The advent of the LNG Export Era has had a dramatic impact on the North American Natural Gas Market. Nearly 13% of all natural gas produced in North America is shipped overseas to trading partners; exposing domestic customers to international markets. This global market exposure has been highlighted by the events in Ukraine when Russian pipeline deliveries were shut off and Europeans were left high and dry. Europe was able to avoid disaster by a combination of large quantities of LNG imports and two warmer-than-normal winters. The impacts of such unforeseen situations to Europe and North America show the importance of scenario analysis–not just for geo-political conflicts, but for natural disasters and/or weather events as well. Similarly, considering the impact that Freeport LNG’s outage had last summer on supply/demand balances and prices, vetting the effects an LNG export stoppage could have on the North American Market is of particular interest. One way to model this kind of demand impact is to create a scenario that incorporates a large-scale hurricane which assumes LNG export terminal shutting down for more than just a few days.

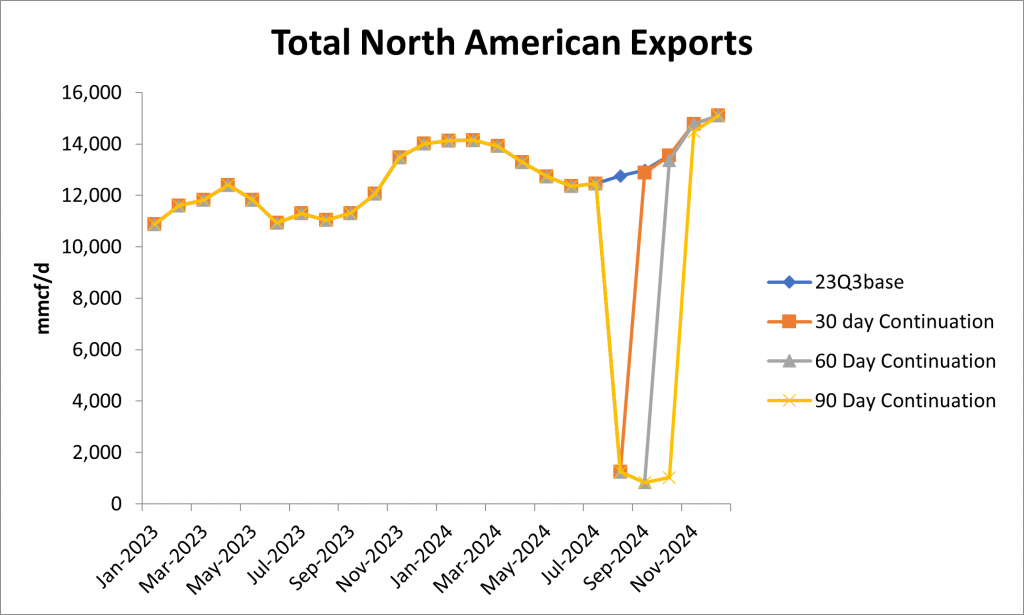

Recent hurricanes have largely spared the Texas and Louisiana coasts, where LNG export facilities are predominantly located. However unlikely, the probability of a large-scale hurricane causing an extended outage is not zero – e.g., previous large-scale, slow-moving hurricanes have caused flooding issues at refineries/petrochemical facilities causing extended outages. We at RBAC, Inc. used GPCM® Market Simulator for North American Gas and LNG™ to simulate exactly that, hurricane related extended outages. Three scenarios; simulating a 30-day, 60-day, and 90-day suspension of LNG exports out of the Gulf as well as corresponding reduction in offshore natural gas production from the Gulf. We will look at pricing impacts to major pricing hubs, to production, as well as how storage acts as a buffer.

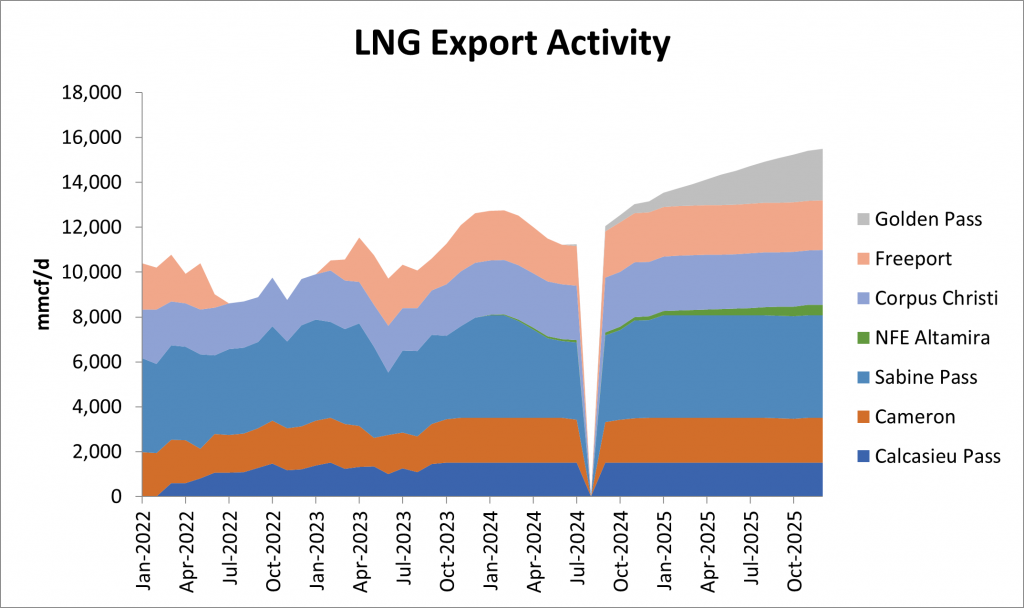

- Calcasieu Pass

- Sabine Pass

- Corpus Christi

- Golden Pass

- Cameron

- New Fortress Energy Altamira

- Freeport

From there we create two additional scenarios with outages of longer duration, specifically a 60-day and 90-day duration affecting the same LNG facilities. The impact of these outages on LNG exports can be seen below. It is important to note that Natural Gas exports are not zero during the outage periods, this is due to the presence of the Elba Island LNG Export facility in Georgia and the Cove Point facility which is in Maryland. These facilities would not be likely to be impacted by a Gulf Hurricane and thus not included in our analysis. As seen below, losing Gulf LNG export facilities has a significant impact on the North American Supply/Demand balance. Roughly 11,000 Mmcf/d or ~11% of domestic demand is lost overnight.

The loss of this much demand in the Gulf Region has significant impacts on local pricing hubs, particularly that of Henry Hub, the most important hub in the country. As seen below, the possible impact of a 30-day, 60-day, and 90-day outages could crater the Henry Hub price, reducing it from our 23Q3 quarterly forecast base price of $2.49 to $1.47 in the event of a 30-day outage. That price goes even lower, to $1.45 during the 60- and 90-day hurricane events. At that level, much of the production in the region is uneconomic, particularly that of the Haynesville Shale – whose depth requires higher up front drilling costs and higher commodity prices to break even. Unsurprisingly, the Haynesville Shale is not the only region impacted, as a drop in production is experienced in the Marcellus Shale and the Permian Basin.

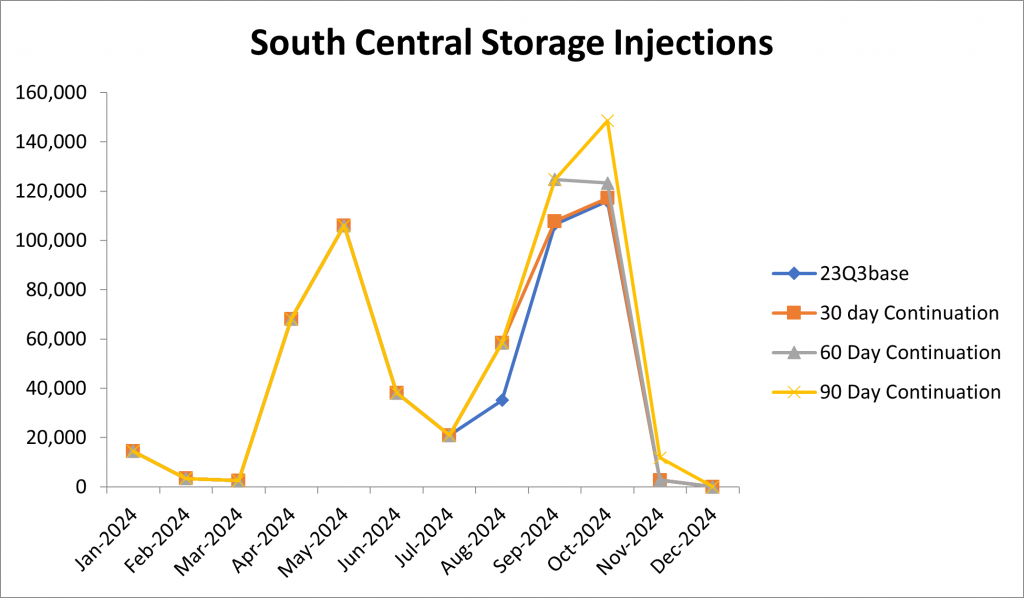

Due to the interconnectedness of the North America natural gas infrastructure, other interesting things occur during this period. In this low-price environment, non-LNG export demand increases, due to the price elasticity of certain sectors like Industrial and Gas-fired electric generation, where we see increases of one Bcf/d and four Bcf/d respectively. Were it not for this demand response, the price of natural gas would decline further. Natural gas storage activity was similarly impacted, with injection activity increasing drastically during the months corresponding to the outages. Storage is both a demand and supply component, depending on the time of year and weather, and, typically, can more readily balance supply and demand than can production as short-term production is less elastic (slower to respond).

As we like to say in regards to the North American Natural Gas Market, “It’s not a vacuum”, meaning that one change can ripple down and effect numerous other industries, consumers, producers, and infrastructure. A sustained outage of LNG Exports from the Gulf of Mexico would have significant impacts, but ones that can be managed and balanced by the current infrastructure, for now. However, were this outage to occur in 2030, at which time additional LNG Facilities will be operating the impact felt will be much greater. While not included in this article, it was included in the study, the results of which are available upon request. This analysis and others are possible with a multi-faceted market simulator like GPCM. Whether or not an outage ever occurs, you can sleep more soundly knowing you’ll be ready for it.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.