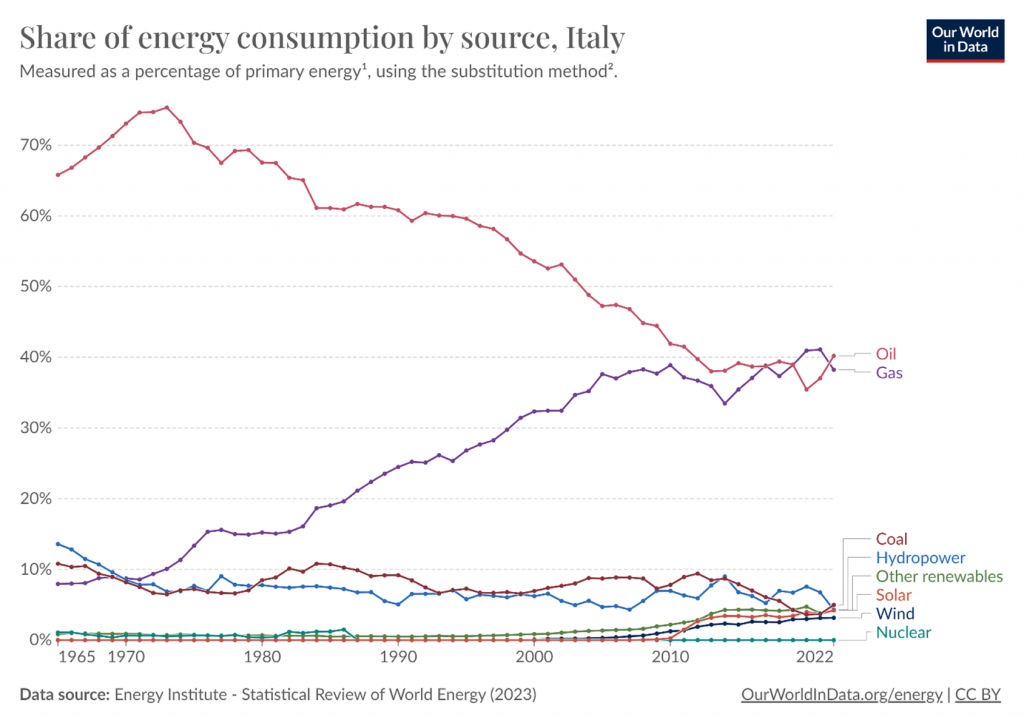

Italy is one of the largest consumers of natural gas in Europe and is also home to one of the ‘supermajor’ oil and gas companies known as Eni. However, along with the rest of Europe, Italy’s domestic demand for natural gas has been decreasing with consumption dropping in 2023 to the lowest point since 2015. Nonetheless, this drop in consumption has not scared off Italian investors from not only investing in Italy’s energy infrastructure and signing new LNG contracts, but also investing in Africa as well. Is Italy committed to natural gas as its energy of the future? Or will it follow the trend of the rest of Europe’s energy transition towards renewables? For now, it looks like Italy is taking the twin path of both—natural gas and other thermal generation which currently make up about 65% of its electricity while hydro, solar, biomass, et al, make up about 30%.

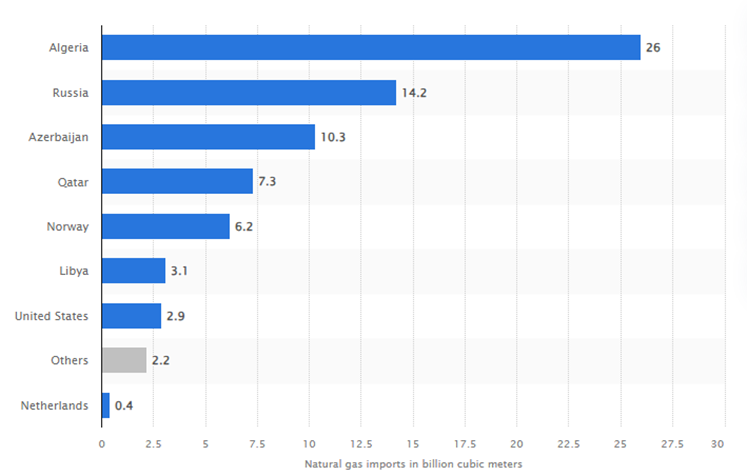

For natural gas, imports make up the vast majority (96% in 2022) of Italy’s gas supplies with Algeria being the largest contributor via the Trans-Mediterranean Pipeline and LNG shipments. Algeria’s primary customers are various European nations with 83% of its exports going to Europe, mostly by pipeline to Spain and Italy.

Italian Gas Investments Domestically and Abroad

Italy imports most of its gas due to minimal domestic reserves and decreasing domestic production. Russia was formerly a top supplier to Italy. However, the invasion of Ukraine and reductions in gas flows to Europe forced Italy to find alternatives. On this, the US Trade Department noted, “Gas imports [in 2022] from Russia (14.2 bcm) and Libya (3.1 bcm) fell by 52% and 19%, respectively, while imports from Algeria (26 bcm), Azerbaijan (10.3 bcm), and northern Europe (7.6 bcm) increased 11%, 43%, and 250%, respectively. Algeria became Italy’s largest gas supplier, accounting for 36% of imports. In the first six months of 2023, gas imports from Russia continued to decline, falling below 5% of the total.”

To further ensure a future geopolitical disruption does not threaten energy security, the Italian government announced its goal to, “double national gas production,” to 6 bcm. This increase in production would come from exploration efforts being undertaken in the Adriatic Sea. The exploration of these offshore gas resources envisioned, “10-year concessions to drill between 9 and 12 miles off Italy’s Adriatic coast, extracting up to 15 billion cubic meters of gas.”

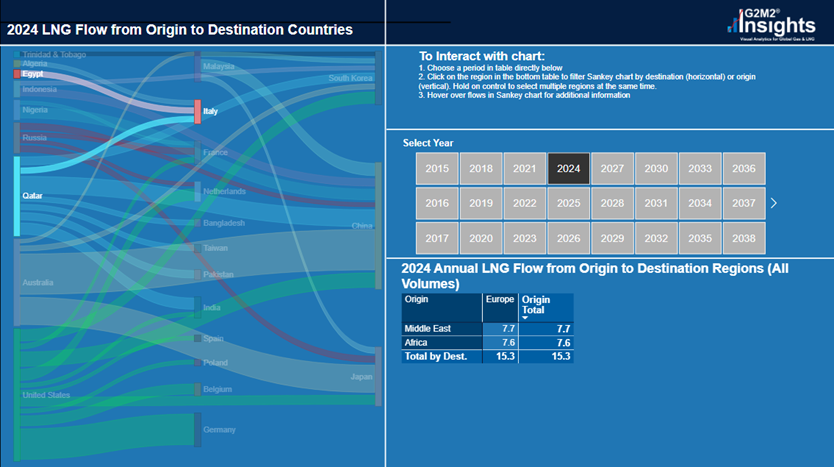

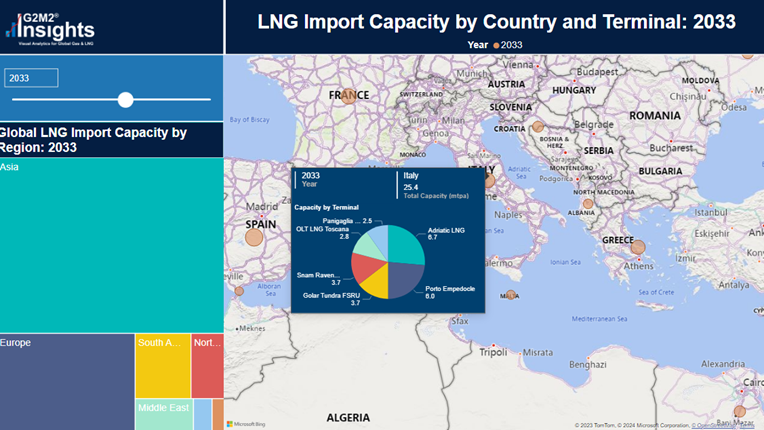

Despite expanded efforts in exploration and production on the horizon, Italy will still be a net gas importer for the near future and thus a buildup of import capacity is required. In 2023, Italy had 14.5 mtpa worth of LNG import capacity which is expected to nearly double to 25.4 in the next decade.

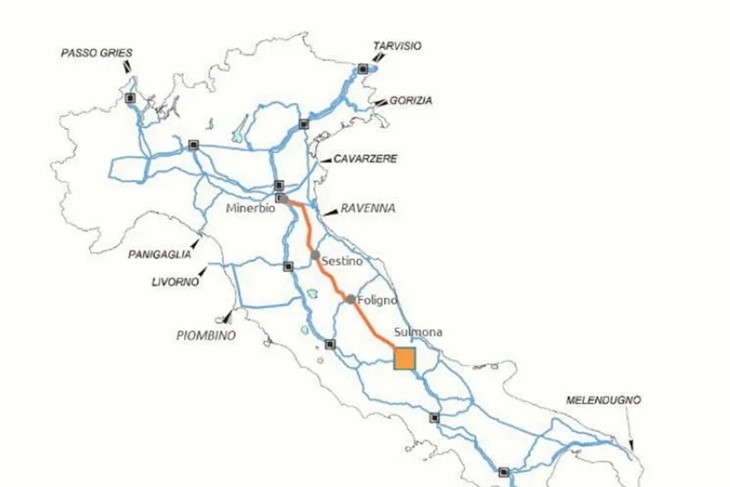

These increases in import capacity are being driven by the Snam Ravenna and Porto Empedocle terminals.

The Snam Ravenna FSRU project would provide 3.675 mtpa worth of capacity and is expected to be operational later this year. It was proposed in 2022 amidst the height of Europe’s energy crisis and was approved in a matter of months in contrast to the years it took for similar projects before the crisis. The Porto Empedocle project was initially proposed in 2007 but was shelved after several years due to a combination of back-and-forth discussion between Enel (Italian distributor of gas and electricity) and the regional government as well as unfavorable market conditions at the time. However, Enel recently announced that the project was once again under consideration and is now estimated to begin operation in 2026 with a capacity of 5.88 mtpa.

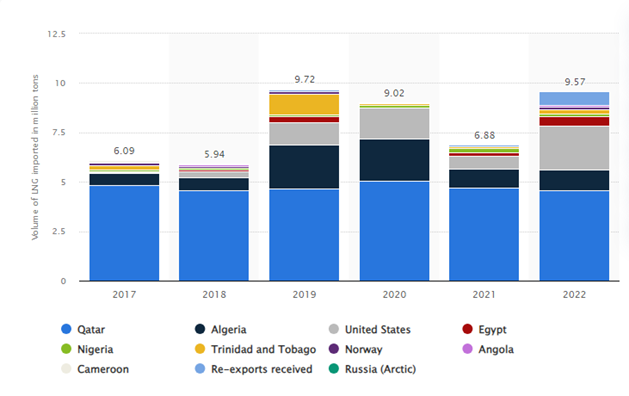

As of 2022, the top suppliers of LNG to Italy were Qatar and the United States with lesser amounts coming from Algeria and Egypt. Eni recently signed a new agreement with QatarEnergy to purchase 1 mtpa of LNG over the next 27 years.

In addition to investing in domestic energy infrastructure, Italy is also investing heavily into Africa. Six billion dollars is being spent in hopes that the abundant resources and huge untapped potential present within the continent will one day be able to meet the future gas demands of Europe. These investments are largely spearheaded by ENI, with CEO, Claudio Descalzi, proclaiming last year that, “We were able to finalize agreements and activities to fully replace Russian gas by 2025, leveraging our strong relationships with producing states and fast-track development approach to ramp-up volumes from Algeria, Egypt, Mozambique, Congo and Qatar.”

Qatar and Algeria are already stalwarts in the LNG export business; and Egypt has likewise committed to becoming both a regional gas producer in the Middle East and an LNG export hub. And with conversations that took place late last year in Cape Town at Africa Energy Week, a lot of eyes are on Africa, noting if the resources are properly developed, several nations could become major players in the global gas market.

What Does Italy Use Gas For?

Italy seems to be headed towards a split mix of natural gas and renewable sources approach to the energy transition Italy is effectively split in half for which regions utilize which renewable sources. Northern Italy contains most of the hydroelectric power plants within the country and the south has abundant solar and wind energy. However, Italy has been facing an ongoing drought which limits the efficiency of hydroelectric generation. The inherent intermittency of renewable energy necessitates the use of a separate energy source which in this case is natural gas which will continue to provide electricity to Italy in times that renewable energy cannot.

Natural gas in Italy is primarily used for electricity, accounting for nearly half of power generation within the country. However, not all gas coming into Italy is immediately consumed for power. Italy has robust storage facilities, which totaled 197 TWh in 2023, second only to Germany within the EU. It is also used for transportation as Italy is one of the largest markets in the world for natural gas vehicles. As of 2021, Italy had 80% share of the 1.23 million compressed natural gas fueled passenger cars registered in the European Union.

The Mattei Plan and Italian Export Hub Dreams

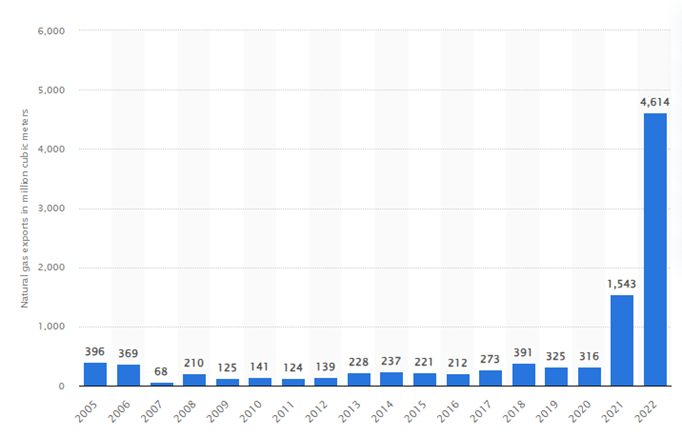

In addition to these uses, Italy also has been exporting a modest amount of natural gas and in recent years, these exports have dramatically increased.

And these numbers may increase even further with the Italian government’s new Mattei plan, named after Enrico Mattei, the founder of ENI. This plan aims to make Italy into an entry point of gas from Africa and the Middle East; and though the plan may be new, Italy has been laying the groundwork toward this goal of being an export hub for a long time. In fact, Italy has long made partnerships with countries in the surrounding region and assisted in construction of pipelines such as the Trans-Mediterranean connecting Algeria, Tunisia, and Italy; and Greenstream which connects Libya and Italy.

Even Israel wants to be a part of Italy’s plans to become a natural gas entry point into the European market. In 2023, Israeli Prime Minister Benjamin Netanyahu stated “Italy has said it wants to be a hub for the supply of energy for Europe. We think exactly that and we have gas reserves that we are now exporting and we would like to expedite more gas exports to Europe through Italy.” With all this effort towards making this goal a reality, both from within and outside Italy, almost every sign seems to point toward the success of this plan, but is everything really as simple as it seems?

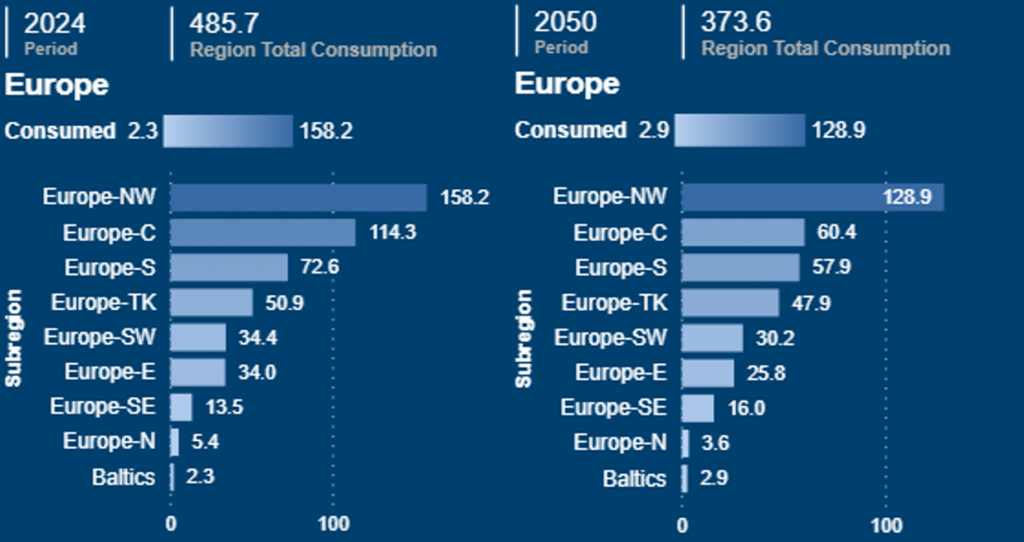

It is a fact that the rest of the European Union has made public and policy commitments toward an energy transition, setting numerous targets and goals to achieve climate neutrality by 2050. If Europe continues along this track, its overall gas demand is likely to decrease to 373.6 bcm of consumption by 2050, which is 23% lower than the estimated consumption for 2024.

The United States is currently the main supplier of LNG to Europe and this is unlikely to change in the near-term. So, the question is, if Italy does intend to become a gas hub, what countries would be buying?

So far, Italy has engaged in preliminary talks with Bavaria to supply gas and hydrogen to the German state. Italy also aims to be a supplier to Austria and Hungary. However, this is contingent on a proposed expansion of the existing Adriatica Pipeline that Snam aims to build and begin operating by 2027.

Currently, the only way Italy will be able to send gas to the rest of Europe is through existing pipelines or those under construction as it does not currently have any LNG export terminals, nor any plan to build such in the future. However, if Italy sees success from its efforts towards becoming a gas hub, then it wouldn’t be out of the realm of possibility for LNG export proposals to follow as most current pipelines within the country possess the ability to reverse flows.

But where would the supply of gas flowing into Italy and through these pipelines come from? The African nations of Algeria, Egypt, and Libya would likely be the primary suppliers of natural gas that would go on to reach Europe, while the Republic of Congo and Angola may also become part of this supply chain. Algeria and Libya possess Africa’s second and fourth largest proven gas reserves. Algeria has long been a key supplier to Europe, especially to France and Italy, but this new plan would further expand its role while introducing new natural gas suppliers into Europe. However, with the European Union pushing for an accelerated energy transition, the demand for gas may carry increased uncertainty and volatility through the coming decades. But what we can be sure of is that gas will still have a significant presence within the European energy mix for many years to come.

Irregardless, Italy seems set on becoming the natural gas gateway from Africa to the European market, and to this end, it is investing massive resources and capital to make this dream a reality. Of course, Africa also has its own plans for utilizing the abundant domestic resources to provide affordable and reliable sources of energy and in the words of the late President of Namibia, Hage Geingob, “Benefits from African resources must benefit Africa.”

Italy appears to be taking this to heart; and a project of this scale would be impossible if not for the full support of all parties involved. At the recent Italy-Africa summit in Rome, leaders from several African countries and organizations convened with representatives from the European Union wherein a commitment to the development of Africa was solidified and assurances made that the benefits of these gas exports will be seen by Africans as well. The Chairperson of the African Union Commission, Moussa Faki, stated that the goals outlined in the Mattei plan align with Africa’s priorities. While the President of the European Parliament, Roberta Metsola proclaimed, “When Africa prospers, Europe prospers and the whole world can.”

For this grand undertaking, it is imperative that market analysts and policy makers have the tools and knowledge necessary to explore all options towards meeting these enormous goals. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can be used to assess the viability and effects that any project or changes in policy would have on supply, demand, prices, and gas flows. It is with tools like G2M2 that both industry and government can find the best ways to achieve energy security for themselves and others, both in supply and production, through robust market analysis and better strategic decisions.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.