Global Gas and LNG Market Advance Despite Volatility

The global market has been a center of attention this month as we zeroed in on Africa developing their domestic gas resources, LNG and economic growth in Southeast Asia and Japan, Australian gas supply disruption scenarios, evaluating the global progress towards the energy transition, and how the United States is quite at the center of much of this, including its role as the top LNG supplier in the coming years. All these and more as we present the latest edition of our newsletter.

Quick Brief – Global Prices: Rebalancing with Increased Volatility

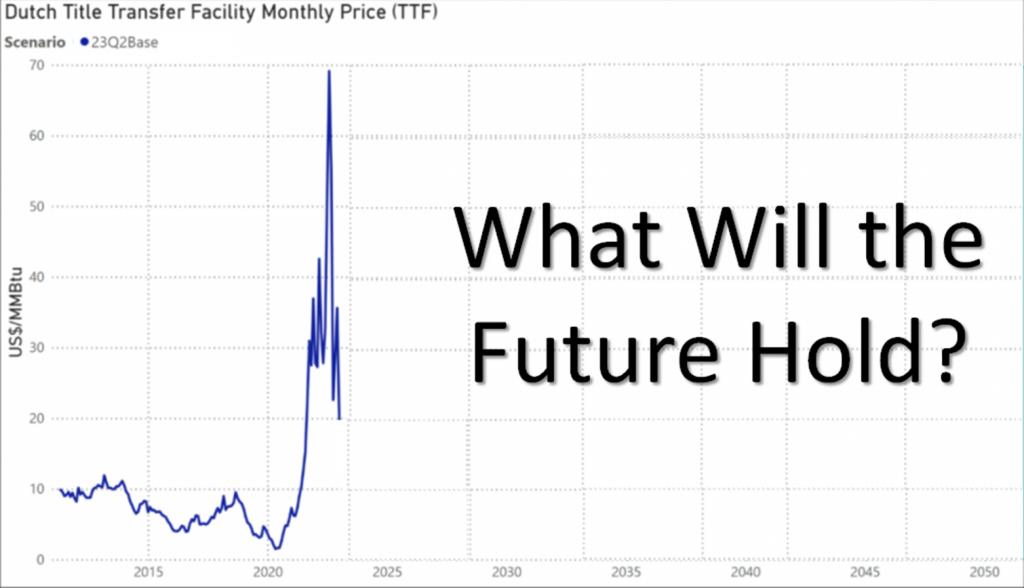

As 2023 commenced, the gas market presented a softer price environment than anticipated following a mild and uneventful European winter. Gas inventories swelled to nearly 80% by the end of June. Concurrently, Asian demand failed expectations to rebound after China’s COVID-19 restrictions were lifted, leaving more LNG available for Europe. These factors combined to create short-term surplus, leading to brief periods of TTF prices below $10.00/MMBtu.

However, the market’s fragility was exposed recently by sudden price spikes, demonstrating that stability is far from guaranteed. Two instances this summer illustrate this volatility. First, extended maintenance outages at Norwegian gas processing facilities caused the TTF front-month gas price to soar from $7.30/MMBtu at the beginning of June 2023 to over $13.20/MMBtu by mid-June, only to plummet back to under $8.60/MMBtu in the first weeks of July, underscoring the European gas market’s sensitivity to Norwegian supply disruptions and its growing dependence on Norwegian gas, especially after Russia’s exports to Europe decreased. Second, European natural gas prices leaped almost 30% in mid-August in response to potential disruptions in LNG supply from Australia. While Europe rarely receives LNG cargos directly from Australia, the price response demonstrated the concerns traders had over global LNG supply availability.

The recent short-lived spikes in TTF prices serve as stark reminders of the market’s fragility given the fundamental shifts in Europe’s gas supply mix. However, in the winter of 2022/23, European gas conservation efforts, coupled with mild weather, managed to help them meet the 15% voluntary gas demand reduction target set by the EU in July of 2022. This effort allowed the TTF price to drop significantly from the summer high of around $69.11/MMBtu to $19.95 by January 2023.

2023 RBAC Annual Gas & User Conference

The agenda has been finalized, we have a great slate of presentations from our own staff and from guest speakers that are sure to provide great insight into not only the global gas and LNG market, but how our market simulation tools can play an important role in understanding this volatile market. Click here for more information and registration and if you are interested in becoming a user of our market simulation tools contact us for a demonstration here.

Articles and Media

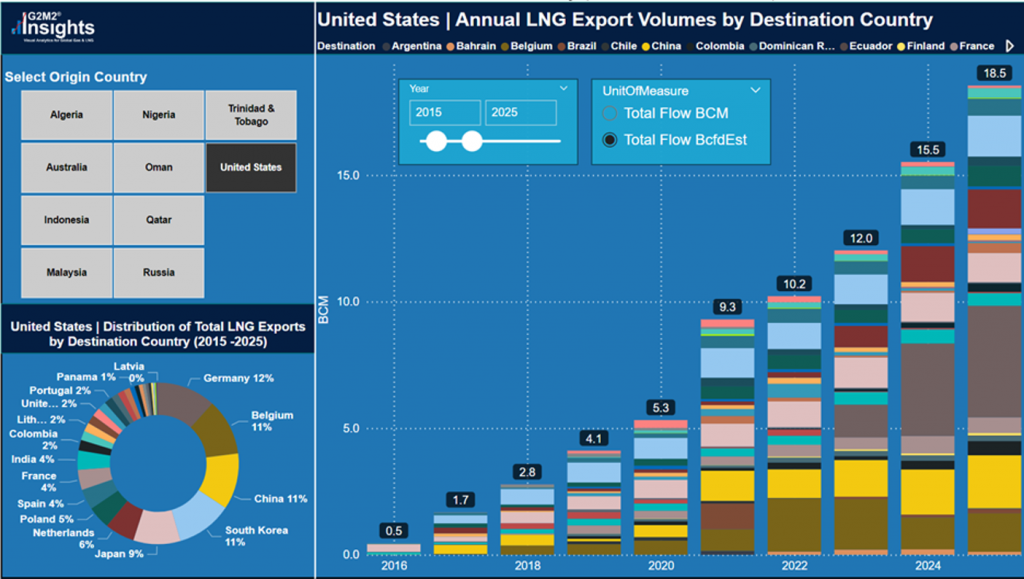

The United States is Leading the LNG Charge

“LNG exports have more than doubled from 2019 to 2022. And as Newton taught us, a body in motion remains in motion. LNG exports continue to rapidly increase, expected to more than double again between 2022 and 2025.”

Has the Energy Transition Been Cancelled?

With Trillions invested in the energy transition, what results are in so far? What has been the effect on demand for fuels such as natural gas and energy access and reliability?

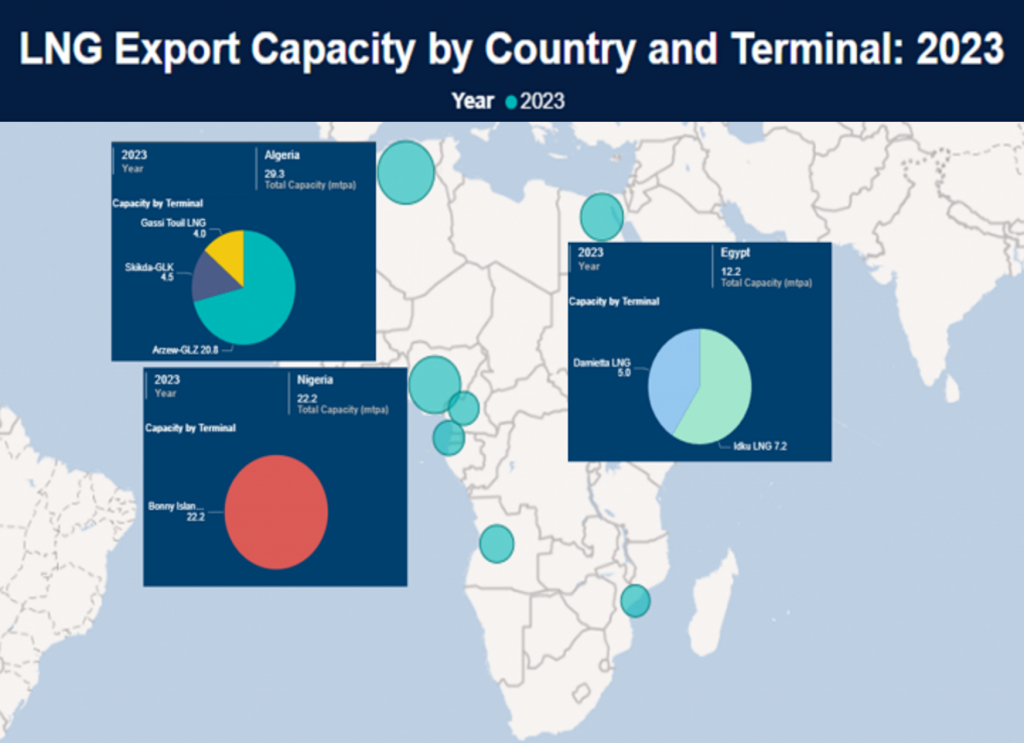

The Natural Gas Sleeping Giant

“If Africa can properly develop their natural resources, they will be able to strengthen their position in the global energy supply chain and provide affordable energy not just for their people but to the entire world.”

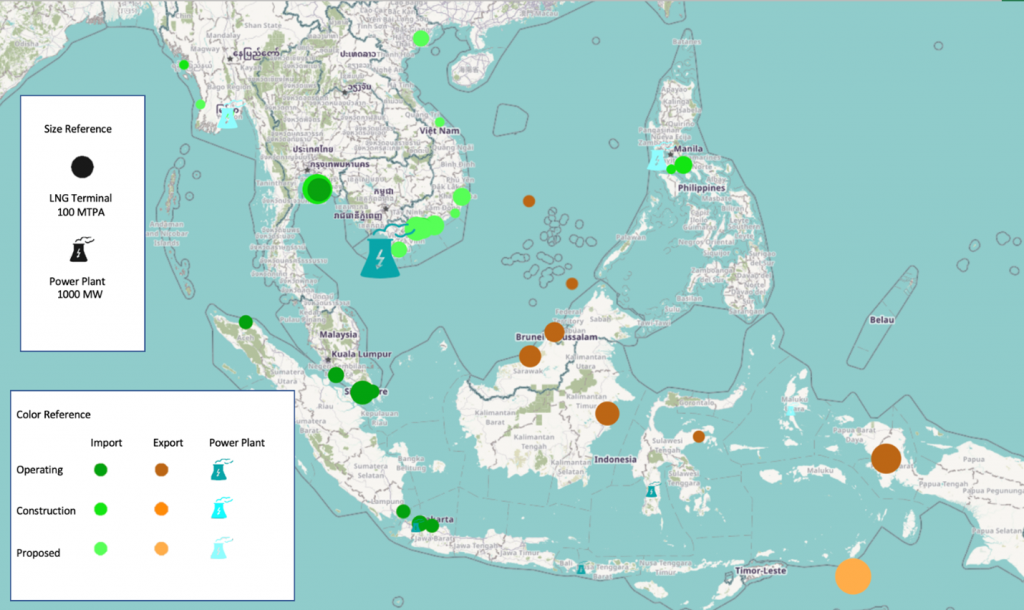

Uncovering the Southeast Asian LNG Market and Japan’s Strategic Inroads

“After East Asia, Southeast Asia is seen as another engine of global economic growth due to the gradual shift of industrial production to the area from more developed regions. Southeast Asian economic growth will be fueled by a substantial increase in energy consumption.”

Read “Fueling Progress: Uncovering the Southeast Asian LNG Market and Japan’s Strategic Inroads”

Potential Effects of Australia LNG Supply Disruption Follow Up

The strikes have now ended at several LNG facilities in Australia, let’s look at what could have happened if these strikes lasted for longer.

Read “Potential Effects of Australia LNG Supply Disruption Follow Up”

Essential Reading

Taken from the trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

LNG Flow Scenarios Under Energy Transition

“This study first highlights the trends, uncertainties, and challenges faced by the global gas market from the LNG value chain to macroeconomics, then further address the question: what will this mean for the global gas market and LNG trade going forward?”

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

Coal-Fired EVs & Weird Climate Logic

“EVs need metals, which must be extracted just like fossil fuels. And they are not going to be extracted, refined, smelted, transported, manufactured, and transported again with wind and solar power.”

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading. For more information visit our website at http://www.rbac.com.

© 2023 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.