We have had more than just warm weather and spring flowers, the Global Gas team here at RBAC wanted to give some highlights on what’s happening in the market.

GLOBAL SHIFT:

The global gas market is experiencing a significant shift as North America increases its liquefied natural gas (LNG) exports in 2023, while Europe’s demand for gas remains muted.

Warmer-than-usual weather conditions and a decline in economic activity amid the ongoing pandemic have caused a significant drop in gas prices in Europe, with some contracts in the UK reaching their lowest levels in over a decade. The shifting dynamics in the global gas market are expected to result in increased competition and lower prices, creating a challenging year for the gas market. It is crucial for energy policies and strategies to be flexible and adaptable to respond to these changing dynamics, and to leverage the opportunity for gas-importing countries to secure cheaper gas contracts and potentially boost their economies.

The global gas market is undergoing a significant shift, with North America ramping up its liquefied natural gas (LNG) exports in 2023 while Europe’s demand for gas remains muted. This changing dynamic is expected to result in increased competition and lower prices, creating a tricky year for the gas market.

According to a recent Bloomberg report, Europe’s gas demand has remained muted due to warmer-than-usual weather conditions and a decline in economic activity amid the ongoing pandemic. This has resulted in a significant drop in gas prices in the region, with some contracts in the UK dropping to their lowest levels in more than a decade.

Meanwhile, North America is expected to increase its LNG exports in 2023, with the start-up of several new liquefaction plants. The Gillis Access project by TC Energy is expected to provide access to the Haynesville shale gas production region, which could help shape the Louisiana LNG market.

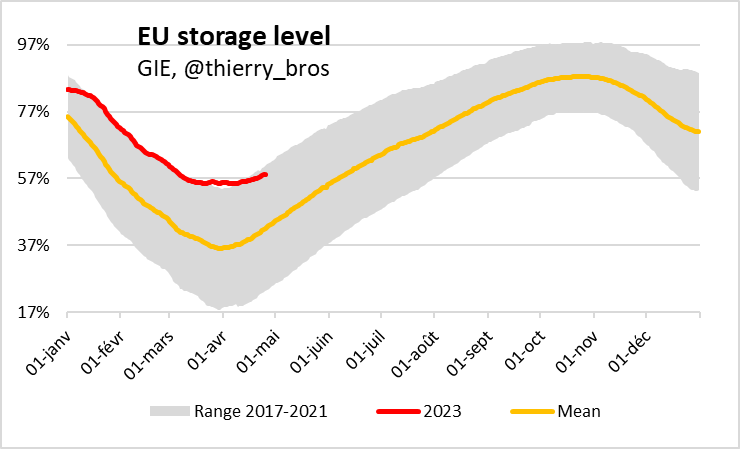

As a result, the global gas market is shifting from a shortage to a glut, with increased competition and lower prices expected. While this could lead to concerns over storage capacity limits in the short term, it could also provide an opportunity for gas-importing countries to secure cheaper gas contracts, potentially boosting their economies.

These shifting dynamics highlight the need for flexible and adaptable energy policies that can respond to changes in the market. As the gas market navigates a tricky year, it will be interesting to see how these dynamics play out and what implications they will have for the global energy industry.

As the market shifts, with increased competition and lower prices expected, it will be crucial for energy policies to be flexible and adaptable to respond to these changing dynamics.

UNCERTAINTY FOR G7

Per Reuters, Climate ministers of the G-7 countries note there may be “considerable uncertainty” for consumption. Such uncertainties of natural gas demand have been the main focus for the Global Gas team at RBAC which added multiple modeling features to better capture and describe uncertainties such as carbon pricing, fuel switching, macroeconomics, weather driven and decarbonization policy and country level targets.

A commentary by G2M2 team on a medium to long term scenario focusing on three pathways of global gas demand was published earlier this year, comparing the different LNG scenarios, driven by different demand assumptions, available here.

RUSSIA AND CHINA COOPERATE

Before the end of 2023, Russia is anticipated to conclude a 30-year natural gas contract with China. The Power of Siberia Pipeline and the Power of Siberia 2 Pipeline are expected to carry 38 and up to 50 bcm per year, respectively, of Russian gas.

After nearly a decade of negotiation on details, including the gas price and development funding on the pipeline, concrete progress has been made on the contract recently. The gas that will be transferred to China is priced at 6.44 USD/MMBtu, which greatly discounts the current global gas price.

How will that impact Chinese demand for LNG and the regional LNG dynamics? G2M2 Market Simulator for Global Gas and LNG provides an easy and transparent approach for scenario planning and analysis. It covers all major pipelines, storage, and terminals in China.

CLIMATE AND CARBON

The price of EU carbon permits (EUA) exceeded €100 per metric ton (mt) of CO2 for the first time on February 21 and it has since come down to €87/mt. However, this drop is likely to prove temporary and the general trend is upwards, with EUA futures prices trending towards €100/mt of CO2, for gas deliveries by the end of the year, and higher in future.

With the focus on emissions, it is important to factor the CO2 price in gas delivered cost in markets like Europe. G2M2 includes a customizable demand function which integrates the carbon pricing into the demand projections.

GERMANY SHUTS DOWN NUCLEAR POWER

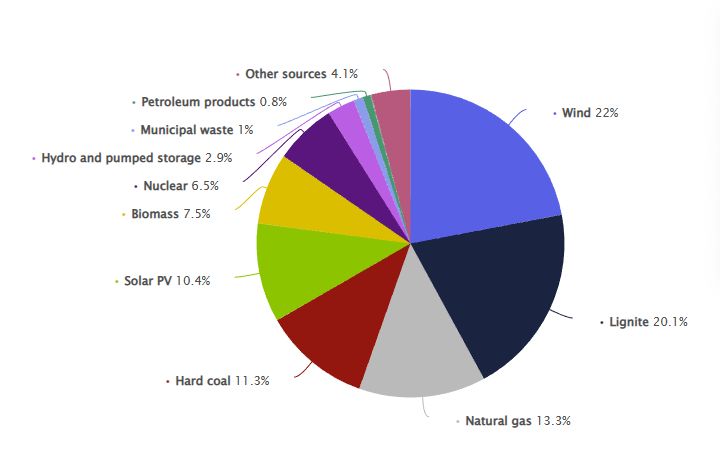

Germany’s last three nuclear power stations shut down, though it had delayed the closure of the three sites in 2022 after Russia reduced European gas supplies.

According to Statista, nuclear accounted for 6.5% of its electric generation for 2021, while gas accounted for 13.3%, and coal and lignite are over 30%. It is hard to see if reducing nuclear will reduce emissions. Unless wind or biofuel can make up for the lost generation, which sounds unrealistic.

As for natural gas, given the challenges that Germany is facing in replacing its gas imports from Russia with LNG and other sources, an increase in power generation from natural gas now would increase the cost of electricity for its people.

SUMMARY

Using gas and LNG market simulation such as G2M2 allows you to create forecasts that cover a wide variety of scenarios and stay ahead of the market. Weather effects on demand, carbon pricing, changes in policy, and storage capacity expansions are just a few examples of the different types of scenarios that G2M2 can be used for.