In my past few articles, I have written about the energy transition, lack of cooperation and mixed messages from regulatory bodies, as well as energy security. As you can imagine, these writings had been inspired (or necessitated) by my concerns over the energy crisis we are facing.

However, my overarching concern is that not only is the energy crisis self-inflicted, but those who we depend on to get us through such tough times and resolve this crisis are not learning from the past but are actually doubling down on the agendas that got us here in the first place.

No matter where you stand on climate change and the energy transition, statistics have shown over many decades that natural gas not only reduces emissions when replacing coal, but is an abundant, accessible, inexpensive (at least before the crisis) and a high-density energy source that can bridge the gap as we transition to a lower carbon future while maintaining energy security.

The mainstream media has been more than willing to report on the “climate crisis.” They have been sounding the alarm and pointing fingers for years now. However, when it comes to doing any real reporting on the challenges of transitioning away from fossil fuels and even the environmental impact of renewable energy sources, the reporting has been very lacking.

Energy Density Gap

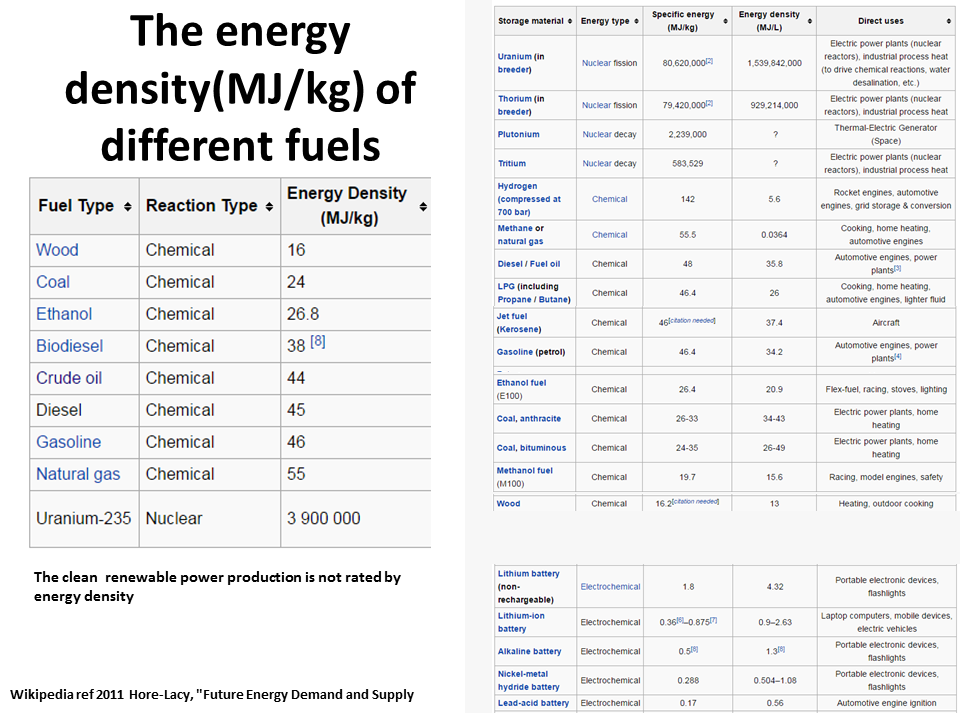

Let’s take energy density for example. The first chart below shows the energy density of different fuel types from batteries (0.17-1.0 MJ/kg) to wood (16 MJ/kg) to Uranium (3.9M MJ/kg) and everything in between. Although with batteries, that is just the output. The energy is produced elsewhere (usually with fossil fuels) and stored in the batteries.

Chart 1: Energy Density (MJ/kg)

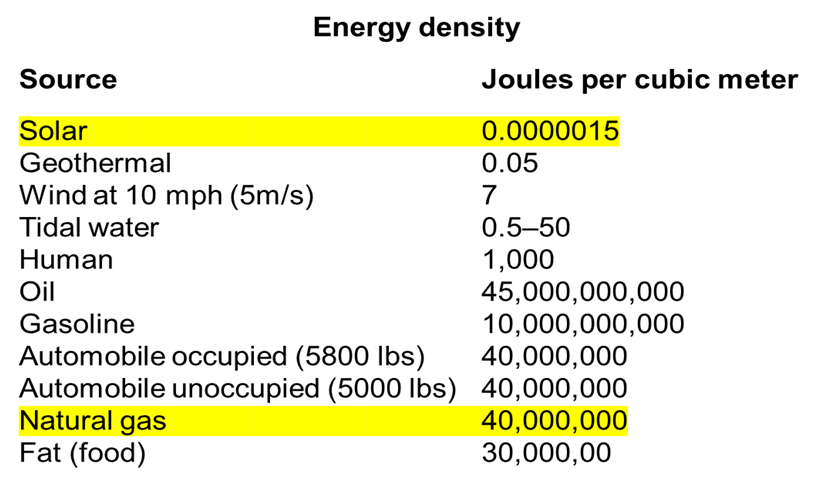

The second chart shows the energy density of both renewable and fossil fuels in Joules per cubic meter for a better comparison of output between fossil fuels like natural gas and renewables such as solar. As you can see, there is a major gap in energy density between the two highlighted sources.

Chart 2: Energy Density (J/m3)

Source: Drexel University[1]

The Magnitude of Transitioning Away from Fossil Fuels

To replace energy consumption from fossil fuel sources, it will take quite a lot of investment in solar, wind and potentially hydrogen down the line. According to Rystad Energy, the “Inflation Reduction Act will attract an extra $270 billion in US wind and solar investments by 2030. The Inflation Reduction Act is set to boost installed solar and onshore wind capacity in the US by 40% by 2030, with an extra 155 gigawatts (GW) of capacity expected to come online this decade.”[2]

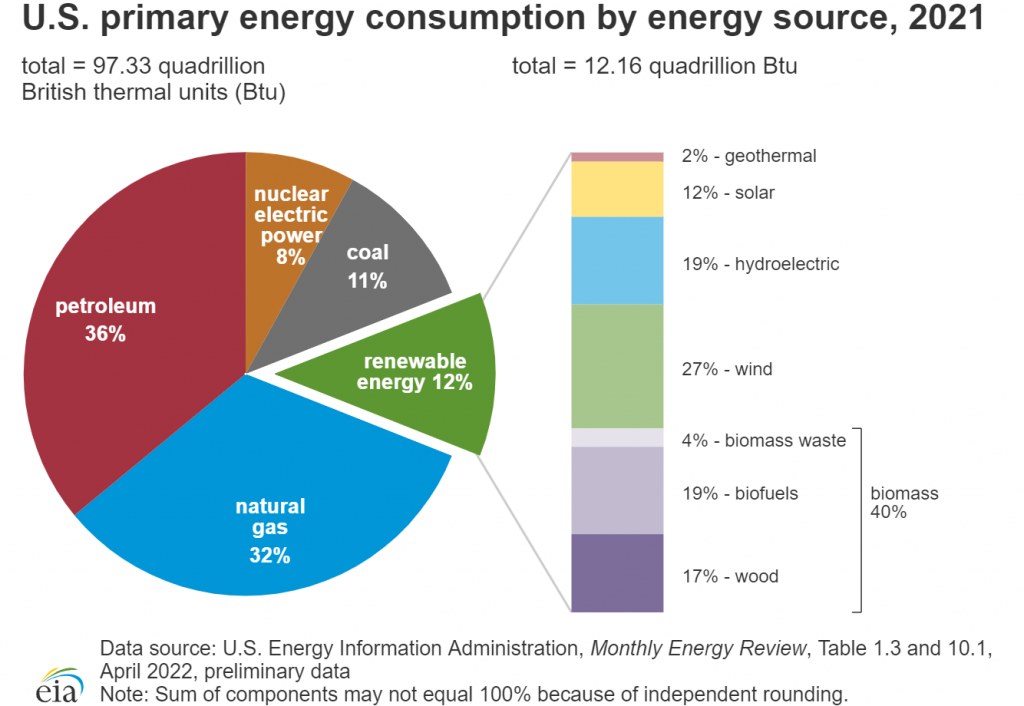

Although this is a significant investment, total fossil fuel (coal, oil, and natural gas) consumption right now, leaving nuclear alone, is 79% of the fuel mix, according to the EIA. With solar and wind increased by 40% by 2030, and even ignoring intermittency, primary consumption of renewables would only be 14% of the total.

Source: EIA[3]

In terms of electricity generation by fuel type, according to EIA, in 2020 Natural Gas had a net generation of 1,624,167 MWh (Thousand Megawatt hours) while solar and wind combined had a net generation of 427,137 MWh.[4] The magnitude of transitioning away from fossil fuels is quite great and, as stated previously, will require enormous financial investments to achieve and again, that doesn’t include the intermittency problem.

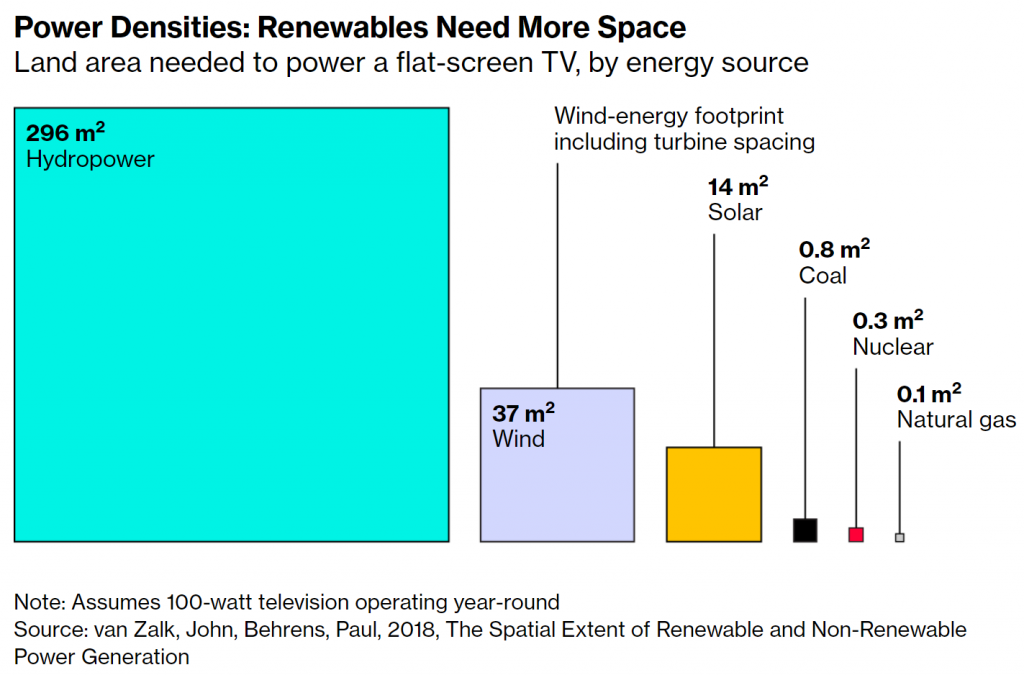

In Bloomberg’s article, “The U.S. Will Need a Lot of Land for a Zero-Carbon Economy”, it was correctly pointed out that, “Wind farms, solar installations and other forms of clean power tend to take up more space on a per-watt basis than their fossil-fuel-burning brethren. A 200-megawatt wind farm, for instance, might require spreading turbines over 13 square miles (36 square kilometres). A natural-gas power plant with that same generating capacity could fit onto a single city block.”[5]

But pictures are worth a thousand words. The diagram below demonstrates that a significant amount of land will be required to move away from fossil fuels which will have its own environmental impact that is rarely acknowledged or discussed.

Modernizing the Grid

Currently, in the United States there is nearly 160,000 miles of high-voltage power lines, and millions of low-voltage power lines and distribution transformers.[6] According to the National Conference of State Legislatures (NCSL), “Significant infrastructure upgrades will be required to address the needs of an evolving energy network. This includes upgrading existing transmission lines to incorporate distributed energy resources and building new lines to improve wholesale market operations, increase resilience and bring energy from remote renewable resources to population centers. The distribution grid—which carries energy to individual homes and businesses at the local level—will need even more investment than the transmission system. Sixty percent of U.S. distribution lines have surpassed their 50-year life expectancy, according to Black and Veatch, while the Brattle Group estimates that $1.5 trillion to $2 trillion will be spent by 2030 to modernize the grid just to maintain reliability.”[7]

Beyond just maintaining the reliability of the grid, to transition away from fossil fuels requires significant expansions of the grid to a magnitude no one has truly faced, including investment in battery storage to handle the intermittent aspect of renewables such as solar and wind.

To wit, and according to Wade Schauer, a research director for Wood Mackenzie Power & Renewables, “storage would need to go from about 11 gigawatts today to 277.9 gigawatts in the grid regions that include New England, New York, the Mid-Atlantic, the Midwest and parts of the South. That’s roughly double Wood Mackenzie’s current forecast for energy storage nationwide in 2040.”[8]

Mining Rare Earth Metals

We touched upon the magnitude of the power generation gap and necessary investments for such an energy transition, but there is also the mining and materials factor, which get far too little attention from the mainstream media. I can understand why though. When you see the processes to obtain the resources necessary to produce renewables and batteries and their environmental and social (human) impact, the narrative that renewables and batteries are cleaner does not quite follow.

Recently, Ursula von der Leyen, President of the European Commission, stated “Raw materials will fuel our green and digital future. Almost 90% of rare earth and 60% of lithium are processed in China.”[9]

I discussed these numbers as well as mineral usage in renewables in my previous article, “For a Successful Energy Transition, “You Need to Learn to Walk Before You Can Run””

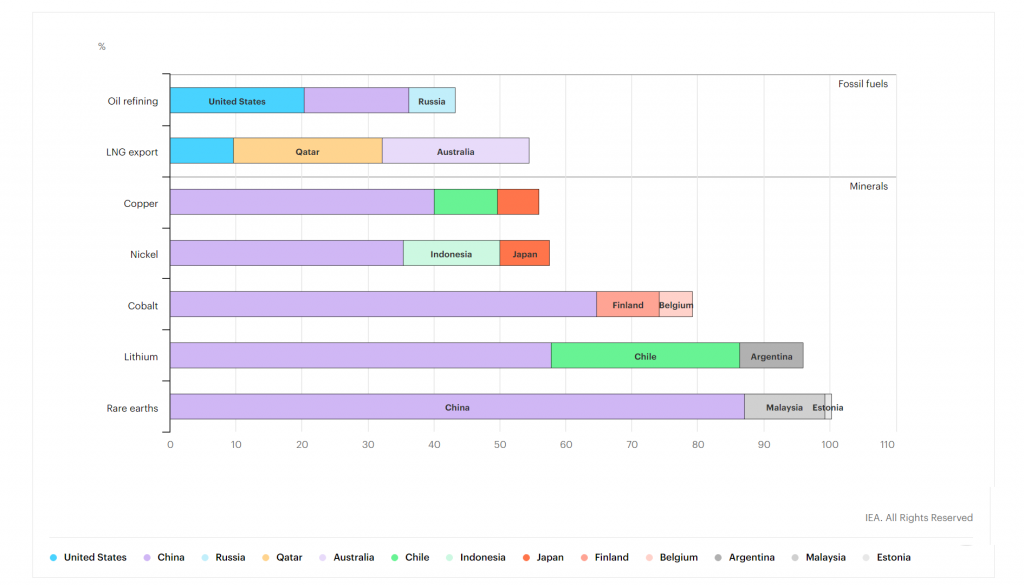

To reiterate, this chart from IEA “shows the top three producing countries for the minerals needed for renewable energy units such as wind and solar. As you can also see, the US has plenty of fossil fuels but is entirely dependent on China and a handful of other countries for renewable energy raw materials.”

Source: IEA[10]

The Next Energy Crisis

There is much more that can be written about that gets far less media coverage than it should, such as recycling limitations of batteries, energy security and energy access in the developing world, and these by no means are any less important, especially providing affordable energy access to over a billion people who do not have access to electricity.

However, what I have addressed already brings us to the crux of my argument and my title, The Next Energy Crisis No One Is Talking About.

We have already seen how geopolitical conflicts such as the Russian invasion of Ukraine, and subsequent sanctions have impacted the energy market. Russia countered the sanctions by first restricting natural gas flows to Europe and later stopping all flows. This not only further exacerbated the energy crisis but threw into question the whole energy transition strategy. Why?

Because Europe had become completely dependent on Russian gas and now with the winter season fast approaching Europe has become completely dependent on LNG imports from the U.S. and any other country they can make a deal with. However, there are capacity limitations that are already being hit and will continue to be an issue throughout the winter.

Even with all the evidence that moving away from fossil fuels too quickly created this energy crisis, policy makers and energy players alike are still signaling their intention to continue to move forward with their previous energy transition timelines. This path once again creates a major vulnerability by relying on one major source for the materials needed, China.

Geopolitical tensions have been building between China and the West for some time. Last month, after House Speaker Nancy Pelosi landed in Taiwan for a diplomatic visit, China renewed threats of retaliation against the U.S. “China’s Foreign Affairs Ministry released a statement calling the visit ‘a major political provocation’ that ‘distorts, obscures and hollows out the one-China principle.’ It added, ‘These moves, like playing with fire, are extremely dangerous. Those who play with fire will perish by it.’”[11]

This pasts week in an interview on 60 Minutes, when asked if U.S. forces would defend Taiwan if China were to attack, President Biden said “yes.” However, the White House later back off that assertion and said U.S. policy towards Taiwan remains unchanged.[12]

Also, since the founding of the Shanghai Cooperation Organization (SCO) in 2001, China as well as other member nations such as Russia, India and Pakistan have increased opposition to the U.S. dollar or Petrodollar as being the main currency used for oil and gas purchases. Since the Russia/Ukraine conflict, Russia has demanded natural gas purchases be made in rubles and has announced an agreement between Russia’s Gazprom and China to start payments for gas supplies in yuan and rubles instead of U.S. dollars.[13] Recently, the leaders of the SCO agreed to take steps to increase the use of national currencies in trade in direct opposition to the U.S. dollar, further escalating tensions with the West.[14]

So, in any geopolitical conflict, what is to stop China from cutting off the West from vital rare earth elements and minerals vital to the proposed renewable-energy-based economies? The result would likely be catastrophic and quite possibly an energy crisis far worse than we have ever seen.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[2] Inflation Reduction Act will attract an extra $270 billion in US wind and solar investments by 2030 (rystadenergy.com)

[3] U.S. energy facts explained – consumption and production – U.S. Energy Information Administration (EIA)

[8] 100% Renewable Energy Needs Lots of Storage. This Polar Vortex Test Showed How Much. – Inside Climate News

[10] Share of top three producing countries in total processing of selected minerals and fossil fuels, 2019 – Charts – Data & Statistics – IEA

[11] China threatens US, sends 21 military aircraft to Taiwan’s air defense zone | American Military News