In three short years, Natural Gas and LNG markets have gone through enormous turmoil: a two-year Covid-19-pandemic-induced natural gas demand slump, a labor and supply chain breakdown, and a demand-rebound energy crisis further exacerbated by Russia’s invasion of Ukraine and the subsequent sanctions placed on Russia, all with varying degrees of impact across the different global supply and demand regions.

The disruption of energy supplies concurrent with the rebound in demand resulted in not only short-term market volatility, but a re-think in energy priorities, namely energy security and independence. Whether desired or undesired, this has inevitably changed the course of the energy transition. Without the abundant and inexpensive Russian gas to support Europe’s ambitious climate goals, reality has set in on the challenges of a full-steam-ahead plan to move away from fossil fuels towards dependency on intermittent renewable energy sources such as wind and solar.

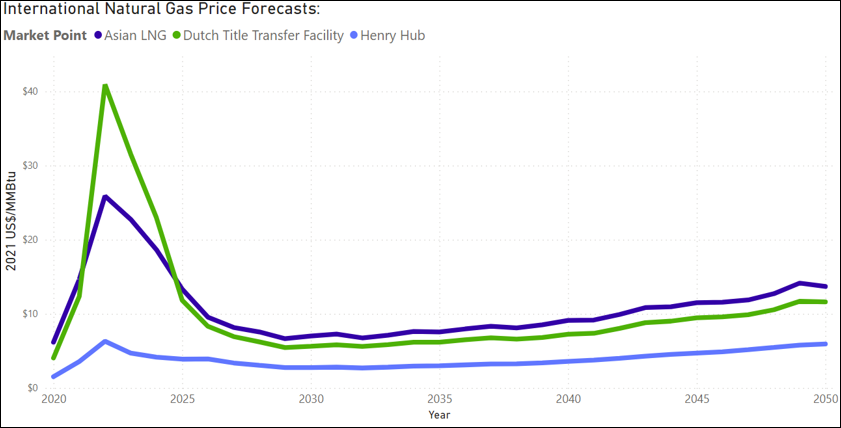

According to RBAC’s 23Q1 global gas and LNG outlook, utilizing the G2M2® Market Simulator for Global Gas and LNG™, natural gas prices are expected to continue at historically high levels until the winter season of 2024, despite a decline in 2023, which so far turned out to be softer than expected, yet the balance remains to be tight, despite the short-term low prices in the first two quarters. Additional factors may push back the annual average price in the next two quarters.

Long-term projections after 2030 suggest that the increasing costs of natural gas production and developing the global LNG supply chain to support demand growth are likely to contribute to this gradual increase in prices.

But what is the implication of this for various regions over time?

Europe

With the current Natural Gas Storage level in Europe at 76%, there is a lot to be hopeful about the summer and the coming 23/24 winter season. However, given the volatility in the market we have seen over the past two years, is it too soon to be hopeful?

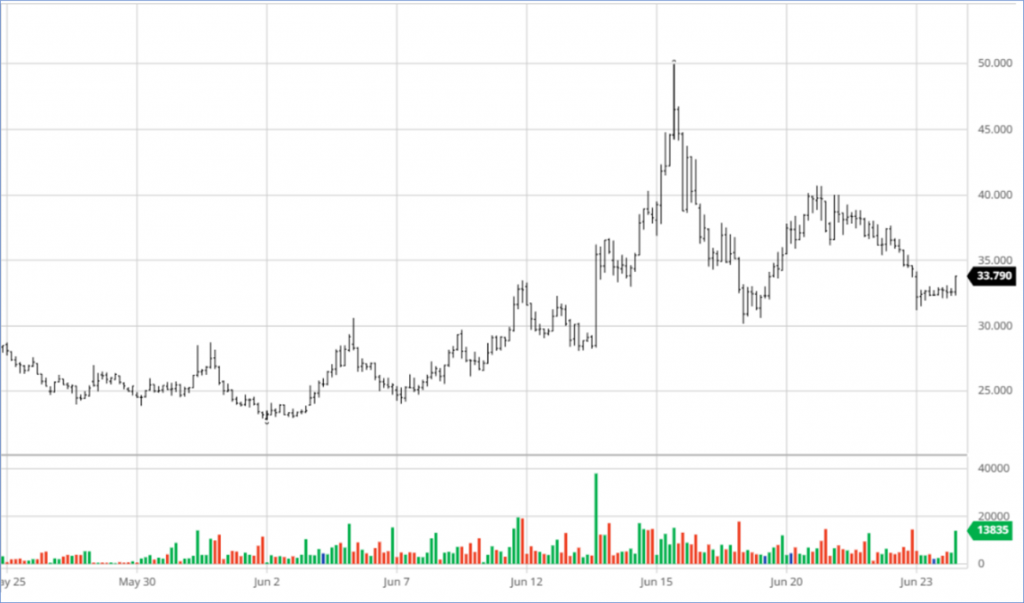

The global natural gas market witnessed a significant drop in prices in the first quarter of 2023 due to , especially from China. This low-price environment, while leading to high storage levels, is anticipated to encourage a shift from coal and oil to gas in the European electricity sector. Although we did see an uptick in TTF prices in June, those prices have since come back down—at least for the time being.

Barring any major black swan event, weather will play a key role in how the EU will be able to manage their natural gas storage levels throughout the summer and leading into the 23/24 winter season and ensure a steady supply of natural gas when needed.

In the global market, this weather variable needs to be considered for multiple regions, such as Europe and Asia. Higher than expected demand due to hot weather in Asia this summer or a colder winter season could lead to increased competition for LNG between EU and Asian buyers.

The modelling of such weather scenarios can be done in a robust fashion, such as was done in the RBAC/Refinitiv study using 20 years of weather data to look at various winter weather possibilities, “Weathering a Storm of Uncertainty: Refinitiv-RBAC 2021 Short-Term Global Gas and LNG Market Forecast”.

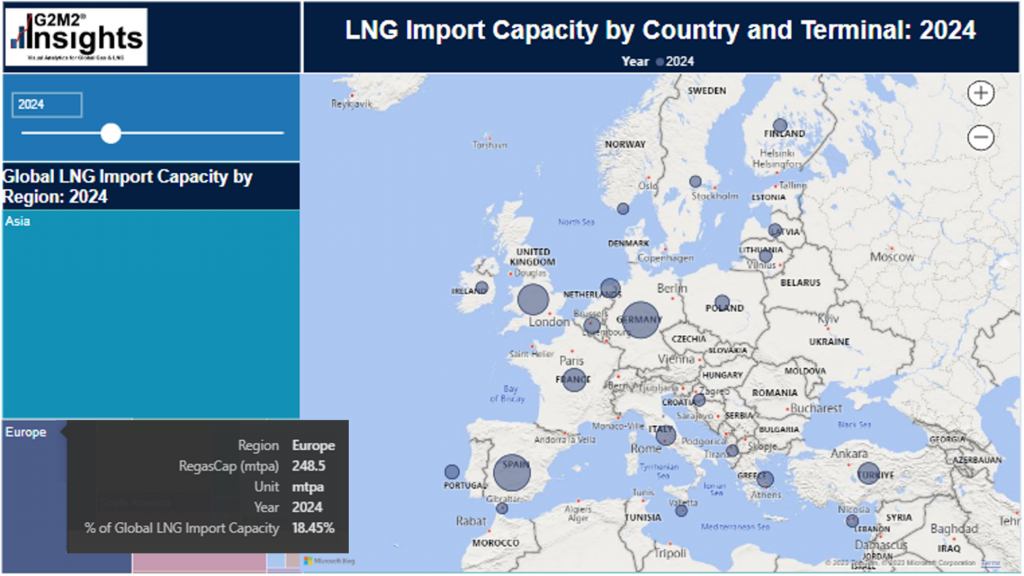

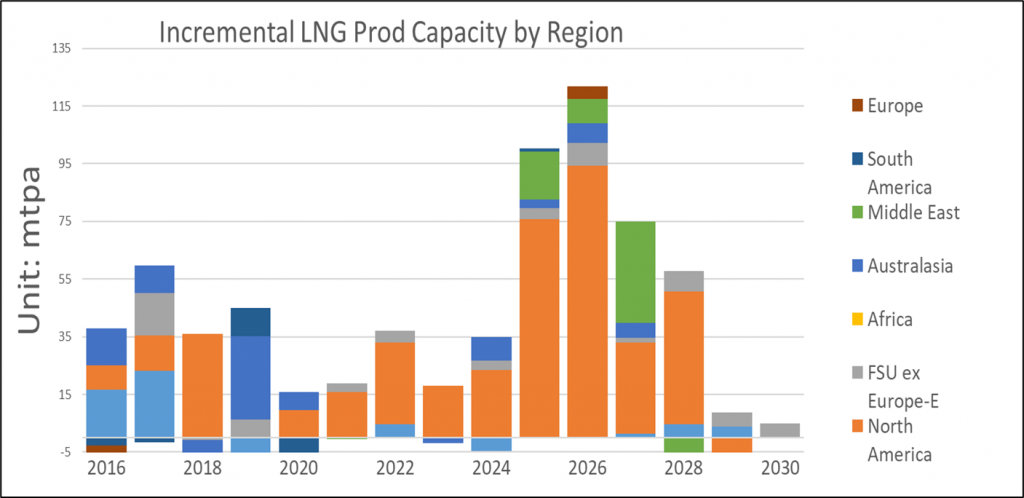

The EU appears to be proactive in ensuring better energy security going into the future by focusing on expanding its regasification units and reducing demand to meet their future energy requirements and reduce the possibility of disruptions, while continuing to push for their transition to a net-zero future with almost 250 mtpa capacity expected to come online by 2024.

Asia

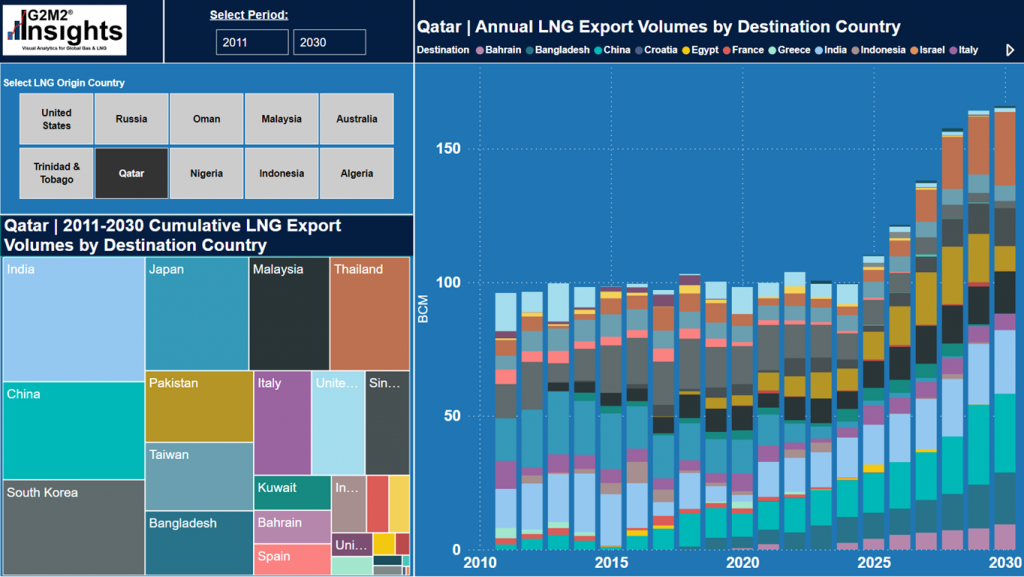

With the fall in gas prices from the extreme highs we experienced in August 2022, emerging markets such as India, China, and Brazil could leverage the lower prices for increased gas import opportunities, potentially transforming their energy strategies. Asia, and particularly China and other Northeast Asian countries continue to exhibit a steady increase in natural gas demand driven by urbanization, industrialization, and a transition from coal to gas.

Should the EU need to utilize more of its gas in storage than expected over the summer months, Asia’s LNG demand could have a significant impact on whether the EU will meet its natural gas storage targets for the upcoming 23/24 winter, without having to pay extraordinary prices on the spot market to make up for storage deficiencies.

Such a scenario of EU/Asian competition for LNG cargos could have a devastating impact on such developing countries that rely heavily on LNG imports for their gas-fired power needs, precipitating shortages and blackouts and hamstringing local industry with lack of electricity, much like we saw in 2022 the first half of 2023 in South and Southeast Asia. This was highlighted in a recent article about the challenges Bangladesh has been facing. Bangladesh’s Worst Power Crisis in a Decade – RBAC Inc.

This practice of “exporting intermittency” is a major source of conflict with developing countries and the “West” in its drive towards a net-zero future with renewables replacing fossil fuels and nuclear, while seeking to limit investment in those countries’ development of their own fossil fuel resources.

North America

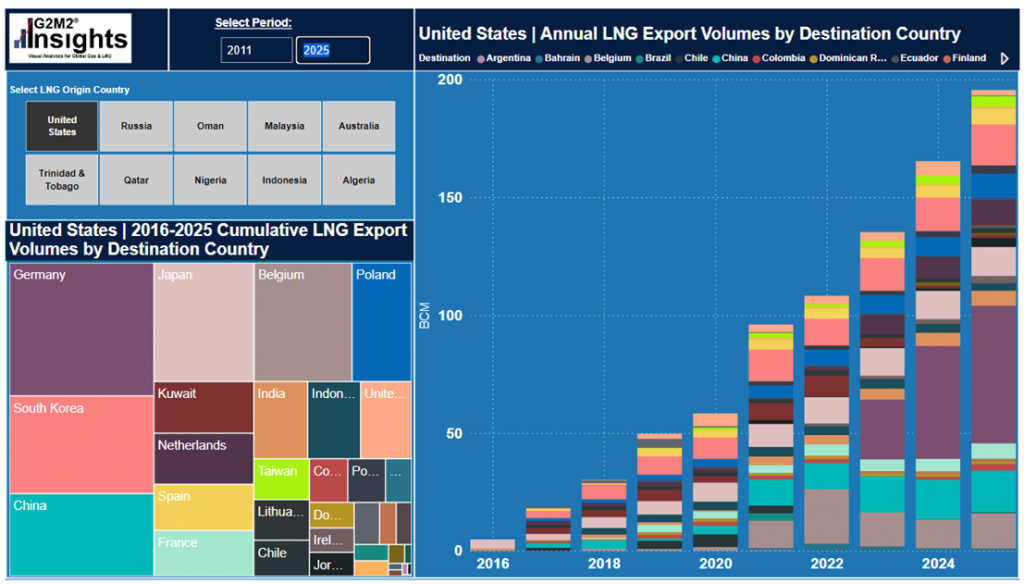

While LNG project developments have been affected due to market volatility, the global LNG production outlook remains stable, with significant liquefaction capacity expected to be added by North America between 2023 and 2028.

Another added factor that works in favor of providing LNG to both Asian and European buyers is that Freeport LNG terminal returned to full capacity in March 2023.

There is a lot to be hopeful about in the global gas and LNG markets. Although challenging at times, the markets have operated as expected throughout the energy crisis. Actions taken by the industry as well as some, albeit apprehensive, support by regulatory bodies has led to potential long-term solutions utilizing natural gas and LNG.

However, there are still plenty of variables that lead to significant volatility in the market that needs to be taken into account when developing strategies for achieving one’s energy and environmental goals.

Here at RBAC, we have seen a shift in short- and long-term energy strategies as the reality of the continued need for natural gas and LNG has set in, with both energy companies and regulators alike and using market simulation software to enable them to run the various “what if” scenarios around changes in supply & demand dynamics, new energy policy, weather, or geopolitical events, so vital to creating a successful energy strategy.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.