Introduction

The European Union has indicated it may expedite the process of eliminating all purchases of energy from Russia by 2026, a year earlier than currently outlined in the REPowerEU roadmap. The goal of this roadmap is to stop all imports of Russian energy whether it is natural gas, oil, or uranium. For now the overall REPowerEU plan is still in the proposal stage but this brings up the question, where outside of Europe would the Russian gas flow to and how would Europe bridge the gap if it was ratified?

Past RBAC Coverage

Here at RBAC we’ve been tracking developments in Russian gas and presenting on this topic around the world. RBAC’s Dr. Robert Brooks presented in Baku, Azerbaijan, at the International Association for Energy Economics a decade ago looking at Russia and Ukraine since the strife in 2014 and did a follow-up in 2019 when cross-Ukraine gas transit was in question and Putin knew EU was intertwined enough to make giving up Russian gas difficult. And right before the invasion in February 2022 our global team reviewed this question: with or without Russian gas and how much demand would not be met. And in 2024, with actions and reactions from sanctions and reshuffling of flows across the world, Dr. Brooks took another deep dive into the subject , tackling the future of Russian LNG.

But now that more time has passed and the global market has moved on from the initial shock of the war, let’s take a fresh look at how things have changed or stayed the same in a new unit of time.

Russia pipeline exports down, LNG exports up

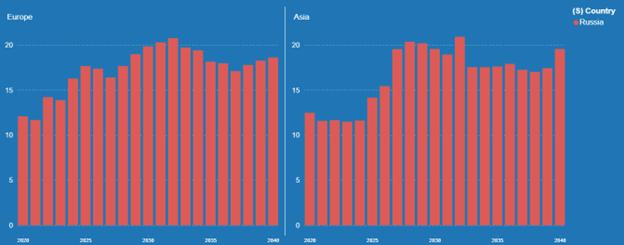

Despite global sanctions imposed on Russia, it has continued to be a major player in the global energy market providing natural gas to both Europe and Asia.

Pipeline gas exports to Europe declined dramatically after 2021, dropping to just 20% of what they were. However, Russian LNG by about 10 bcm between 2021 to 2025, and some European countries are still quite reliant, at various levels, on Russian pipeline gas, particularly in Central Europe and the Balkan region. But, with such reliance, whether from pipelines or LNG, what would happen if trade were completely severed?

Russia pipeline exports forecast

TurkStream

Currently, the primary conduit for Russian gas into Europe is through the TurkStream pipeline from Russia across the Black Sea and transiting through Turkey and into the Balkans connecting to Central Europe.

Since Turkey is not a member of the European Union, it is not bound by EU energy sanctions and it has used Russian gas through another Black Sea pipeline Blue Stream to fulfil about 40% of its domestic demand and so is likely to remain a significant consumer of Russian gas itself.

As previously discussed in our coverage of Turkey, its long-term strategy has included diversifying supply sources and establishing itself as a regional energy hub. This includes integrating its own domestic production in the Black Sea, with gas imports from Russia, Azerbaijan, Iran, and LNG terminals. With the current political conflict, this strategy will definitely be a challenge to manifest for both Europe and Turkey.

Turkey could theoretically use all Russian gas for domestic consumption and export Azeri and other gas through TANAP, through Greece and on to Europe, though this is the type of loophole the EU is trying to close.

It might try, on the other hand, to increase LNG imports, Iranian gas imports, and upgrade infrastructure in order to refuse Russian gas altogether.

But in practice, the situation is more complex. If TurkStream is blocked, it would cause serious problems for the Balkans and countries like Hungary and Slovakia, who have been vocally opposed to EU cutoff plans. Both are landlocked and heavily reliant on Russian energy, yet as EU members, they face stricter limitations if the bloc enforces a complete phase-out of Russian gas.

Hungary and Slovakia

In the short-term Hungary and Slovakia could seek a temporary exemption specific to them as their energy infrastructure is built around Russia. Slovakia has already stated at a recent UN general assembly, “We have no other options that could be both sustainable and affordable [in reference to EU energy policy proposals].” Hungary has a similar view with Prime Minister Viktor Orbán telling United States President Donald Trump that the loss of Russian energy imports would be a disaster for the country. Additionally, as both Hungary and Slovakia are landlocked, direct LNG imports are not an option, and it would take time for new pipeline infrastructure to be built to source gas from other areas.

Over time, however, as new LNG capacity, pipeline reversals, and regional storage projects mature, both countries are likely to gradually reduce Russian intake, relying instead on EU-blended gas or contracted LNG routed through neighbors, and Hungary recently signed a contract with Engie, indicating intent to diversify, even if starting with small steps (about 5% of its consumption).

We’ve addressed how European countries who are still reliant on pipeline gas from Russia might address this challenge, but what about those who rely on Russian LNG?

Russia LNG export forecast

Overall, Russia is currently expected to provide approximately 40 million tonnes of LNG each year between 2025 and 2040 to Europe and Asia. This would vastly change if there is a ratification of the new REPowerEU plan to halt all Russian LNG.

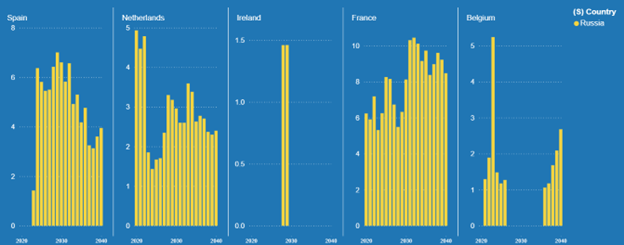

With Europe moving to cut out LNG from Russia in its entirety, what countries would be hit the hardest? Belgium, Spain, Netherlands and France import the most. Also of note is while the UK has phased out purchases of gas from Russia, shipping companies based in the country continue to transport that LNG to other countries. Since the invasion of Ukraine, 76% of Russia’s liquified natural gas exports have been carried on UK-owned or UK-insured ships.

Figure 2 shows the European countries that would be importing LNG from Russia if the REPowerEU plan was not passed. If it was passed, the countries would need to source LNG from elsewhere after 2026 or 2027 depending on when the plan goes into effect.

Europe LNG import forecast

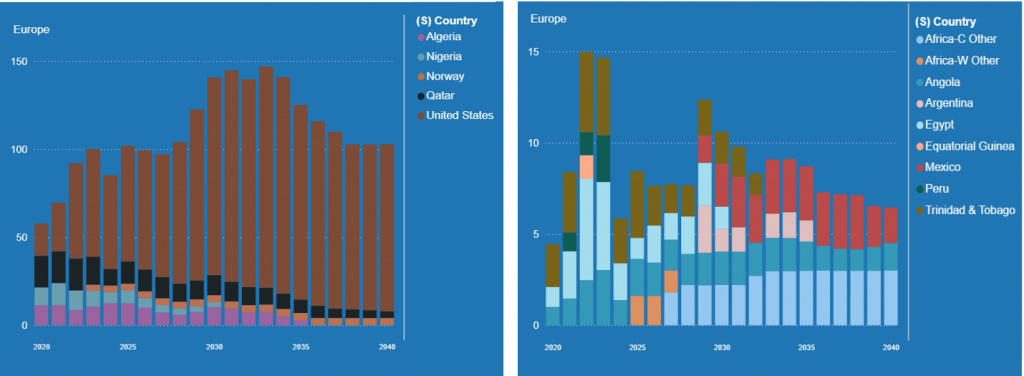

After Russia invaded Ukraine, Europe’s leaders begin scrambling to overhaul their energy strategies and find new supply sources. Europe turned to the United States as well as countries such as Qatar, Nigeria, and Algeria.

European countries have also signed long-term LNG contracts as well to secure new supply sources. Earlier this year the EU announced an agreement to buy, “$250 billion worth of energy from the US.” As seen in Figure 3 the United States is projected to provide the lion’s share of LNG to Europe reaching a peak of over 100 mtpa.

Europe would certainly be affected by the complete cutoff of Russian gas and LNG, however most EU countries are much less reliant on Russian gas than they were previously , and the LNG import market has inherently more opportunities for supply diversity than gas by pipeline. This brings us to the next question, where would the newly available supply of Russian LNG flow to?

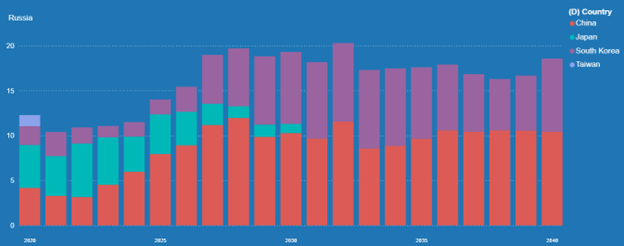

Russia LNG flows to Asia

Asia became Russia’s largest customer since demand from Europe began rapidly declining after the start of the Ukraine war. Looking to figure 5 below, China (Red) South Korea (Purple), and Japan (Green) are the top customers led by China and South Korea. No doubt Russia would price its LNG to grow this trade in the future if European customers decide not to buy.

Power of Siberia

In addition to LNG, Russia exports a large quantity of natural gas via pipeline to Asia. The largest export pipeline is called Power of Siberia. Also known as the China–Russia East-Route Natural Gas pipeline, it connects Siberian gas fields with Heilongjiang, China’s northern most province, and has been in operation for several years and is expected to reach full capacity of 38 bcm this year, accounting for roughly 9% of China’s annual gas consumption. A second pipeline connecting these two countries might also be in the works. The Power of Siberia 2 Pipeline is envisioned to carry an additional 50 billion cubic metres (bcm) of gas annually from Russia’s Arctic Yamal fields to China via Mongolia.”

China is a key figure in the global energy market with massive demand and the potential for new long-term contracts with Russia or other countries as their trade relationship with the United States has taken a hit due to tariffs.

Europe and Russia’s Energy Future

If Europe does decide to move forward the date to fully cutoff gas from Russia it is certain to have a significant effect on global market dynamics. The countries that were reliant on that gas would seek alternative supply sources either in the spot market or through long-term contracts. Asia would then likely be the new recipient of the newly available supply of gas.

Uncertain market scenarios such as this are exactly why modeling and simulation tools such as the G2M2® Market Simulator for Global Gas and LNG™ exist. G2M2 can be utilized to visualize the effects of changes in supply, demand, and prices and adjustments can be made on a case-by-case basis to account for any variables in the market. Some example scenarios that could be run relating to the cutoff of Russian gas from Europe include:

- Increased European LNG exports from sources other than Russia

- Increased Russian LNG exports to Asia and pipeline exports to non-European countries

- Effects of new pipeline construction or changes to gas flow direction

- Potential impacts of FSRU utilization

- And many more.

Interested in learning more about G2M2? Contact us here for more information and to schedule a free demonstration.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.