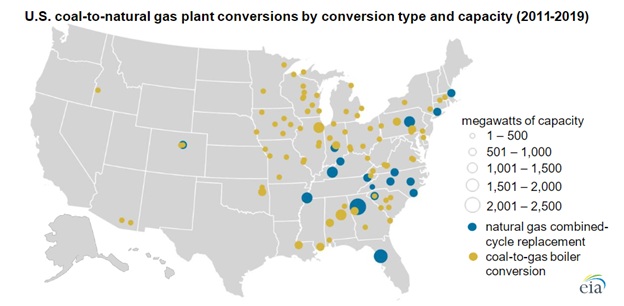

Coal-fired plants are also being converted into natural gas plants at an increasing rate. Since 2011, more than 100 coal-fired plants have been replaced or converted to natural gas.[15]

In addition, to meet IEA‘s energy transition targets, less is being spent on both LNG import and export terminals than the amount experts say needs to be spent on renewables to meet deadlines. This is incredibly important if the goal is reaching lower emissions; compared to coal, natural gas releases far less emissions, by about 50 to 60%.[16] Not only are the emissions being lowered by natural gas and LNG, but the costs are as well.

When evaluating any project, investors must ask themselves whether the costs are sustainable and what will be the return on their investment. For now, the energy transition is leaving a lot of questions unanswered regarding what the future of energy will look like. But what we are seeing is much evidence that Natural gas and LNG will continue to play a pivotal role in shaping this future, serving as the bridge from coal to cleaner energies going forward. Countries and companies must always consider balancing environmental concerns with the imperatives of economic development and energy security to provide reliable and affordable energy for all.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] https://rbac.com/has-the-energy-transition-been-cancelled/

[2] https://www.powermag.com/germany-restarts-coal-fired-generation-to-support-winter-power-supply/

[4] https://www.powermag.com/uk-restarts-coal-fired-units-as-temperatures-power-demand-rise/

[5] https://www.bbc.com/news/science-environment-68381160

[10]https://www.iberdrola.com/about-us/our-activity/offshore-wind-energy/offshore-wind-park-construction

[11]https://uslightenergy.com/how-long-does-it-take-to-build-a-solar-farm/

[14] https://rbac.com/lngs-role-in-a-realistic-energy-transition/

[15]https://www.eia.gov/todayinenergy/detail.php?id=44636

[16]https://gasvessel.eu/news/natural-gas-vs-coal-impact-on-the-environment