What This Shift Means for Natural Gas, LNG, Power, and Global Growth Part 2

In Part 1, we explored how Davos 2026 highlighted the limits of energy strategies that underweighted reliability, cost, and infrastructure. In Part 2, the focus shifts to what is now forcing the issue: surging electricity demand from AI and data centers, tightening gas–power interdependence, and the growing impact of physical, infrastructure, and market constraints that are reshaping outcomes faster than policy cycles alone.

AI, Data Centers, and the New Firm Demand Explosion

Alongside reliability and security detailed in part 1, a third force shaped the conversation at Davos 2026: rapid growth in electricity demand. Unlike past electric demand growth, this new wave is driven by AI and data centers that often require large, firm (non-interruptible) power at scale.

“I think the limiting factor for AI deployment is fundamentally electrical power” Elon Musk at Davos. His remark captured a growing recognition that AI innovation and all it portends is increasingly constrained not by chips, but by energy availability.

Furthermore, Jensen Huang, CEO of Nvidia framed AI as “a five-layer cake,” including “energy, chips and computing infrastructure, cloud data centers, AI models and, ultimately, the application layer.” Energy in this framing, is not simply an input, but the foundation on which the entire stack depends.”

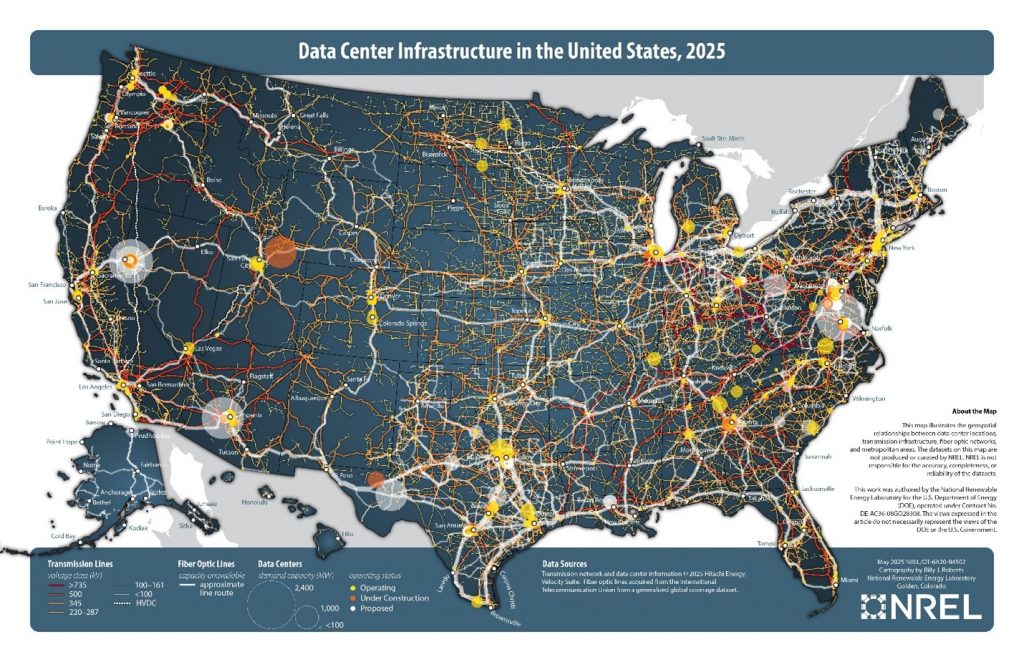

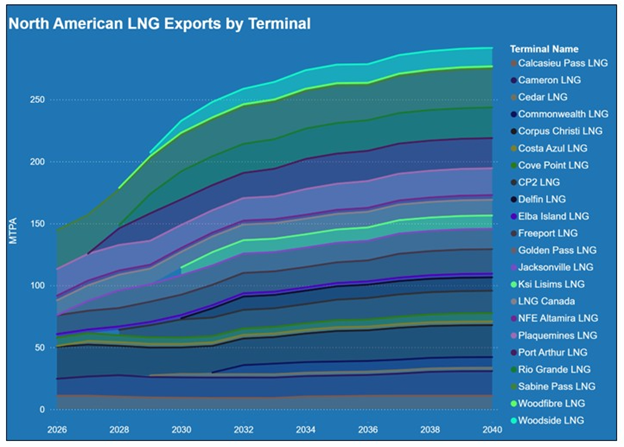

And AI and data centers are indeed driving large, concentrated, and often non-interruptible power loads. Power generation scales for data centers which used to range in the teens, are now running hundreds of megawatts, with clusters reaching gigawatt scale. And all that power is going to be fueled by firm capacity—built at speed that means natural gas, which is already in competition with LNG exports in the USA.

RBAC has examined this interaction (and sometimes collision) through many articles and podcasts, and most recently in Data Centers and LNG Play 3D Chess for Natural Gas, which shows how data-center load growth intersects (Figure 1) with LNG export expansion (Figure 2) and constrained infrastructure at various points throughout the natural gas pipeline system.

Electricity demand driven by AI data centers’ rapid growth has shifted the energy discussions from long-term targets to near-term firm deliverability. Power systems must be able to supply that non-interruptible energy at scale, reliably and at a cost conducive to growth, otherwise such growth itself becomes constrained, or it simply will move elsewhere. Thus, we find data centers growing in clusters where exists both abundant energy and conducive regulation.

And this rapid growth in power demand has also changed natural gas and LNG from a “bridge fuel” in the era of an energy transition, to vital input into reliability and scalability of a worldwide AI driven power boom.

This role extends beyond advanced economies, supporting reduced coal reliance and enabling economic and social development through more resilient power systems in emerging markets, including India, which has called for increasing its natural gas from 6% to 15% of its energy mix.

The United States: Did Trump Set the Tone?

U.S. President Donald Trump may have set the tone, at least from an American perspective, by repeatedly framing abundant and affordable energy as the foundation of economic and industrial strength while contrasting U.S. energy abundance with Europe’s self-imposed constraints. He notably said, “I want Europe to do great. I want UK to do great. Sitting on one of the greatest energy sources in the world …”

His core message could simply be that Europe could “do very well” economically if it adopted a more pragmatic energy approach that prioritizes cheap, reliable, and domestically produced energy.

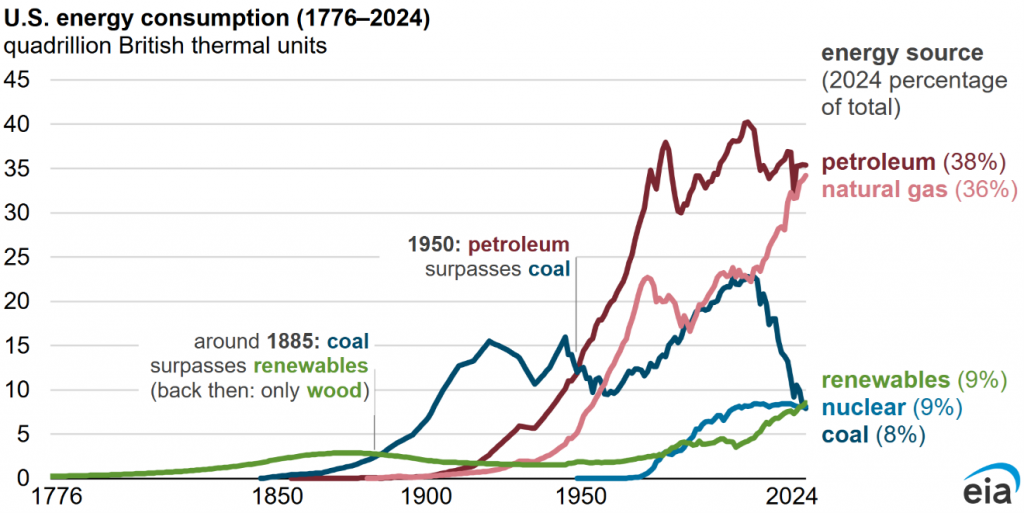

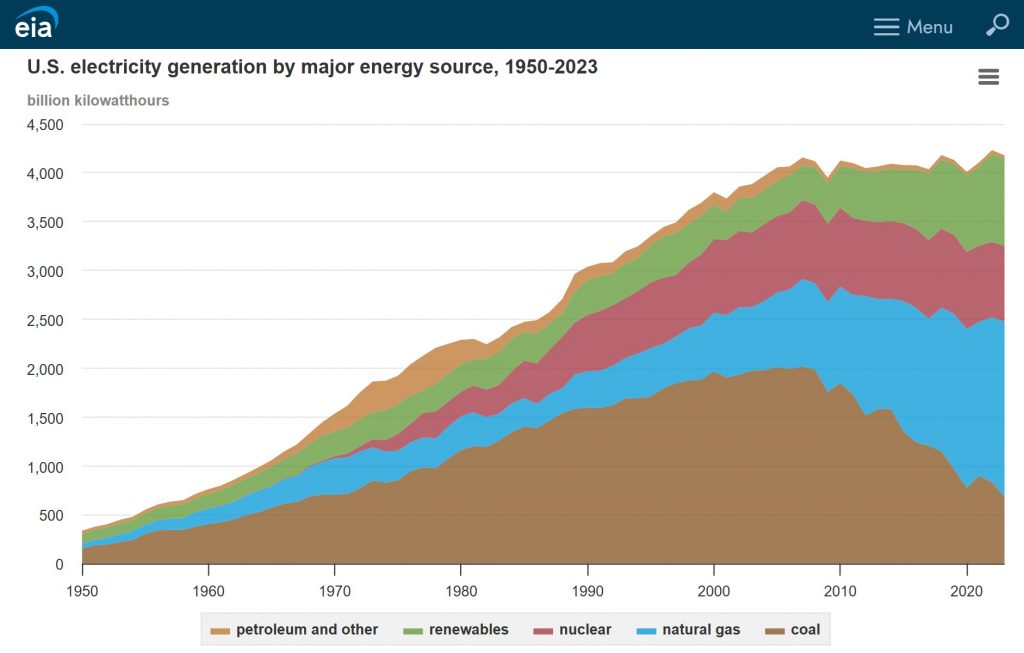

Even with a massive expansion of variable renewable capacity over the past two decades (hydro and biomass having been used for much longer), total U.S. primary energy consumption has changed most gradually.

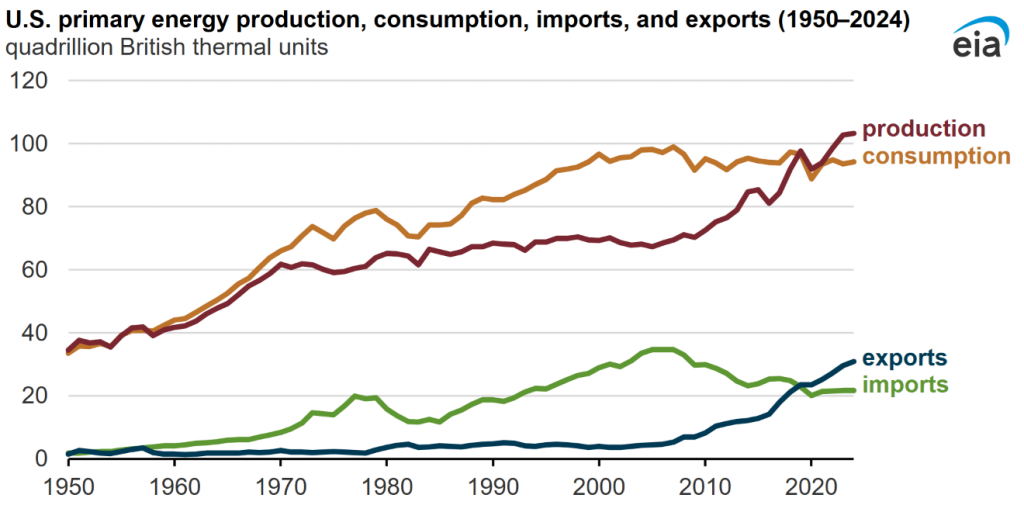

According to the U.S. Energy Information Administration, total U.S. energy consumption in 2024 was about 94.2 quadrillion Btu (Figure 3), below the 2007 peak, with natural gas reaching record highs, driven largely by power-generation demand.

Despite becoming a major energy exporter (Figure 4), the United States continues to maintain relatively low energy costs for industry. If we compare this to Europe and the UK, where policy choices have contributed to significantly higher industrial electricity prices, even where gas prices themselves are not proportionally higher, the difference is striking:

“In 2024, industrial electricity prices in the EU reached €0.199 per kWh, compared to €0.082 in China and €0.075 in the U.S. This stark price disparity directly impacts the EU’s industrial competitiveness.” (Business Europe)

And industry voices are not quiet about this, especially in the UK where they have the highest industrial power prices, yet, not at all the highest gas prices. “We can pretend to be ‘climate leaders’ on the world stage by setting a mission for a Net Zero grid by 2030, but this comes at the cost of winning the gold medal in the international industrial electricity price Olympics.” (David Turver)

European Commission President Ursula von der Leyen, came from a different angle in her special address at the World Economic Forum in Davos promoting nuclear and renewables as homegrown energy, though she did acknowledge the importance of reliable and affordable energy, saying, “Europe needs an energy blueprint that pulls together all the parts. … We are for example massively investing in our energy security and independence with interconnectors and grids. This is for homegrown energies that we are trying to promote as much as possible. The nuclear and the renewables to bring down prices and cut dependencies to put an end to price volatility manipulation and supply shocks. But now we have to speed up this transition because homegrown, reliable, resilient and cheaper energy will drive our economic growth and deliver for Europeans and secure our independence.” (WION)

While acknowledging the importance of cheap energy and doubling down on what looks like current policy + nuclear, where Europe goes with its energy mix in the future remains to be seen.

What This Means to the Future of Energy

As Davos reframed the conversation in terms of energy security, affordability, and reliability, and all in the midst of what could arguably be called a “Race for AI Dominance”, the challenge for policymakers, investors, and market participants has become more acute. Moreover, the strategic planning to achieve what appear to be divergent goals and purposes is a serious challenge.

Money flows toward value creation. For several years, through such things as the Inflation Reduction Act, money flowed towards future potential value creation in regards to the climate.

Now, even in such a place as Davos and the World Economic Forum, the acknowledgment of energy as a lynchpin to economic viability and success of business, nations, and even at the level of the citizen, has brought a renewed challenge to those involved in energy analytics.

How do these interacting forces play out across gas, power, infrastructure, trade, and investment?

A New Kind of Analysis

RBAC was founded to help the energy industry answer this conundrum through creation of advanced market simulation tools and scenario analysis, precisely because energy systems are defined by interactions, such as those between gas and power, domestic demand and global LNG trade, infrastructure constraints and prices.

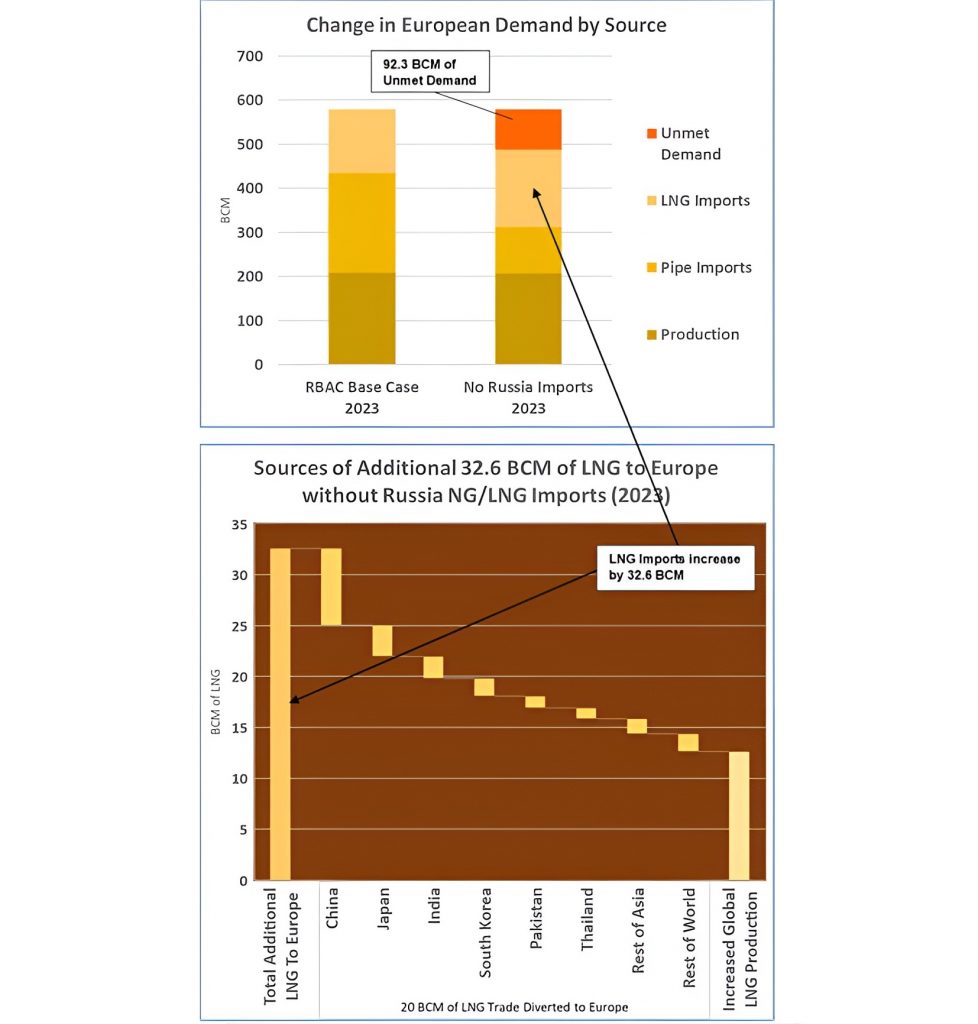

To wit, RBAC did an analysis of a Europe without Russian natural gas prior to the invasion of Ukraine (Figures 5 and 6), and predicted quite correctly that “a conflict with Ukraine could prove to be quite costly for Europe in both the higher cost of importing LNG and the loss of natural gas supply for consumers. For Russia, it could mean a significant loss of market for its pipeline gas as well as the inability to ship LNG from Yamal during the winter months to key markets in Europe while the Northern Sea Route to Asia is closed.”

RBAC has been following this issue for over a decade, with the latest report on the phase-out of all Russian gas, as well as any future possible re-introduction. There has been the view that, when (and if) Russian gas returned, there would be no market for it, yet, analysis found “[the] reshuffling of intra-European flows could threaten the returns of infrastructure investments made since the invasion of Ukraine.”

Similarly, The Double Prime Mover: Electricity Runs the Future, But Natural Gas Keeps It Running illustrates how accelerating electricity demand has tightened the coupling between power and natural gas markets (Figure 7), making system reliability increasingly dependent on their interaction.

In an energy-security-first environment, one cannot simply weigh stated policies, market signals, or investment flows in isolation, but the key is understanding the economic, market, and infrastructure constraints and where they are choking or glutting first, and how these translate through to prices, flows, and investment decisions across gas, power, and LNG markets.

Conclusion: Energy Realism Takes Center Stage

Davos 2026 reflects a critical shift in how global leaders see energy. The conversation itself is increasingly anchored in energy security, encompassing reliability, affordability, infrastructure, and economic growth.

This change appears not to be rhetorical for it is grounded in experience: Germany’s reassessment of firm capacity, Europe’s response to supply shocks, grid failures that exposed system gaps, and demand growth that pushes the limits of deliverability.

Davos showed things can change. For natural gas, LNG, and power markets, this new take on energy matters. But talk may be cheap. Until policies (and contracts) are inked, the path forward may still be murky.

Markets are responding less to declarations and more to familiar market fundamentals, though the interactions between policy and markets are many, varied and complex. Understanding these market dynamics using advanced market simulation tools is what wins in an energy-security-first world.

Would you like a demonstration of RBAC’s market simulation tools? Click here for a demo or to contact us for more information.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.