I shared with you the Asian gas balance chart last week and promised to continue this story. Here this goes.

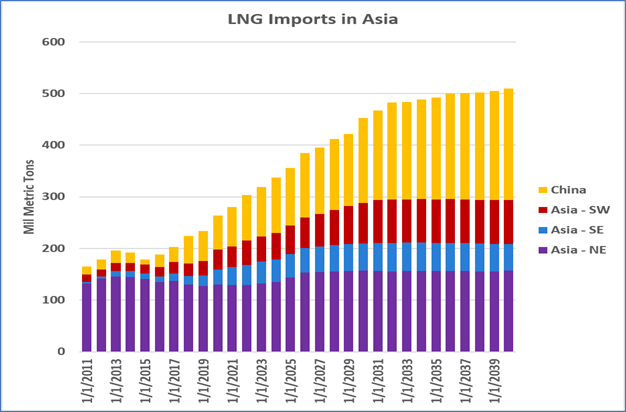

When we look into LNG imports in Asia, we need to get a closer look at the various importing markets, as they have different needs and hence characteristics for LNG demand. It is a critical element in figuring the LNG strategy dealing with the Asia market. First, there are three different sub-regions for LNG demand. China, being the single largest market surpasses North-East Asia of traditional LNG buyers and then followed by Southwest Asia, representing robust growth from the emerging market of India.

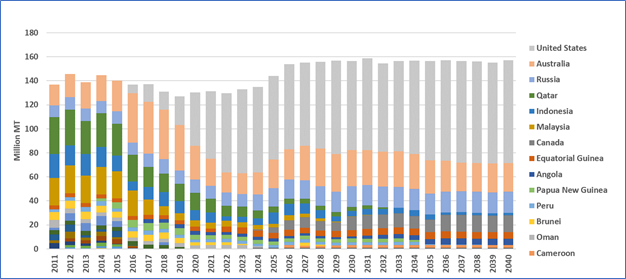

For China, here is an outlook by source country of LNG imports. Note that China relies on a relatively diversified portfolio of LNG supplies, not dominated by one single source. This aligns with the active development of the partnership with upstream markets in the Middle East and Africa in recent years by China and also eases the potential tension of LNG import constraints due to the US-China trade war. With that being said, it is not yet set in stone the final contract strategy. Noting that this outlook describes all the existing contracts in place, it is essential to recognize that all the incremental import demand beyond contracted volume in later years solely based on a spot basis in this scenario. One could certainly hypothesize various contract strategies to lock in deals as China moves forward with its LNG negotiations, which would change the dynamic and commitment of flow once there is a long term contract in place. For one, the G2M2® modeling system distinguishes LNG contracts (FOB vs. DES), besides spot transactions. So, with long term contracts in place, the percentage of take-or-pay volume would impact the flow dynamic different from spot transactions. It would also be interesting to run scenarios on the sensitivity of flows under various contract strategies to evaluate potential risks and opportunities.

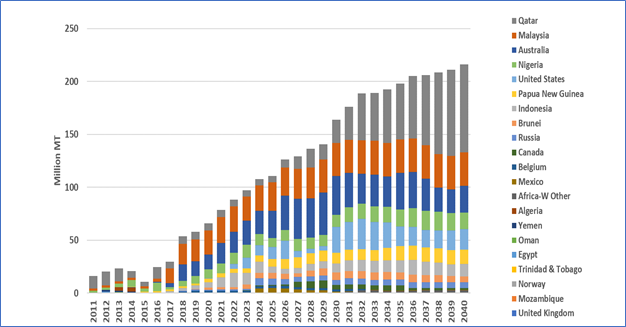

On the other hand, this is an outlook of LNG imports to the Northeast Asia region, including Japan, Korea, and Taiwan. Two critical differences compared to LNG imports into China: first, the volume stays steady throughout the forecasted period, compared to other sub-regions in Asia. Noting that specific nuclear and coal policies in the power generation sector would change the demand for gas, for example, in Japan, while it would not interrupt the main theme of the story here. Second, there is a significant mix of US LNG for Northeast Asia compared to any other import options. The geographical advantage of US LNG supports this outlook to the NE Asia market, as well as existing relations reflected in a large volume of committed LNG contracts in place between the two. We see great potential of the partnership between North America and NE Asia buyers, possibly with additional Canadian LNG volume. Furthermore, it would be extremely valuable to understand the evolution of contract terms in LNG as Asian buyers are actively seeking re-negotiations in recent years. It would be crucial for North America LNG projects to develop a deep understanding of relative competitive position among suppliers for potential buyers, and how to figure out the right leverages to maximize the project value, under various scenarios.