Uncertainty Within Colombia

Internal debate over how Colombia should approach developing its domestic resources has created uncertainty over the future of not only the industry, but the country’s energy security. Could Colombia face a natural gas crisis in the near future? The short answer is “yes.”

Irene Vélez, the then Colombian Minister for Mines announced earlier this year that they “have decided not to award new oil and gas exploration contracts,” acknowledging that it was a controversial move, but that they did it as a “clear sign of Colombia’s commitment in the fight against climate change.”1 The decision to stop new licensing has put the government at odds with energy industry leaders within the country who believe exploration of new areas is needed as existing reserves are decreasing rapidly.

But the government instead plans to revive suspended licenses or push for development of already approved blocks, rather than explore new areas. Yet, some areas were abandoned due to security, ending in a declaration of force majeure. Both the community consultation process and security have been cited as reasons for slow development. Moreover, some of the licenses were proposed as unconventional drilling sites, but President Gustav Petro also opposes fracking, reducing the country’s options.

While then finance minister, José Ocampo, reportedly told reporters Colombia was still open to new oil and gas projects, President Petro’s public stance is to move away from fossil fuels and replace them with tourism and green energy. This evoked criticism from former Environment Minister Manuel Rodríguez who said, “Colombia must not sacrifice its economic growth to make itself the champion of energy transition in Latin America,” and Julio César Vera, former president of the Colombian Association of Petroleum Engineers, implored the government not to kill the “golden goose” supplying both energy and revenue to the resource-rich country.2

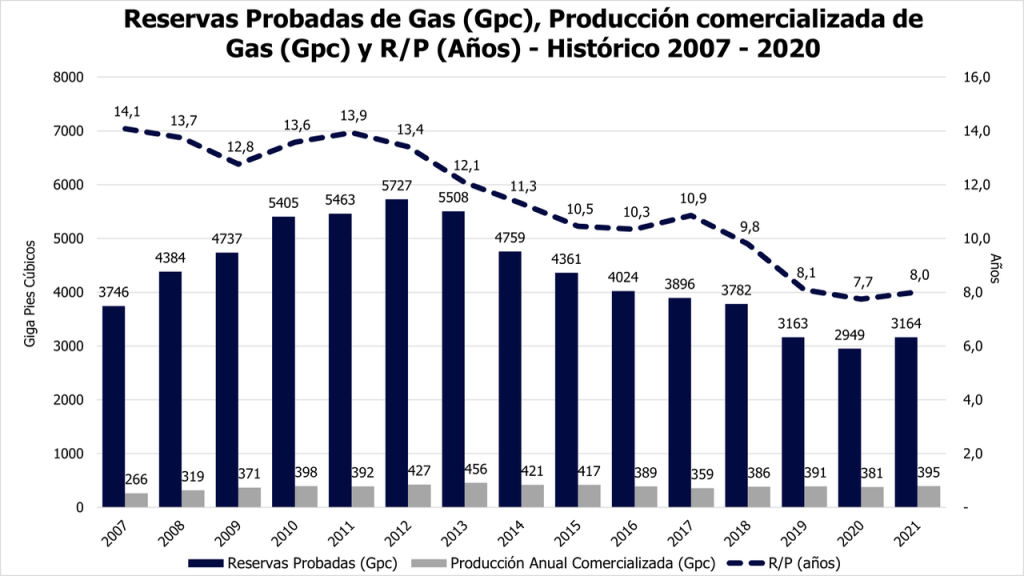

Thus, with restricted exploration and production, what is the risk to Colombia’s energy security and independence? According to the National Agency of Hydrocarbons (ANH), at the current rate of extraction, Colombia’s proven oil and gas reserves will only last seven to eight more years.3

The Trans-Caribbean Pipeline

President Petro announced at the end of 2022 that an agreement had been made to import gas from Venezuela via the Trans-Caribbean pipeline (also known as the Antonio Ricaurte Gas Pipeline). However, physically getting the gas shipped through the pipe is proving difficult for Colombia.

The pipeline has not been in operation for the last eight years. After becoming operational in 2009, “The plan was for Venezuela to import gas from Colombia for four to seven years and then reverse the flow so that Venezuela would export gas as new projects came online.”4

However, after delays spanning several years, the second phase of the plan for the flow to be reversed never materialized. Over time, gas exports from Colombia steadily decreased with the contract between the two countries expiring without renewal in June of 2015 . The pipeline returned to the spotlight after both country’s presidents met in November 2022. In January 2023, Colombia’s Ecopetrol requested exemption from US sanctions to negotiate with Venezuela’s PDVSA, regarding the previously abandoned plan of reversing the flow. Yet it remains unclear whether Venezuela will finally deliver the promised gas, since maintenance on the Venezuelan side of the pipeline has been poor since the shutdown.5 Moreover, local industry in Colombia is not overly supportive of this project. As one publication writes: “In Colombia, the mere proposal to import natural gas thanks to PDVSA generates rejection in private sector union organizations.”6

With the status of the Trans-Caribbean pipeline being uncertain, what are the options of Colombia to avoid a shortfall after the next 7 years?

Domestic Exploration

Colombia’s exploration industry was very active until 2015 when frequent attacks on pipelines and wells began to discourage investment in the energy industry.7

Despite facing an impending shortage, a sudden increase in oil and gas exploration activity seems unlikely due to political opposition and a slow approval process. How about domestic production?

Most of the natural gas currently produced within the country is associated gas from oil extraction operations in the Pauto Sur, Cupiagua, Cupiagua Sur, and Floreña fields. The only major non-associated gas producing field in Colombia is the Chuchupa field which has had over 94% of its total reserves recovered. The field’s production peaked in 2010 and is estimated to reach its economic limit in 2031.8 While this field is becoming non-viable, a new field is moving to take its place.

That new field is Sinu-9 and will be operated by NG Energy, a Canada-based E&P company currently operating in Colombia.

They operate the Maria Conchita field in the northern La Guajira province which is located just 14km away from the Chuchupa field.9 NG Energy expects an “Eight-fold boost in its natural gas production in Colombia after a new field [SINU-9] begins production next year.” This would be an increase from the current 7 mmcfd that the Maria Conchita field produces to a total of a combined 60 mmcfd in late 2024.10 “NG Energy sees natural gas production at Maria Conchita rising to 20 mmcfd by the start of November, according to Fonseca. The Sinu-9 field is forecasted to produce 30 mmcfd in the first quarter of 2024, and an additional 10 mmcfd in the third quarter.” In addition to NG Energy’s gas production expansion efforts, the Colombian state-owned gas producer, Ecopetrol SA, announced plans to expand offshore gas output.11

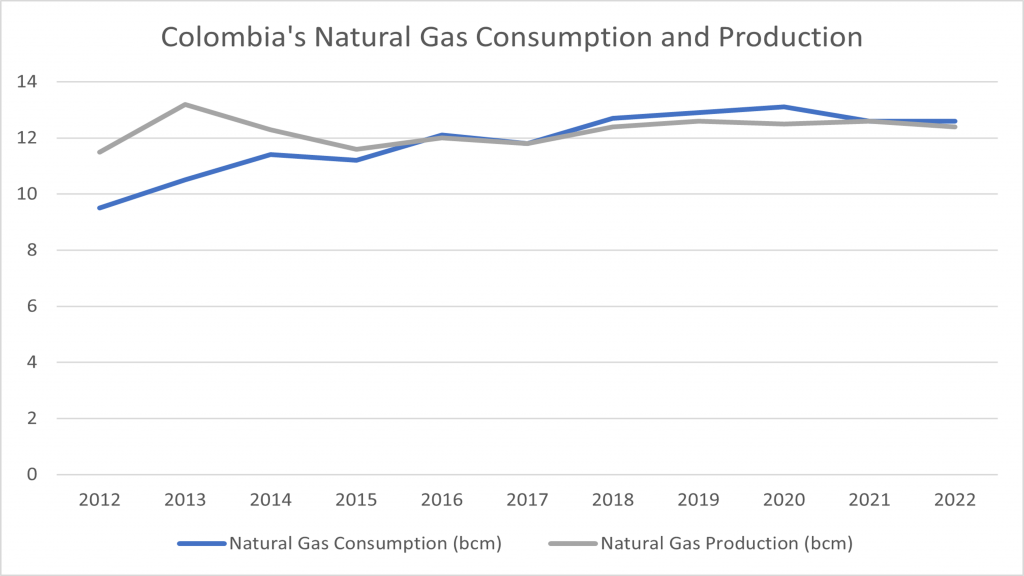

Since Colombia’s demand for natural gas surpassed its domestic production, it must secure new sources of domestic gas production, else it will need to import more pipeline gas, LNG, and/or electricity to meet demand.

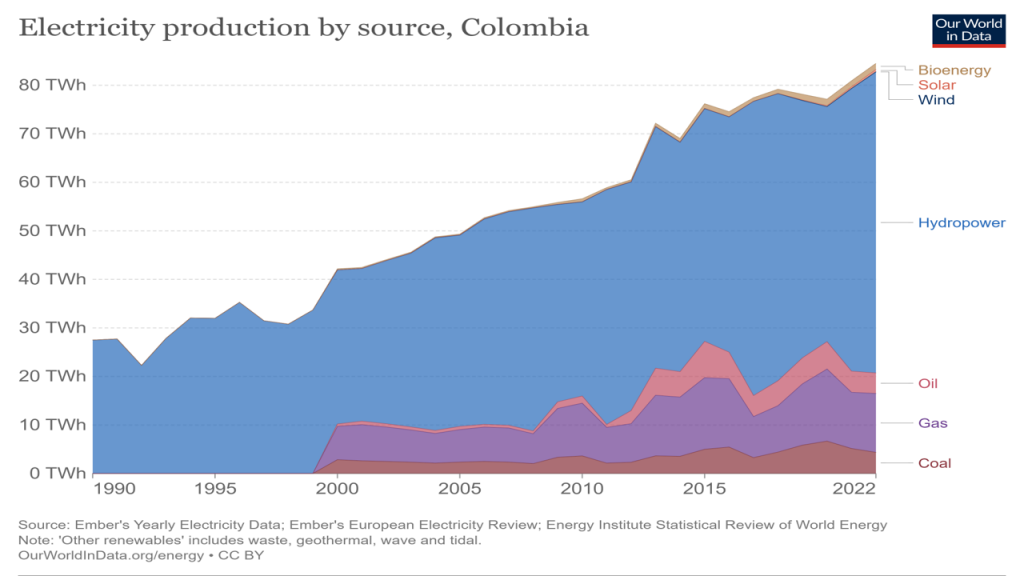

Currently, and despite having recently added 2.4 GW of hydroelectric capacity in December 2022,12 Colombia imports both LNG and electricity. Colombia has electrical grid connections with its neighbors, Ecuador and Venezuela. Colombia and Ecuador frequently trade electricity with each other, “In 2020, Colombia imported 1.3 gigawatt hours of electricity [from Ecuador] … Exports to Ecuador were 250 MWh.”13

Colombia's LNG Imports

If Colombia does not expand its domestic natural gas industry to meet rising demand, then it will need to import LNG for gas-fired power generation. Colombia has already dramatically increased the amount of LNG imported this year compared to previous years due to threats of drought from El Niño.14 It has already imported nearly 60% more LNG than in 2022 and tripled the imports from 2021 to ensure that there was enough fuel to power the country.

Hydropower makes up 73% of Colombia’s electricity production, but when El Niño changes wind and weather patterns resulting in droughts, more natural gas is needed to make up for the electricity deficit.

The last major drought the country experienced was in 2015 to 2016, and it was labeled as a “1 in 50-year event and the second strongest in the history of Colombia,” by the World Energy Council. The rainfall within the country was 40% below average and water levels within dams decreased by 60 to 70%. When coupled with increased demand, a significant shortage of electricity resulted.15

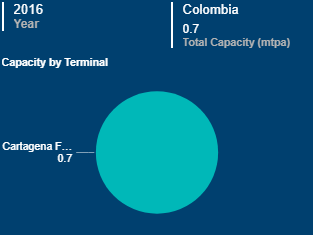

This unprecedented drought precipitated in further development of natural gas and LNG to serve as a backup to hydro in dry seasons. At the time Colombia only had 0.7 million metric tons worth of LNG import capacity, which was helpful, but unlikely to provide enough fuel for power if such an event occurs in the future.

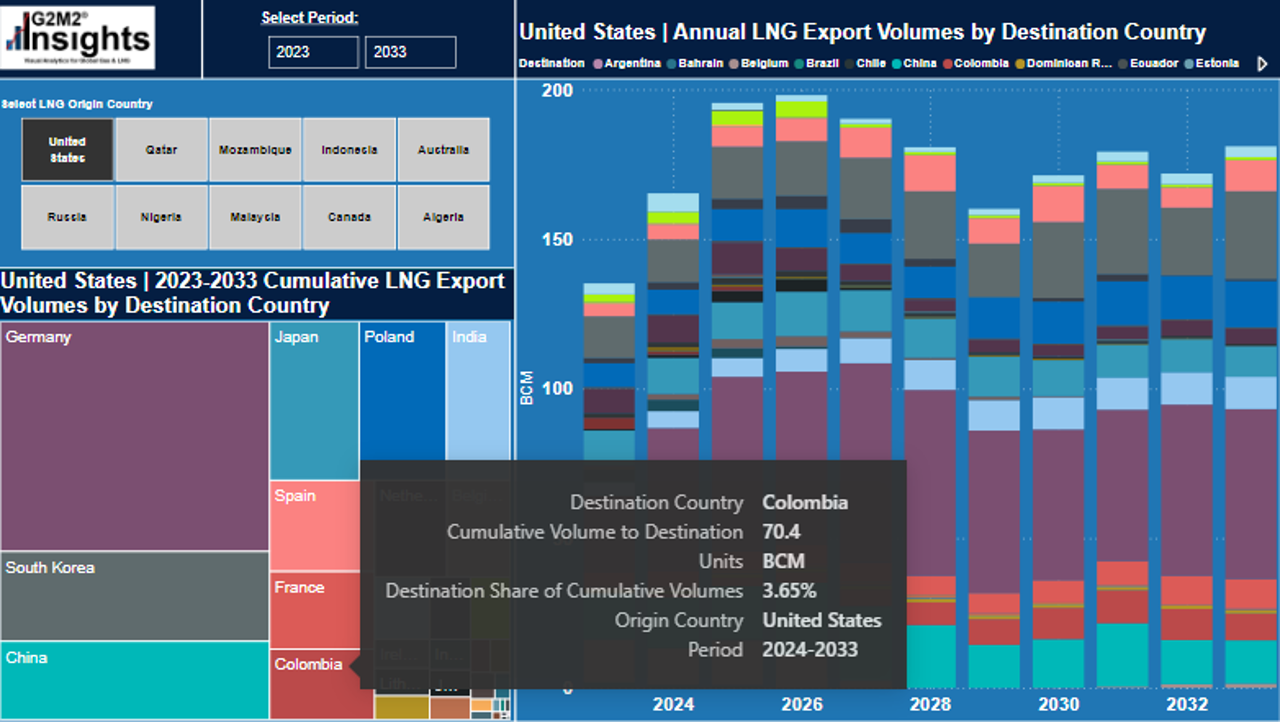

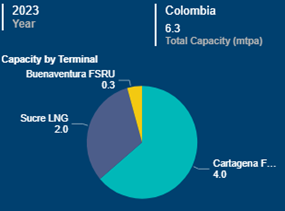

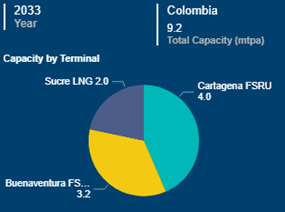

Thus, Colombia has since greatly increased its import capacity to 6.3 mtpa in 2023 and has plans to further increase that capacity to 9.2 mtpa within the next decade.

Figure 9, Colombia LNG Import Capacity 2023 to 2033. Source: G2M2 Insights

In addition to using natural gas for electricity generation, Colombia is also seeing rapidly increasing usage of compressed natural gas (CNG) as a fuel for transportation. By December of 2022, it was estimated that nearly 200,000 vehicles within the country utilized CNG, but 2023 has shown explosive growth in natural gas vehicles (NGVs). In January 2023, new registrations of NGVs grew by 553% compared to January of 2022.16 The usage of CNG is gaining popularity not only in South American countries17 but other emerging economies such as countries in Africa where they are also integrating CNG into their transportation sector.18

Colombia’s Future

Colombia has historically relied on hydropower for its electricity generation but will need to diversify its energy mix so not to be at the mercy of another severe drought. Most of its natural gas production is reliant on its oil industry. But it is facing production declines and difficulty securing investment in new projects19. Combined with a lack of government support for new gas exploration contracts, Colombia appears to be heading towards a greater reliance on imports of both pipe gas and LNG in the near future. Whatever its energy transition plans, it appears natural gas will remain an important part of Colombia‘s energy mix, to both diversify and avoid shortfalls caused by dependence on a single source of power (hydro).

RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can be used to help companies or even countries better navigate the global gas market and enable leaders and investors to make informed decisions that can provide affordable and reliable energy for all.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] Colombia’s Controversial Oil and Gas Exploration Ban Explained | OilPrice.com

[2] Colombia announces halt on fossil fuel exploration for a greener economy | Colombia | The Guardian

[3] Colombia Is on The Brink of a Natural Gas Crisis | OilPrice.com

[4] Venezuela’s PDVSA says halting Colombia gas imports | Reuters

[5] How a New Gas Deal Is Reshaping Venezuela-Colombia Relations (foreignpolicy.com)

[6] Ecopetrol manages OFAC license to buy gas from PDVSA – Finanzas Digital

[7] Colombia’s Farc blows up oil pipeline in Catatumbo – BBC News

[8] Oil & gas field profile: Chuchupa Conventional Gas Field, Colombia (offshore-technology.com)

[9] Maria Conchita – NG Energy International (ngenergyintl.com)

[10] NG Energy expects “eight-fold” increase in Colombian natural gas production in 2024 (worldoil.com)

[11] Ecopetrol to drill test well in Colombian Caribbean | Oil & Gas Journal (ogj.com)

[12] Colombia’s Ituango hydropower plant launches commercial operations (hydroreview.com)

[13] Country Analysis Executive Summary: Colombia (eia.gov)

[14] Colombia boosts LNG imports ahead of El Niño dry weather | AJOT.COM

[18] Africa: The Natural Gas Sleeping Giant – RBAC Inc.

[19] Colombian oil production seen falling amid headwinds – BNamericas