What’s the Window of Opportunity for Energy Professionals?

While oil and gas production in shale plays has gotten most of the glory in the last two decades and since 2016 for natural gas with exports opening up, the Gulf of Mexico (GoM) [also recently called Gulf of America] is poised for a comeback.

Can it become an even more vital hub for offshore natural gas production?

According to a recent feature in Pipeline & Gas Journal (PGJ), titled “Gulf of Mexico Looking Economically Viable in Coming Years”, the revitalization of the region is increasingly grounded in technological advancements, favorable market dynamics, and improved cost structures.

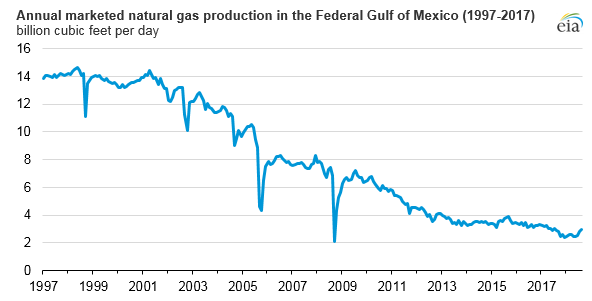

Historically a key contributor to U.S. natural gas supply, the GoM saw declining production over the past two decades as operators shifted focus to shale plays.

However, PGJ’s April 2025 article by Richard Nemec provides an analysis which indicates the tide could be turning. New project sanctioning is on the rise, and production declines are expected to stabilize — and potentially reverse — as new, economically viable developments come online.

One notable driver is cost efficiency. Offshore production, once considered expensive compared to onshore shale, is becoming more competitive. According to the Nemec, improvements in deepwater technology, drilling techniques, and facility designs are dramatically reducing the breakeven price for new projects. Where once $50+/barrel oil prices were needed to justify investment, many new projects are viable at prices below $35/barrel, which significantly boosts natural gas project economics in the region as well.

At the same time, infrastructure advantages are critical. The Gulf boasts robust existing pipeline networks, gas processing facilities, and proximity to major LNG export terminals like those along the Louisiana and Texas coasts. This lowers both upfront capex and time-to-market compared to greenfield developments elsewhere.

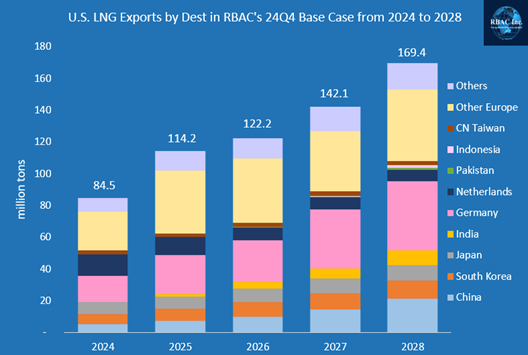

Furthermore, Nemec emphasized a global market shift: with U.S. LNG exports projected to expand sharply over the next five years, driven by demand in Asia [and yes, Europe], the strategic importance of the GoM as a supply basin is increasing.

As noted by Dr. Robert Brooks founder and CEO of RBAC in “Affordable, Clean Energy Access Everywhere”, LNG exports are “critical not only for America’s economic future but for the world’s transition to a cleaner energy system.” This macrotrend underpins the resurgence in GoM investment.

Senior Gas Analyst at RBAC, Robert Kachmar, points out in “The Future of North American Natural Gas and LNG” that supply sources such as the GoM are well-positioned to fill increasing LNG needs, especially as U.S. pipeline bottlenecks constrain some inland production regions:

“Access to tidewater and established transportation networks provides Gulf Coast producers a competitive edge that should not be underestimated.”

Senior Analyst at RBAC, Scott McKenna, in “North America’s Changing Natural Gas Flows”, further noted that new infrastructure optimizations are reshaping flow patterns:

“Traditional east-to-west flows are being supplemented — and in some cases replaced — by southward and seaward movements toward LNG terminals, with Gulf production right at the center.”

Are these factors enough to indicate that energy professionals should keep an even closer eye on GoM developments? What potential do they have to significantly alter their strategic forecasts? Does the potential for both increased production and heightened export opportunities mean a strategic reevaluation of investment, operational, and policy considerations?

Opportunities and Risks

As the Gulf of Mexico reasserts its importance on the energy map, what advantages will afford companies that leverage accurate modeling and forward-looking market fundamentals analysis? Will they be the ones best positioned to capture the benefits — and navigate the risks — of a possible new era of the Gulf?

Why Accurate Market Modeling is Essential for Capturing Opportunities

As opportunities reemerge in the Gulf of Mexico, so do the complexities. The interplay of new projects, price movements, regulatory shifts, supply disruptions (such as hurricane risks), and evolving global LNG demand creates a market landscape that is dynamic — and at times volatile and uncertain.

In this environment, robust market simulation and optimization tools become indispensable. As Dr. Brooks’ overview on “Simulation and Optimization” states:

“Without accurate simulation models, companies risk basing multimillion-dollar decisions on outdated assumptions and guesswork rather than data-driven insight.”

Key qualities that energy professionals should seek in any modeling solution should include:

- Scenario Flexibility: The ability to rapidly model different supply, demand, and infrastructure cases.

- Infrastructure Detail: Comprehensive modeling of pipelines, processing, and storage assets.

- Risk Simulation: Tools to analyze impacts from weather events, geopolitical disruptions, and policy changes.

- Global Connectivity: Modeling both domestic and international linkages, especially for LNG trade.

- Visualization: Clear, intuitive interfaces that turn complex market data into actionable insight.

Simulation platforms must not only model the current market but also help anticipate future shifts — allowing companies to strategize effectively rather than react belatedly.

What Tools Exist for Enabling Better Market Decisions?

For energy professionals seeking such capabilities, tools like RBAC’s GPCM® Market Simulator for North American Gas and LNG and G2M2® Market Simulator for Global Gas and LNG offer comprehensive, industry-leading solutions. These tools allow for in-depth modeling of natural gas flows, LNG trade patterns, infrastructure bottlenecks, and market risk scenarios — all essential for navigating the opportunities and risks emerging in the Gulf of Mexico and beyond.

Would you like to know more? Contact us and schedule a free demonstration.