At the recent LNG2023 conference in Vancouver, Alberta’s Premier, Danielle Smith stated that Alberta has begun talks with British Columbia to greatly expand the reach of Canadian natural gas to more foreign markets such as Europe and Asia to spur LNG exports, displace coal and thus gain carbon credits through reducing global emissions, as outlined in Article 6 of the United Nations Paris Accord.

With the competitive advantage afforded by dramatically reduced LNG shipping times compared to the U.S. gulf coast, Canada could be right on the money with this proposal. So, how would this new source of competition affect European and Asian gas markets?

West Coast Projects

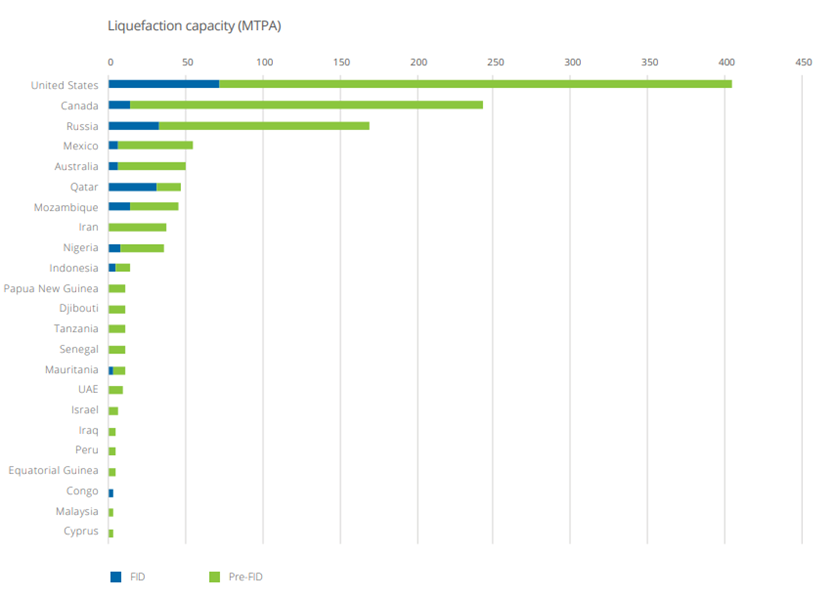

Canada already has a substantial amount of liquefaction capacity and several projects currently seeking final investment decisions (FID) that would increase their capacity to 229.6 mtpa.

Canada is only second to the U.S. in projects at this stage of their development, signaling massive future growth. Some of these projects include LNG Canada, Woodfibre LNG, Cedar LNG, Ksi Lisims LNG and all of which would reside in British Columbia.

A common theme of these projects is involvement with local communities and especially First Nations (indigenous residents of Canada). All of these projects have different agreements (LNG Canada, Woodfibre LNG, Cedar LNG, and Ksi Lisims LNG) with the indigenous peoples whose land these projects are being built on or traverse. These agreements generally include environmental protection standards, boosting the local economies by providing jobs and education resources for these communities.

Recently, the Minister of Environment and Climate Change announced a plan to remove tax credits or subsidies on production, but also outlined exceptions for projects that meet certain requirements such as, “Enable significant greenhouse gas emissions reductions…Support Indigenous economic participation in fossil fuel activities.”

LNG Canada

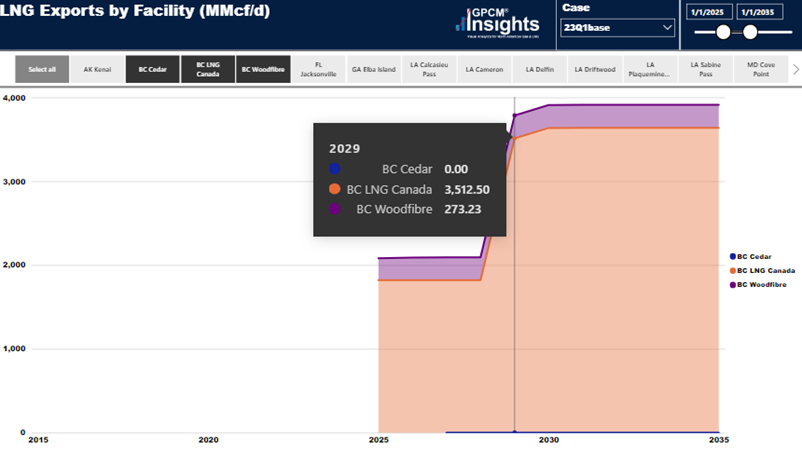

LNG Canada is nearing completion, currently at 85%, and is currently on track to begin shipping LNG cargoes in 2025. This project is a joint venture between Shell, PETRONAS, PetroChina, Mitsubishi Corporation and KOGAS and would initially be exporting volumes of 14 mtpa with room to expand to 26 mtpa. The expected market for LNG sourced from this facility will be Asian countries are seeking to meet their lower emissions targets by phasing coal out of their energy mix.

In conjunction with this, TC Energy is also constructing the Coastal GasLink Pipeline which has an initial capacity of 2.1 bcfd with possible expansion up to 5 bcfd. This pipeline would run from Dawson Creek, British Columbia to the LNG Canada terminal near Kitimat and is backed by a 25-year transportation agreement between TC Energy and the LNG Canada partners. However, this pipeline is seeing major budget overruns and has forced TC Energy to divest from other projects such as its Columbia Gas Transmission and Columbia Gulf Transmission pipelines, where they divested a 40% interest to Global Infrastructure Partners (GIP) worth roughly $3.95 billion USD.

Woodfibre LNG

As seen in the previous chart, “LNG Exports by Facility,” Woodfibre LNG is expected to begin exporting in 2025. It will contribute 262.69 mmcfd increasing to 272.86 mmcfd by 2050. These three projects and other proposed projects will be vital for helping Canada make their mark within global natural gas and LNG markets.

Cedar LNG

Cedar LNG is a proposed FLNG Export facility that, much like LNG Canada, is expected to supply to customers in the Asia Pacific region. This facility is to be, “Powered entirely by clean, renewable energy from BC Hydro, [making it] one of the lowest carbon intensity LNG facilities in the world.” This project will add up to 3 mtpa.

Ksi Lisims LNG

Ksi Lisims LNG is a similar facility to Cedar LNG in that it also utilizes hydropower and is an FLNG facility. It was initially proposed under the name, “Rockies LNG Partnership Terminal, “but was then changed to the current name under an agreement with the Nisga’a Nation. This facility is expected to be operational in 2027 with a capacity of 12 mtpa, however the project is still awaiting FID. If a FID is made, construction should begin in 2024.

East Coast Projects

The projects above are all centered in British Columbia which is where the bulk of current proposals are based. The East Coast has also had several projects attempted, but none have come to fruition.

Énergie Saguenay

GNL Québec had been developing the Énergie Saguenay project since 2014, aiming to be operational by 2026 and exporting 11 mtpa of LNG. However, the project was cancelled in 2021 due to failure to convince the Québec Government that they met the “Three criteria for approving the natural gas facility: it had to help with the transition toward greener forms of energy, lower greenhouse gas emissions and have sufficient public support.”

Bear Head LNG and Goldboro LNG

Bear Head LNG and Goldboro LNG were two other projects under consideration. However, due to various factors both projects stalled or changed course from their initial goals. Bear Head LNG was initially going to be an export terminal (GPCM was utilized for the initial feasibility study) with up to 12 mtpa capacity, but the company in charge of the project was bought out in May of 2022 and was then changed to a green hydrogen and ammonia production, storage and export project.

Goldboro LNG was also going to be an export terminal with up to 10 mtpa capacity, but the project was shelved due to, “Cost pressures and time constraints due to COVID-19 have made building the current version of the LNG Project impractical.” There is still a shred of hope for a similar project as Pieridae Energy is keeping their dream alive, even if the project is of drastically lower scope compared to the initial proposal. But with a stiff regulatory environment and a fracking moratorium that would need to be lifted for this project to potentially be approved, it seems rather unlikely at present that it will be moving forward anytime soon.

Canada’s Future LNG Exports

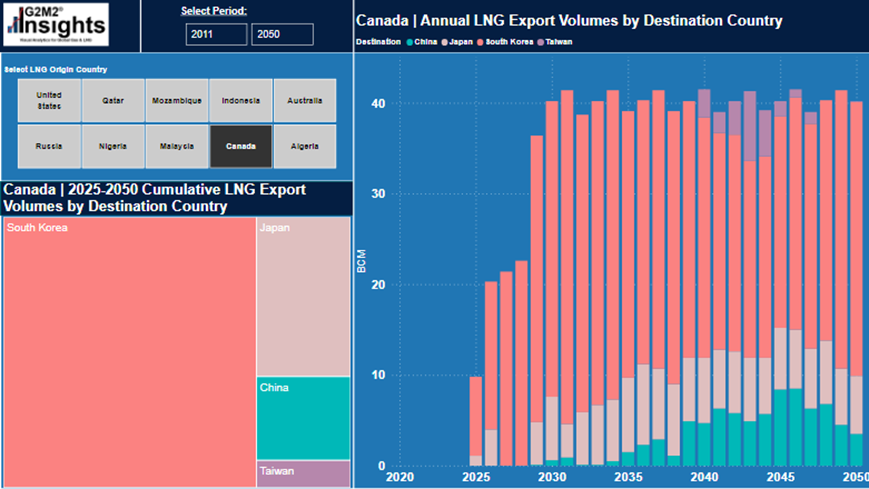

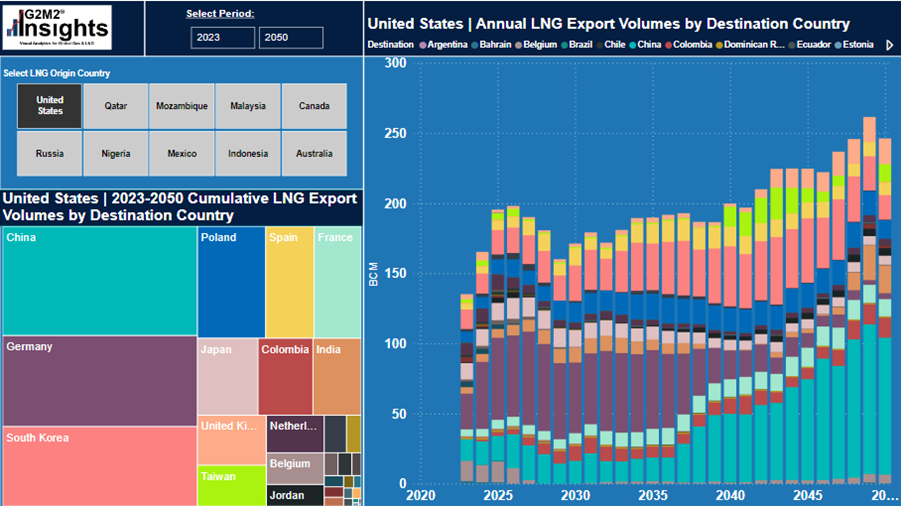

Canada is expected to begin exporting in 2025. Using RBAC’s market simulation tools for Gas and LNG, we can quantify and qualify Canadian exports as to flows and destinations based on market clearing, prices, supply and demand (Figure 4). These exports will initially supply 8.7 bcm to South Korea and 1.1 bcm to Japan and expand to include China starting in 2030 and Taiwan in 2040. And by 2050, Canada is expected to supply a sum total of 697.3 bcm to South Korea, 152.7 bcm to Japan, 80.3 bcm to China, and 26.1 bcm to Taiwan.

As Canada continues to increase their infrastructure for LNG exports, how will this new source affect competition for European and Asian contracts?

Canada Enters the Competition

They say time is money, and the time it would take for LNG from Canada to arrive in both Europe and Asia is significantly less compared to other export terminals. “Shipping LNG from Canada’s West Coast to Asia takes 11 days, compared to 20 days from the U.S. Gulf Coast…With the completion of proposed projects in Atlantic Canada, shipping Western Canada’s gas to Europe would take seven to eight days.”

The more days an LNG carrier spends at sea means more money spent on daily rate charges (which may reach as high as $500,000 per day), and if you contract a vessel for a year, the more time spent at sea means less deliveries the vessel can make. The terminals in British Columbia also avoid passage through the Panama Canal and its associated costs, which can be anywhere between $60,000 to $300,000.

The canal can also get backlogged due to high traffic or other circumstances affecting passage. Currently, low water levels are impeding traffic through the canal. If a vessel is stuck sitting in line waiting to traverse or waiting for space to open in the docks, it can also incur additional fees. Export terminals in the Gulf face much higher costs due to a combination of these fees.

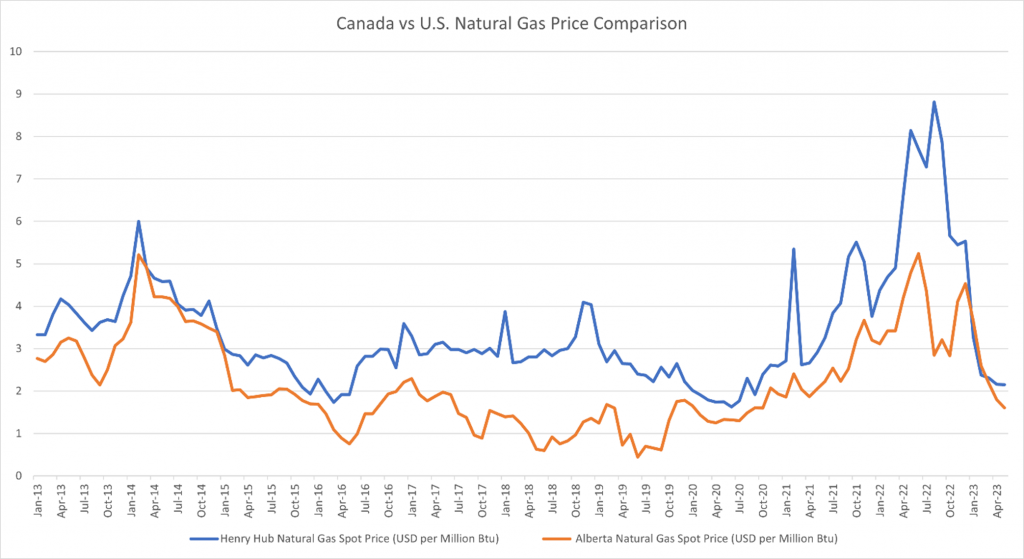

Another cost saving these terminals offer is FOB (free-on-board) price. Historically, Western Canada’s gas prices have traded at a discount compared to U.S. Gulf Coast prices. In this graph comparing spot prices at Henry Hub and Alberta, Canadian Gas has traded $1.19 USD cheaper on average over the last 10 years.

If the cost of transporting to terminals and liquefying the gas in Canada is lower than cost of gas delivered to US Gulf Coast LNG export terminals, then it results in even further cost savings.

The U.S. Response

If these Canadian projects materialize, could it result in a shift of Asian and European countries importing more LNG from Canada and less from the U.S.? Unlikely, with the demand so great, but this doesn’t mean the U.S will stand by idly.

Currently the U.S. is exporting 135.2 bcm worth of LNG to a variety of countries, and this number is expected to almost double in the coming decades. This is due to a variety of projects either under construction or in the proposal process, with some of them directly competing with the Canadian projects as they would begin operations around the same timeframe and be supplying the same areas.

One of these projects is the Alaska LNG project which would consist of a gas treatment plant near Prudhoe Bay in the north and a pipeline running across Alaska to a liquefaction facility in Nikiski. The facility in Nikiski is expected to process, store, and transport up to 20 mtpa (mentioned recently in more detail in RBAC’s article here).

One of the advantages of the Canadian projects is their ability to bypass the Panama Canal for exports, however this advantage may not last for long. In December of last year, “The U.S. Energy Department on Tuesday approved permits for Sempra Energy to send U.S. natural gas to Mexico for re-export from LNG terminals.” These permits allow Sempra to ship gas via pipelines to western Mexico, convert to LNG at their terminals, and sent consumers across the Pacific.

The Costa Azul, Vista Pacifico, and Saguaro Engeria LNG terminals are three facilities that this would take place. Costa Azul was initially constructed as an import terminal and is now being converted to an export terminal, the construction for phase 1 is estimated to be completed by 2025. Phase 1 will have a capacity of 3.25 mtpa and phase 2 will have a capacity of 12 mtpa. Vista Pacifico has not begun construction yet, but it is also expected to be operational in 2025 with a capacity of 4 mtpa.

Saguaro Energia is a 3-phase project with the first phase already having received FID. Phase one will have the capacity for 9.4 mtpa and is expected to be operational between 2026 and 2027, the remaining phases are in the pre-FID stage and do not currently have estimates for being operational. Phase two will provide 4.7 mtpa in additional capacity and phase 3 will provide between 14.1 and 15 mtpa, these three phases combine for at minimum 28.2 mtpa.

Another advantage of the U.S. has over Canada over LNG projects is the approval process length. A 2020 study by the Canadian Energy Research Institute found that, “Canada had a competitive disadvantage with LNG projects, which take approximately 19 more months to gain approval in Canada compared to the U.S.” 18 LNG export projects in Canada have been proposed since 2011 and very few have actually started construction, in comparison between 2014 and 2020, “the U.S. built seven LNG export facilities and approved 20 more.”

Canadian LNG may soon begin competing with the U.S. for European and Asian LNG contracts once their facilities become operational, but they still have a long road ahead of them and the U.S. still has projects in the works to help ensure they don’t lose a portion of their contracts.

Market Analysis Tools

Analysis of future Canadian LNG exports to destination in Europe and Asia was done with GPCM® Market Simulator for North American Gas and LNG™ and iterating with G2M2® Market Simulator for Global Gas and LNG™. For more information on how these tools can help you in your market analysis, contact us here.