Due to unpredictable weather and a currency that is rapidly declining in value, Bangladesh is experiencing its worst power crisis since 2013.

So far in 2023, the country has been forced to cut power for 114 days, compared with 113 days in all of 2022. That’s because of the loss of 2.9 GW of natural gas, 2.2 GW of coal and 3.0 GW of diesel and fuel oil power plants; that is, nearly 36% of their total power capacity was offline due to inability to import fuel supplies.

“With forecasts for more heatwaves and the peak power-use months of July-October approaching, the country’s power minister recently warned that outages in the south Asian country, home to 170 million people, could continue in the coming days.” (Source)

To trace the origin of the fuel shortfall currently plaguing Bangladesh, we must look back at the events of 2022. Last year’s rising global fuel and commodity prices resulted in a dramatic increase in inflation and rapid depletion of their foreign currency reserves.

In an attempt to protect the declining reserves, “The government had stopped all non-essential imports and reduced the supply of dollars to commercial banks. This has not only forced banks to refuse new letters of credit applications but also has made their promised payments to foreign suppliers for previous imports uncertain.” (Source)

Coupled with the declining credit and loss of GDP from shutdowns in 2022, the value of Bangladesh’s taka currency fell by over a fifth since May 2022 not long after the invasion of Ukraine, and dollar reserves declined by a third to a seven-year low in April this year.

Thus, with little credit, low forex reserves and a 20% drop in currency value, the country was being priced out of the spot market. The highest price Bangladesh paid for LNG on the spot market was $36.95 per mmbtu in October, 2021 (Source).

Luckily for them, prices, “have since eased, falling by a third since the start of (2023) on slower demand and high inventory levels in Europe and North Asia, leading emerging market buyers like Bangladesh to seek tenders on the spot market once more” (Source). Prices were low enough to where they were returned to buying more LNG in the spot market, a change from a previous decision to halt spot purchases after prices spiked in 2022.

Even though low spot prices allowed the country to finally obtain much needed LNG imports, what’s strange is that Bangladesh has relatively unexplored gas reserves that could be the key for a future of reliable energy.

Natural gas was first discovered in Bangladesh in 1955, “Total gas initially in place (GIIP) has been estimated to be at 39.0 trillion cubic feet (TCF), out of which estimated total recoverable gas reserve (Proved plus probable) is 27.12 TCF. Up to December 2017, as much as 15.22 TCF gas was produced, leaving only 11.91 TCF of recoverable gas” (Source). But the question remains, with all of these available natural gas reserves, what is holding the country back from using them?

During an online forum in which geoscientists from around the world met to discuss the current state of gas exploration within the country and what can be done to improve the situation, the speakers present in this forum agreed that the exploration of these reserves stalled, “Because of a lack of dynamic vision” (Source).

The overall consensus of the forum was that in order for Bangladesh to have a future that is not dependent on LNG imports, they have to, “Put an end to its extremely slow pace of exploration as well as the bureaucratic overlordship on the national exploration activities. Instead, the explorations have to be self-driven, more frequent and faster with increased linkages with international expertise.”

To this end, Petrobangla (Bangladesh Oil, Gas & Mineral Corporation) has planned to drill a total of 46 explorations, development and workover wells during the period 2022-25 (Source). What remains to be seen is if these wells will actually be drilled, as past events may reveal that such lofty goals could be too good to be true. For example, in 2015, Bapex (Bangladesh Petroleum Exploration and Production Company) enthusiastically announced plans to drill 55 exploratory wells through 2020. But, in reality within that 5-year timeframe, only 6 of the initially planned 55 wells were actually drilled (Source).

Update: July 26th, 2023

At present 70% of Bangladesh’s gas production comes from the Bibiyana and Titas fields. These fields have seen as massive depletion in their available reserves with Bibiyana only at 5% of its original reserve and Titas at 30%. Several IOCs such as ExxonMobil have expressed interest in deep sea gas exploration off the coast of Bangladesh, but no further negotiation has taken place. As these reserves become even more depleted, efforts need to be made towards increasing exploration and production activities to avoid another shortage.

Bangladesh certainly has the assets and tools needed to become energy independent, so long as they don’t get in their own way. But to do that, they must concurrently solve domestic gas prices, subsidies and their impact on greater economy while attempting to revive their development of natural gas exploration.

In January 2023, the prices of retail gas were raised in attempt to lessen the burden imposed by unsustainable subsides. The prices were increased by anywhere from “14.5% to 178.9% for industries, power plants and commercial establishments, who together account for 78% of gas use in Bangladesh” (Source). Despite these substantial price increases, it is only expected to provide temporary relief.

When asked whether these price increases would secure an uninterrupted gas supply, Nasrul Hamid, the country’s energy minister stated, “That will be a challenge. We will increase the supply by importing LNG, but how much we will be able to import remains to be seen.”

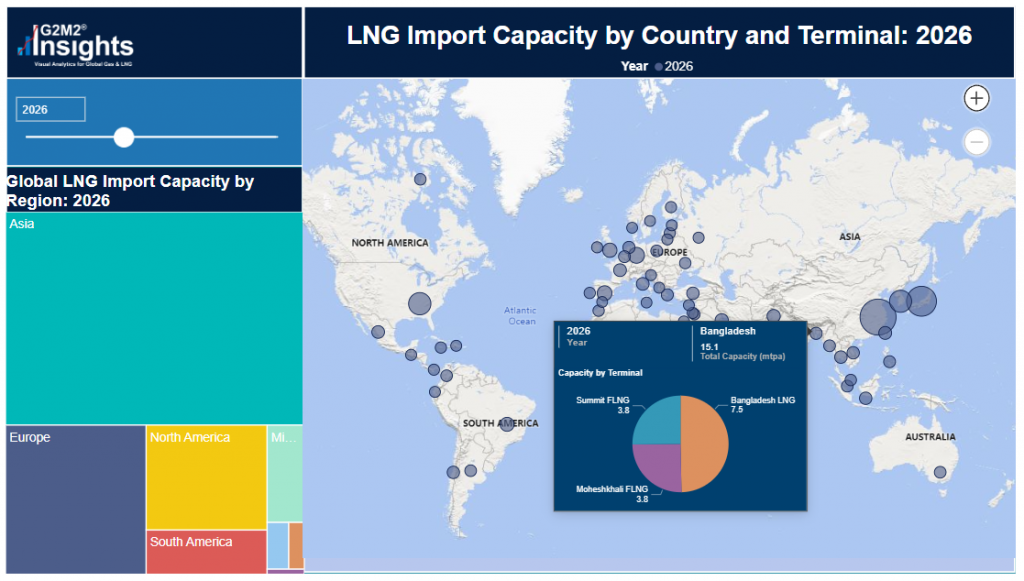

Bangladesh hopes that two newly signed long-term LNG contracts with Qatar and Oman will help solve their supply crisis, a 15-year contract for 2 mtpa of LNG from Qatar (Source) and a 10-year agreement for 0.5 to 1.5 mtpa of LNG from Oman (Source). However, neither country’s shipments start till January 2026. These new contracts can help with supply security, but Bangladesh still faces credit risks and some remaining exposure (even under contract) depending on its specific price formula.

Thus, with domestic production gas production of about 23.3 BCM and a consumption of 30 BCM, Bangladesh will need to rely on the spot market and until these new contracts take effect.

As an import-dependent economy, having to pay a premium in the spot market greatly weakened their ability to import the gas needed to keep their power plants operating. With natural gas making up 44% of their electricity generation mix (Source), a severe power crisis quickly followed once they became unable to meet their demand.

In an attempt to alleviate this crisis, purchases had to be made in the spot market, such as the one last week from Excelerate Energy (Source), to avoid a total collapse. Bangladesh was fortunate enough to be able to come to an agreement with Qatar and Oman for LNG imports to ensure energy security for the future. They aren’t exactly out of the woods yet, but the end of the crisis may soon be in sight. However, these stories of energy crisis and consequent strife are not unique to Bangladesh, and often don’t have as happy of an ending.

Developing countries often rely on energy imports to fuel their growing economies due to a lack of their own infrastructure or expertise to take advantage of their natural resources. When prices in the international spot market exceed what these countries can easily pay, it leads to outages that cause more harm than they would in a developed economy, highlighting the importance of robust supply chains and effective planning in fuel management and understanding of energy economics.

Since emerging economies are more susceptible to changes in the market than more developed nations, it is even more important that these countries have a reliable outlook on the global gas and LNG market to make informed decisions regarding contracts, infrastructure investments, and changes to their energy policy and strategy.

G2M2® Market Simulator for Global Gas and LNG™ would allow these countries to create scenarios such as severe weather cases, new LNG import/export terminals, new pipeline projects or expansions on previously existing pipelines, and several other scenarios. The base case database for G2M2 is produced by RBAC’s expert staff of energy industry veterans and researchers. Each update to the base case incorporates explicit assumptions for energy industry developments including new pipelines, storage, LNG projects, gas supply, gas-fired generation and other gas and LNG demand. The base case database also allows for even further scenario customization with the ability to replace the assumptions from our analysts.

G2M2 can be used to gain invaluable insights about the potential future of the market and help to get a clearer picture of what the market could look like in the next several decades.

To find out more, please contact RBAC Inc here.