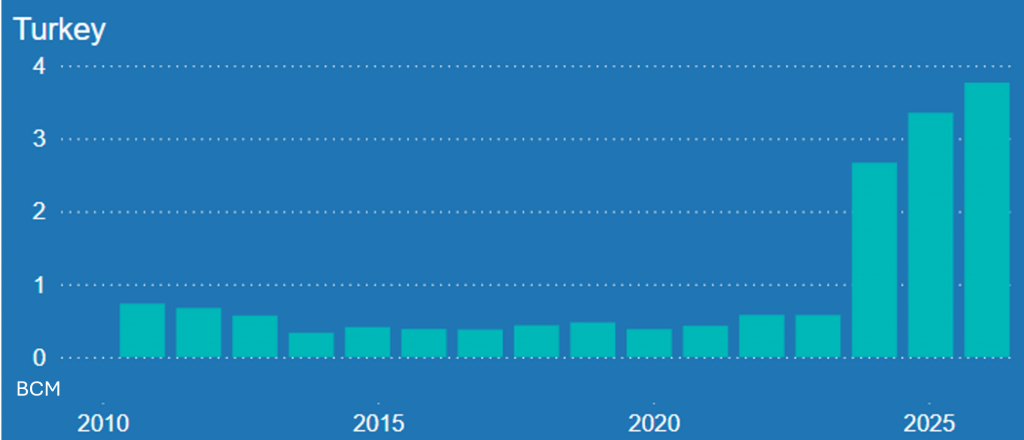

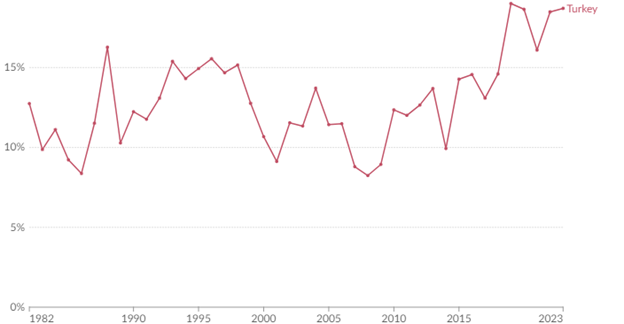

With production ramping up at the Sakarya gas field in the Black Sea, Türkiye (Turkey) is looking to beef up its natural gas industry as the nation plans to move away from past reliance on Russian gas. Domestic production within Türkiye saw massive growth between 2023 to 2024 and is now the highest in the last 13 years with continued development expected.

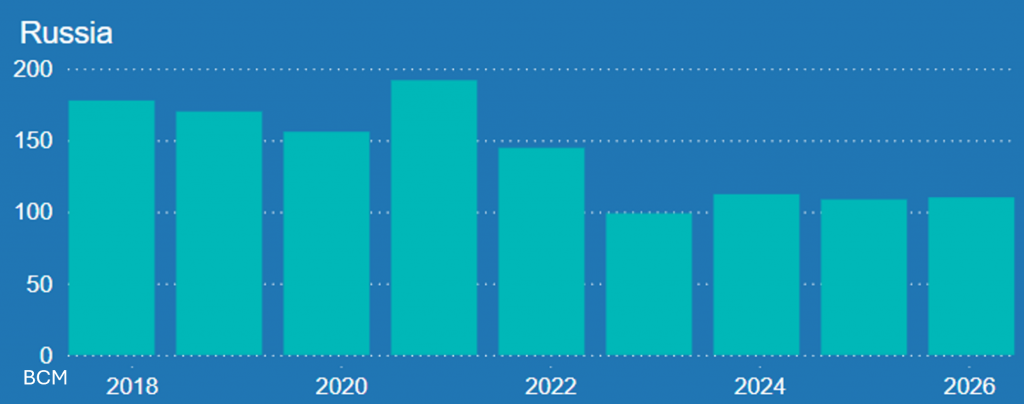

After the invasion of Ukraine began in 2022, several countries across Europe stopped buying fuels such as oil and natural gas from Russia. Natural gas pipeline exports from Russia fell by nearly 100 bcm between 2021 through 2023.

Türkiye was one of the few that continued to utilize Russian natural gas so vital to powering it’s economy and Russia is its largest supplier.

Natural gas is one of the three pillars of energy within Türkiye’s energy mix, the other two being coal and oil.

“Gas consumption which totaled 58.8 bcm in 2021 was composed of; 27.4% households, 35.3% electricity production, 28.9% industry, 7.9% service sector and 0.5% other sectors’ share.”[1]

The Black Sea is home to Türkiye’s gas reserves and was seeing dwindling production until a discovery in 2023 renewed interest and investment into domestic gas production. The total volume of reserves in this discovery is estimated to equal 710 bcm.[2] Combining the projected demand for both households and industry, it in itself would be able to meet the energy needs for the country for the next 15 to 20 years.[3] Production has already started at the Sakarya gas field and is set to be producing 40 mcmd by 2025. Developments of gas discoveries in the Black Sea could greatly assist in Türkiye’s overall goal of becoming less dependent on natural gas imports.

In addition to the Black Sea, the Mediterranean Sea is also a hotbed of both natural gas activity and territorial disputes. There have been several natural gas discoveries over the past 15 years within the sea, however the location of these gas reserves is often subject to debate amongst the countries in the region.[4] When these discoveries were made, Türkiye quickly made efforts to explore the potential of these reserves to begin production if possible. However, these actions led to political clashes with Cyprus and Greece as both claimed that Türkiye was drilling in their waters.

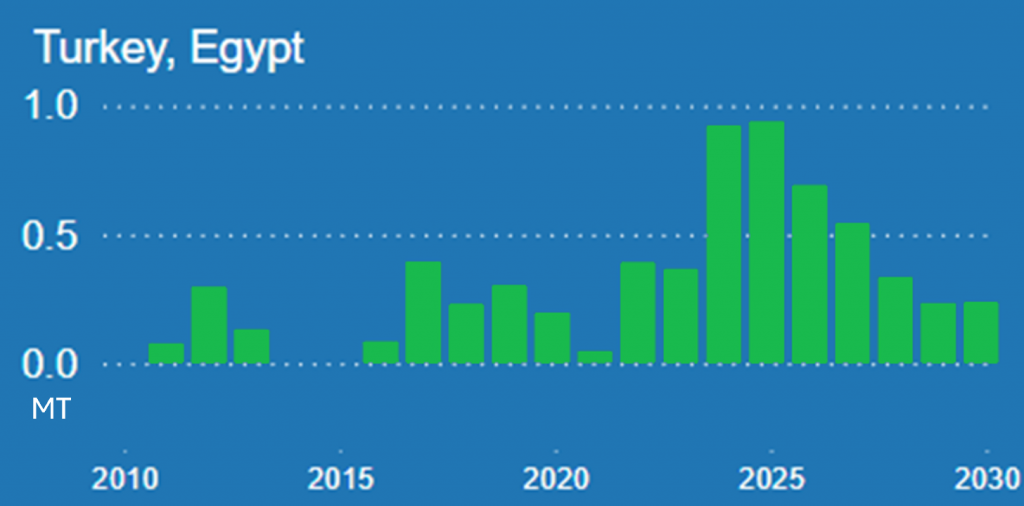

Conflict within this region and more specifically between Greece and Türkiye has been occurring for decades and continues to occur to this day.[5] Yet there is evidence of icy relations with Greece are thawing.[6] Egypt is also developing natural gas resources within the Mediterranean.[7] Egypt and Türkiye have often had disagreements in the past, but as of late both are making efforts to rekindle diplomatic relations.[8] Türkiye has even received LNG deliveries from Egypt every year since 2016.

Discoveries made in the Mediterranean can often take years on the political front before development of the resources is seen. For this reason, from a Turkish perspective land-based pipelines are often a more reliable method of securing gas.

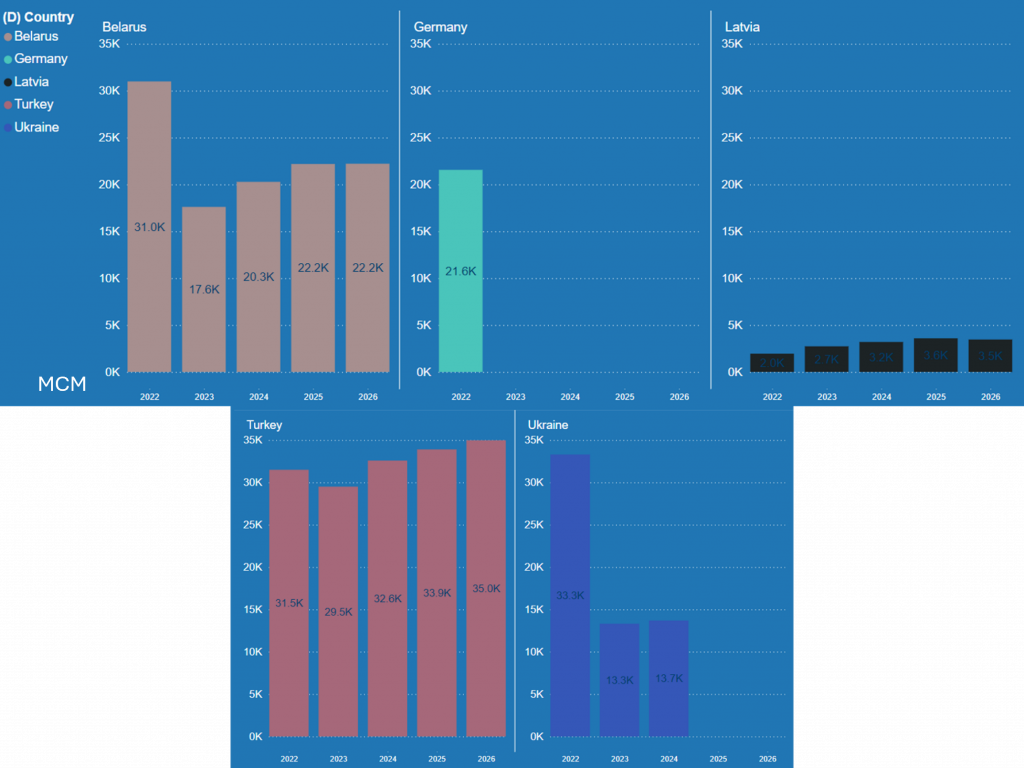

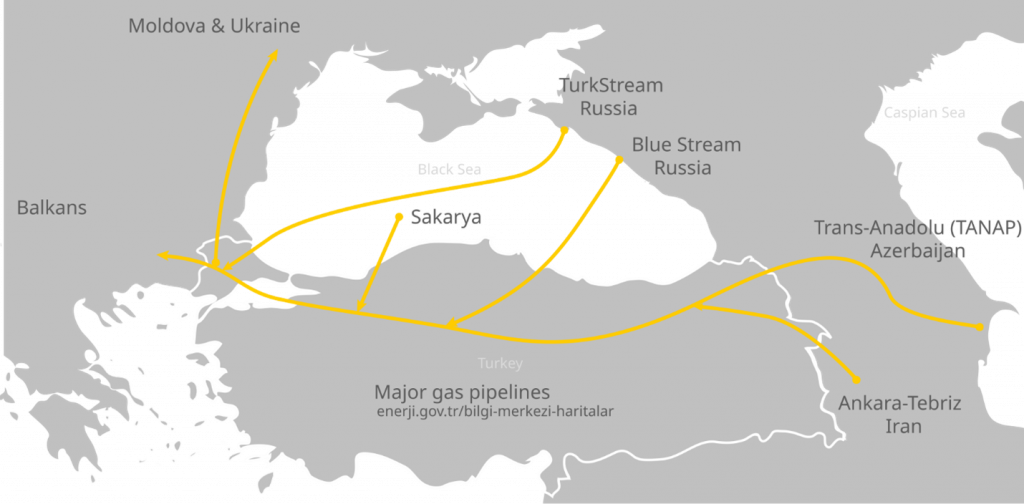

The vast majority of pipeline gas coming into Türkiye is from Russia with some also coming from Iran and Azerbaijan. The gas from Russia is transported through the BlueStream and more recently the TurkStream pipeline, gas from Azerbaijan through the Trans-Anatolia Pipeline (TANAP), and gas from Iran through the Ankara-Tebriz pipeline.

There are also several pipelines that pass-through Türkiye that go on to other countries within Europe. Because of this Türkiye would like to establish itself as a regional energy hub in Eastern Europe. Situated between the Middle East, Russia, Central Asia and Europe, Türkiye is in a prime position to serve as a middleman between the two regions. The pipelines passing through Türkiye towards Eastern Europe include the Trans-Balkan, Balkan Stream, Trans Adriatic, Trans-Anatolian.

Recently, in addition to lessening dependence on gas from Russia, Türkiye is also taking initiatives to diversify its supply from other sources outside of domestic production. Currently, Iran and Türkiye have a 25-year contract that expires in 2026 in which Iran supplies gas to Türkiye at 10 bcm per year.[9] During a meeting in Tehran, Alparslan Bayraktar (Turkish Minister of Energy and Natural Resources), stated that, “We are seeking to diversify our gas import routes.” He noted that Iran is one of Türkiye’s key suppliers and that the Turkish government is interested in extending the contract.

On the Azerbaijani side of things, construction is underway for several projects such as the Nakhchivan gas pipeline,[10] a deal that was signed on May 15th which includes capacity expansions for various pipelines.[11]

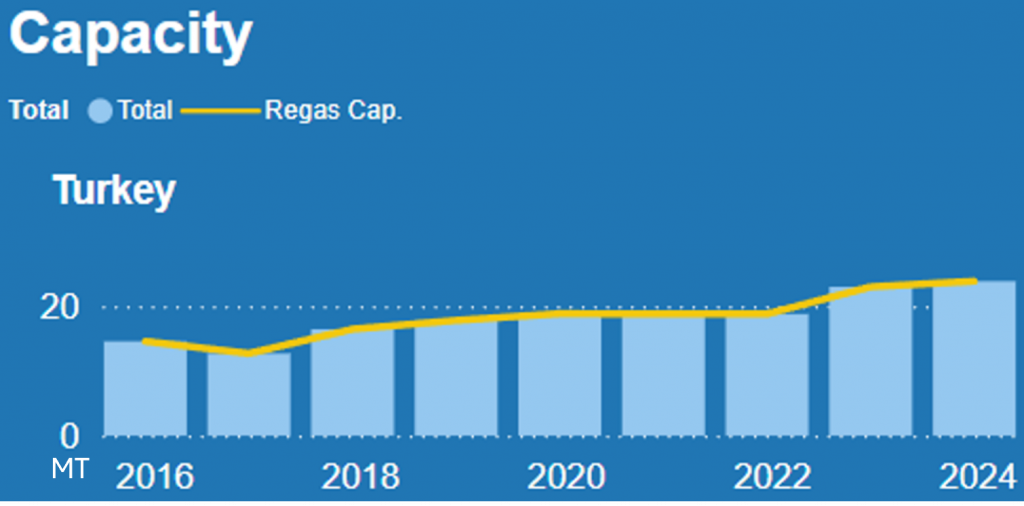

In addition to pipelines, Türkiye currently has 5 LNG import facilities, 3 of which are FSRUs. The combined capacity of these facilities is 23.9 bcm. Türkiye does intend to further increase its LNG import capacity and storage capacity. [12]

In September of 2023, Russia proposed the creation of a gas hub within Türkiye, to help replace the gas no longer flowing to Europe. However, the discussion has not advanced since then.

This gas hub would have been located in the northwest region of the country and connected with LNG import terminals and also have plans for upgraded storage capacity. Pipeline gas flowing into the country would have fed into the hub and be priced in a local gas exchange.[13] “Russia sees the hub as a way to re-route its gas exports now that European countries have sharply cut their buying. It hopes to sell some gas via Türkiye to countries that would not be willing to buy directly from Russia.”[14]

In addition to oil, coal, and natural gas making up the three pillars of Türkiye’s energy mix, renewables have also had a growing presence. Hydropower, solar, and wind are the biggest producers of renewable energy currently within the country.

Türkiye is positioned to play a major role in gas flow from the Middle East to Europe. In addition to this, the discovery of new gas fields in the Black Sea may transform the natural gas industry from being primarily import based to more balanced between domestic production and imports. However, the market is always shifting, and disruptions could occur at any moment. It is with market simulation tools such as the G2M2® Market Simulator for Global Gas and LNG™ that both countries and companies alike can find the best methods to achieve energy security, both in supply and production, through robust market analysis and better strategic decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[2] Turkey discovers natural gas worth over $500bn in the Black Sea (offshore-technology.com)

[3] Ibid

[4] Turkey’s Energy Challenges – TheGeoPolity

[5] Aegean dispute – Wikipedia

[6] Why the latest attempt at a Greece-Turkey reset, while positive, falls short – Atlantic Council

[7] Egypt’s Gas and LNG: Global Challenges and Global Ambitions – RBAC Inc.

[8] Turkey and Egypt aiming to extend diplomatic thaw at Cairo summit | News | Al Jazeera

[9] Iran, Turkey hold talks to expand energy cooperation – Tehran Times

[10] Azerbaijan, Turkey start construction of Nakhchivan gas pipeline | Eurasianet

[11] Turkey Excludes Iran from Turkmen Gas Transit Route | Iran International (iranintl.com)

[12] Turkey to expand infrastructure for regional gas hub, minister says | Reuters

[13] Ibid

[14] Exclusive: Disagreements delay Russian gas hub plans in Turkey | Reuters