LNG Spotlight and Natural Gas Getting the Shoulder

A lot of eyes have been on natural gas and LNG recently with turmoil in the United States regarding LNG export project permitting, potentially opening the door for new market participants. Meanwhile, US domestic gas prices have been depressed and are “getting the shoulder”, as you will see below.

In this edition of our newsletter, we have a quick brief on a lawsuit filed by sixteen U.S. states regarding the LNG export pause; an announcement of an LNG seminar in Singapore being jointly hosted by RBAC and JLC; a short recap of both CERAWeek in Houston and a networking event held by Energy Capital & Power in collaboration with Angola’s National Oil, Gas & Biofuels Agency; China’s surging LNG demand; a discussion on the overall state of the market for natural gas and LNG; why prices at Henry Hub were all over the place to kick off the year.

We hope you enjoy these articles and interviews, and they give you greater insight into the energy market and industry all with the goal of increasing your knowledge and helping you make better energy decisions.

Join our mailing list today and receive updates directly from RBAC. Not only will you receive this newsletter in your inbox, but also those who sign up on our website will also receive articles a week in advance and other important communications from the team here at RBAC.

Quick Brief – Sixteen States File Lawsuit against the Biden Administration over LNG Export Policy Changes

The decision to temporarily pause approval for new U.S. LNG export projects has been under intense scrutiny from all corners of the energy industry. Texas and Louisiana along with fourteen other states have filed a lawsuit in efforts to lift this pause.

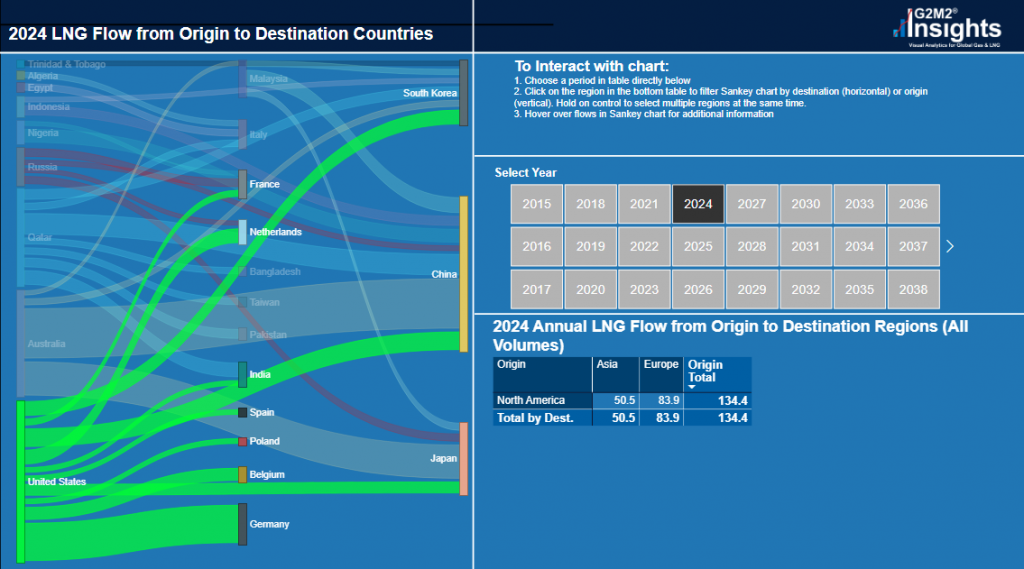

Demand for LNG is expected to increase dramatically within the coming years and the United States is expected to remain a top exporter. The longer that the pause is in effect, the more uncertainty it injects in the market, putting at risk the reputation of the U.S. as a reliable supplier. It also affects the projects themselves and the companies behind them, as well as local state economies and economies abroad that are counting on U.S. LNG for their gas supply.

Many countries in Europe and in Asia rely on U.S. LNG and future supplies could be in jeopardy as a result of the pause.

This lawsuit was just announced so it will take time until a ruling is reached, but until then participants in the market around the world will wait with bated breath on how the continuation or dissolution of the pause affects global supply and prices.

RBAC, Inc. and JLC Present: LNG Market Insights for Asia

RBAC and JLC are jointly hosting an in-person LNG seminar on April 23rd at the Conrad Centennial hotel in Singapore!

This seminar will feature an in-depth review of the global gas and LNG market as it exists today and how it is likely to evolve into the future. Participants will learn tools to help them understand the state of the market and to quantify the effects that market growth and risks can have on it in both the near and long term. This seminar is only in-person and is completely free to attend.

Articles and Media

Gain insight into natural gas and LNG markets across the globe with analysis and commentary from our energy industry experts.

Angola Oil & Gas Networking Event

Dr. Robert Brooks attended an event in Houston held by Energy Capital & Power in collaboration with Angola’s National Oil, Gas & Biofuels Agency. It was a meeting of various companies and investors looking to get involved in Angola’s natural gas industry as well as other parts of Africa.

Read here: Dr. Robert Brooks attends Angola Oil & Gas Networking Event

CERAWeek Recap

CERAWeek 2024 just occurred in Houston, and we have compiled a list of highlights and important takeaways regarding the future of energy from this insightful conference.

Read here: CERAWeek 2024 Takeaways

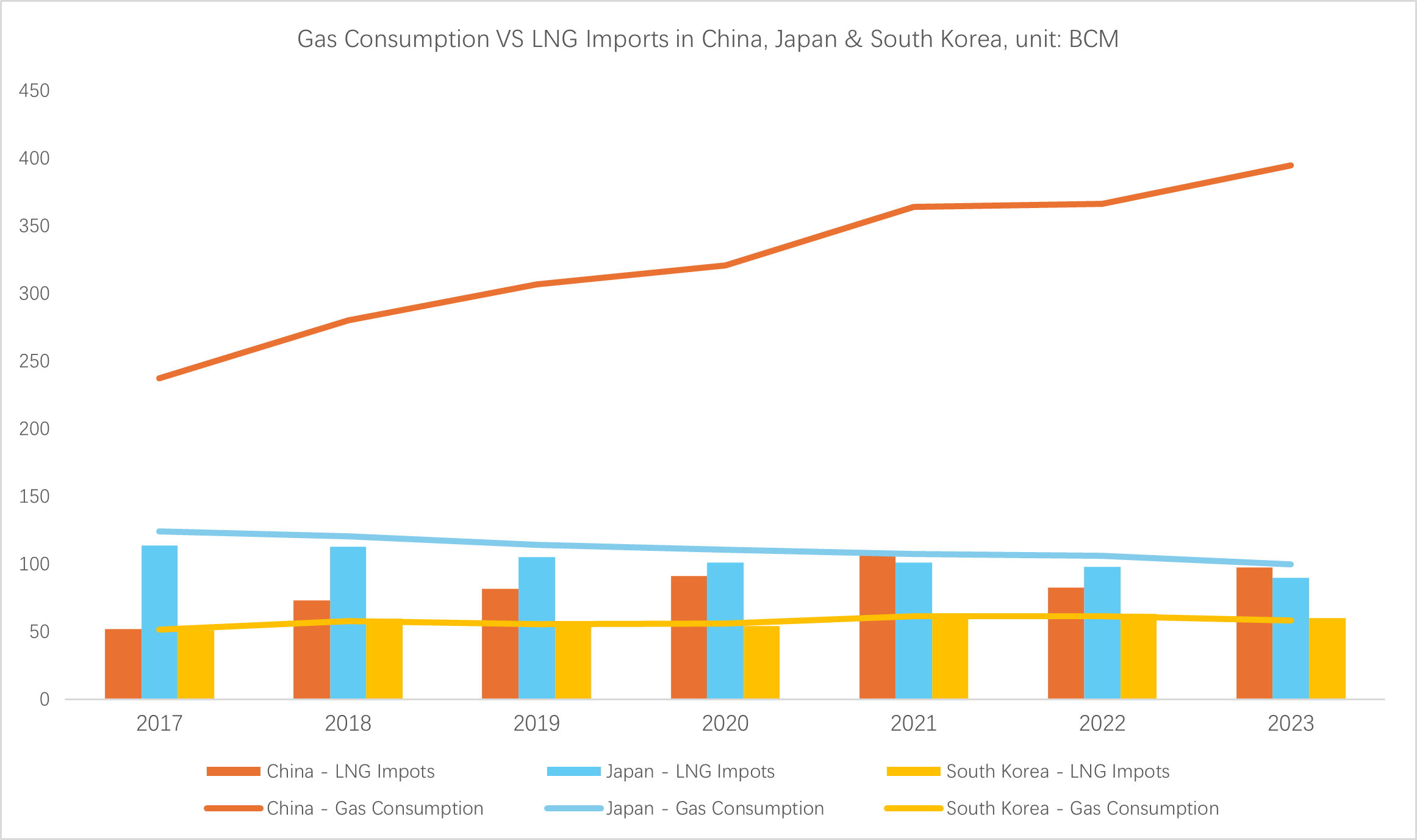

China’s LNG Surge: Surpasses Japan as Top LNG Importer

“As more and more LNG export projects are completed, China’s LNG imports are likely to be more diversified in the future, and as Japan has expressed their intention to reduce its domestic gas consumption as part of energy transition policies, Japan may end up participating more in the global trade of LNG than simply being an LNG importer and consumer.”

Read here: China’s LNG Surge: Surpasses Japan as Top LNG Importer

Global Gas & LNG Insights Podcast: Natural Gas and the Economic Outlook

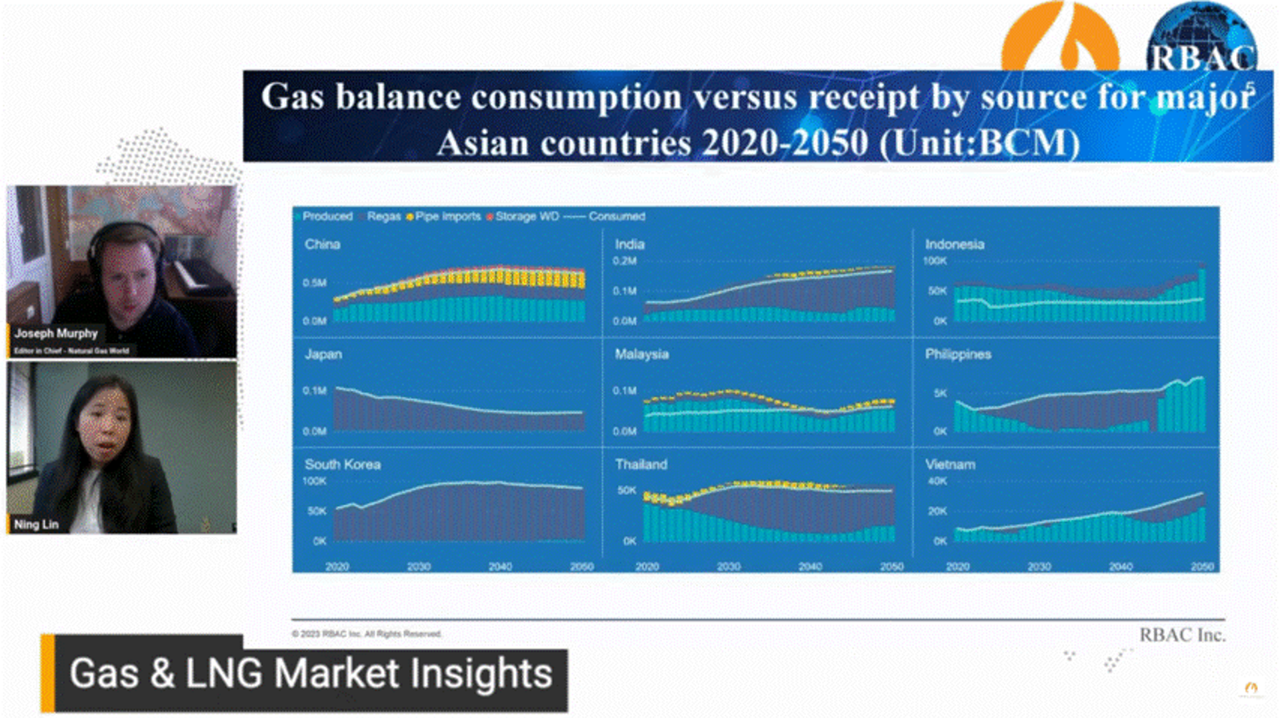

Dr. Ning Lin joined Joseph Murphy on Asian and European markets as well as the potential long-term effects of the US LNG pause on global supply-demand balance.

Read more about the podcast here: Global Gas & LNG Insights Podcast: Natural Gas and the Economic Outlook

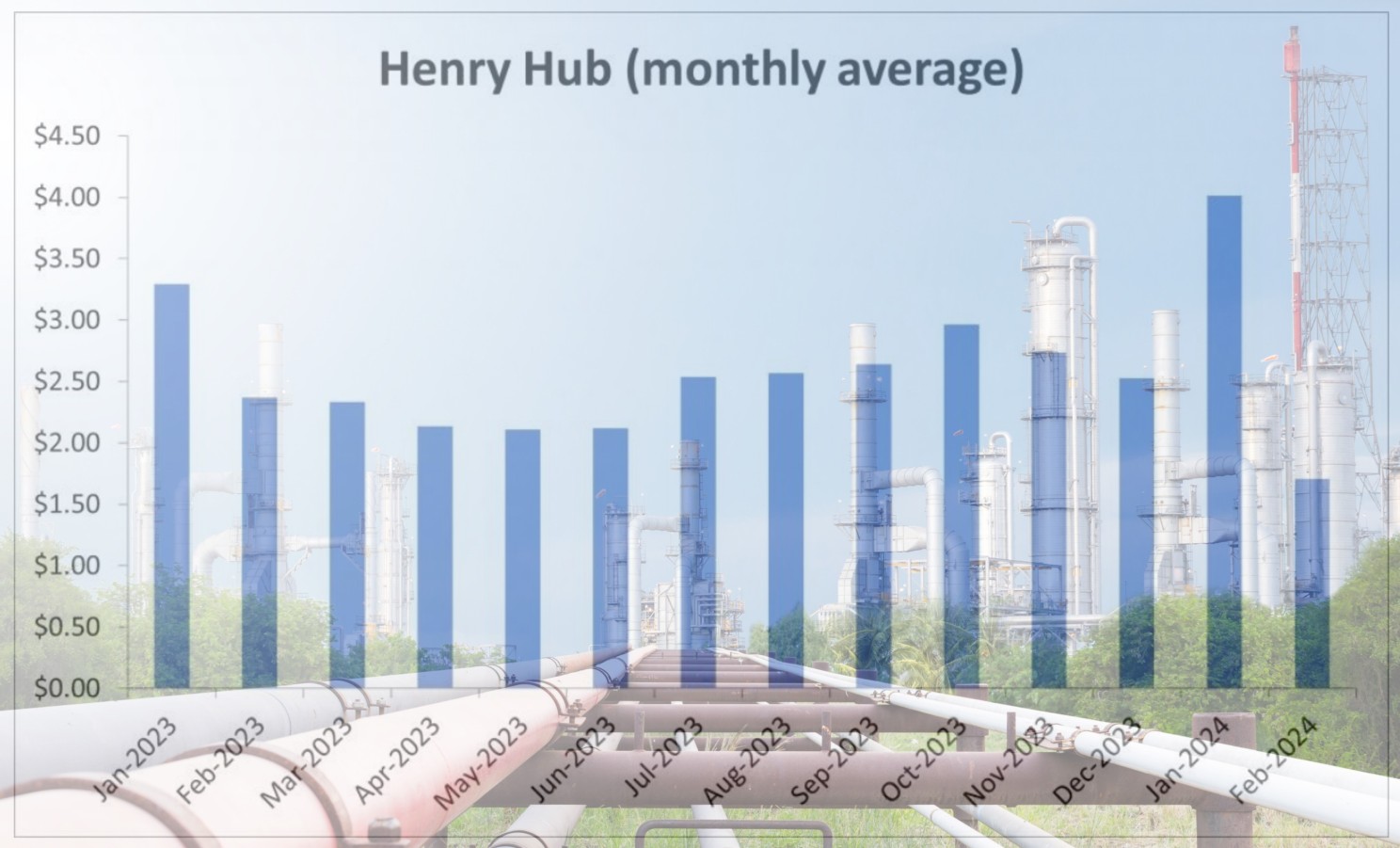

Natural Gas Markets are Getting the “Shoulder” Early this Year

Prices have been hectic recently with Henry Hub reaching its lowest point in 27 years. What caused this dramatic shift in prices and where will the market go from here?

Read here: Natural Gas Markets are Getting the “Shoulder” Early this Year

Essential Reading

Taken from the treasure trove of the writings from our energy experts. Here read technical insights and far-sighted analysis relevant through the lens of today’s energy.

What Would Happen if a Major Waterway were Closed to LNG tankers?

No LNG carrier has transited the Suez Canal for 65 days. They are instead being re-routed around Africa resulting in dramatically longer travel time. Panama Canal is experiencing restrictions due to drought. How are prices at TTF and in Asian markets being affected by these and how would you prepare for such scenarios?

Read: What Would Happen if a Major Waterway were Closed to LNG tankers?

Food For Thought

Read some of our engaging commentary on social media and join us in the conversation.

What are the most Reliable and Affordable Energy Sources?

A new report says that Nuclear and Natural Gas top the charts for reliability while other energy sources didn’t make the grade. What were the factors that made it so?

Read here

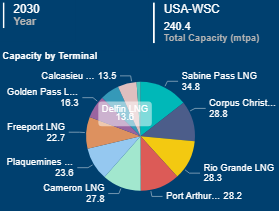

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2024 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.