RBAC’s Founder, Dr. Robert Brooks spoke at America’s Natural Gas conference in Houston, on September 27th, 2022, along with a multitude of informative industry speakers and at a conference packed with insight and future trends.

What was it like, and what insights were shared? Let’s dive into it.

Organized by Hart Energy, Dr. Brooks presented “Weather and Whether Russia,” on the gas outlook and the future of Europe and what happens when geopolitics invades your market analysis.

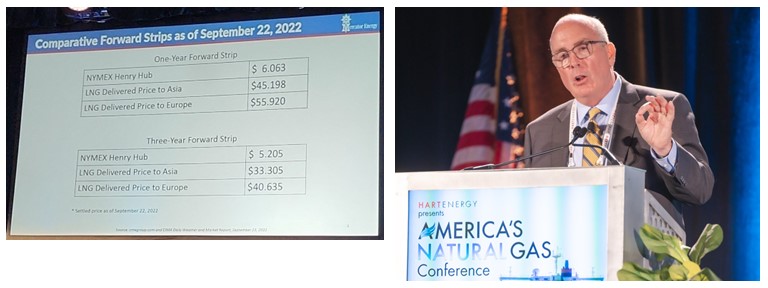

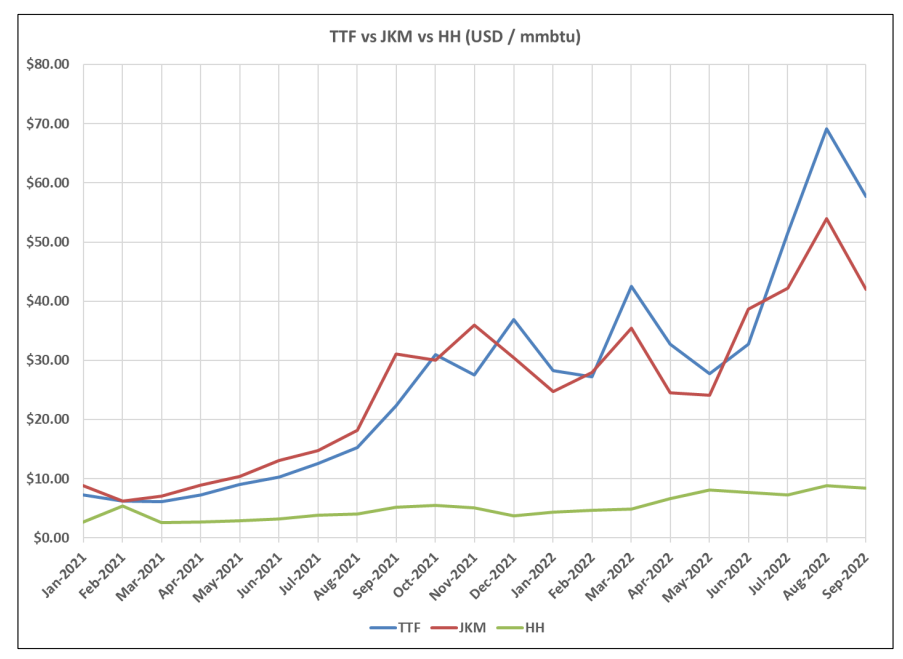

Dr. Brooks noted, “It’s all well to do your forecasts but don’t forget geopolitics in your analysis,” and continued regarding weather and war that when it comes to gas prices, “geopolitics looks like it trumps weather,” but importantly, “North America prices remain ‘pretty isolated’ despite LNG exports.”

Bernadette Johnson, Head of Power & Renewables at Enverus Energy noted that There is a disconnect between current energy policy (aspirational) and reality about planned power gen retirements. Natural gas not going away. On power generation, she further said that Coal is losing ground, natural gas is holding steady while wind and solar are growing.

Ken Hersh, co-founder of NGP, opined that the “world has slept itself into a crisis.” He sees decoupling of 3 spheres, Russia, China and USA. And noted that electrifying anything makes no sense without a commitment to nuclear, which we haven’t.

Gordon Huddleston predicts of Aethon Energy predicted growth next year will be in the double digits.

Deborah Gholson, Gas Development Service Advisor, Berkshire Hathaway Energy GT&S told of their energy products and championed LNG and its reduction of global emissions.

BPX’s Kyle Koontz reflected on the miracle of natural gas and how to be part of the solution regarding energy. He called out that we must stay focused on the here and now and natural gas is the here and now.

Jim Diemer, Director, Commercial & Strategic Analytics, Sempra Infrastructure, asked “Are you willing to make a 30-year investment when permitting is uncertain and the next administration may change the rules by executive order?” It’s a reality check on where politics intersects energy policy and corporate investment. It was a call to reason rather than a criticism, per se.

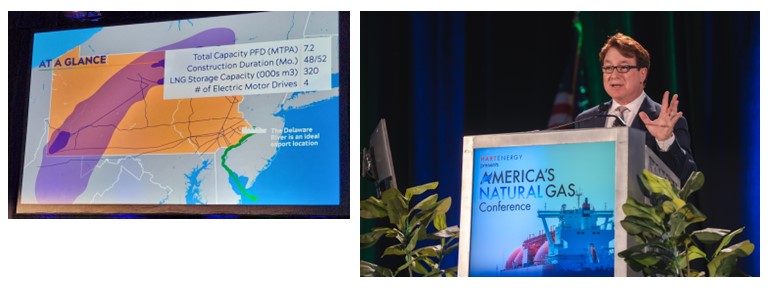

Franc James, Founder, Chairman & CEO, Penn LNG, said they are at the pre-file stage with FERC with its Penn LNG project. “We are basically a Qatari mega train that can produce 7.2 mtpa capacity,” and noted that the infrastructure was 99% in place. He also gave one of the more interesting insights asking, “How do you address Environmental Justice? Simple. Listen to the community.” Penn LNG opened a 501c to help its local community and give back.

Thomas Holcombe, Director of Business Development, Kinder Morgan Inc., gave an interesting presentation on their RNG projects, advocating renewable natural gas to be part of the energy transition solution.

Interestingly, the final presentation by Tim Oudman, Vice President, Business Development, Republic Services, announced that Republic will capture 70% of landfill gas and get renewable natural gas up to scale with 40 projects across 19 states by 2027.

“While (LNG) economics are attractive today, there’s a lot of uncertainty going forward,” Kristy Kramer, VP, Head of Gas & LNG Markets, Research at Wood Mackenzie, warning of a possible bubble for Natural Gas and LNG projects. Think supply chain, inflation, a challenge to EPC (engineering, procurement and construction) companies.

John A. Harpole of Mercator Energy circled back around to how Russia “trapped” Europe with a “20-year plan” to control the flow of energy to Europe. He warned the high prices of energy mean the de-industrialization of Europe and that “Today’s fertilizer shutdown equals tomorrow’s famine,” giving a serious warning for policy makers to heed.

There was a very interesting presentation on Hydrogen Dr. Minh K L. of Rystad Energy, calling it a pillar of the energy transition and noted that part of where that comes from is Natural Gas.” His analysis showed large growth in the sector.

Amol Wayangankar, Enkon Energy Advisors Founding Principal, said that drivers of U.S natural gas demand include increased U.S. LNG exports, growth in renewable generation and increased gas exports to Mexico. He also pointed out that Natural Gas storage will be more important as renewable penetration increases. Think California.

And throughout the conference there was networking and feedback about Dr. Brooks’ talk was great.

RBAC has been following Europe and its Russian gas flows for decades, presenting in Baku, Azerbaijan; Paris, France (see “Putin Knew”) and most recently at the World Gas Conference in Daegu, South Korea, speaking to a packed crowd and was interviewed by the Times of Korea where he described a “methodology for forecasting a range of gas prices around the world in different demand scenarios and how they may change.” Gas prices are largely dependent on demand driven by weather—especially in winter months.

RBAC did an analysis in January 2022 of the possibility of a total shut-off of Russian gas, and to some extent, with events of magnitude (the Russian invasion of Ukraine and sanctions and Russia’s response) have required a major update of gas market analyses.

So, at America’s Natural Gas Conference Dr. Brooks answered the questions:

- Has geo-politics overwhelmed weather as the primary determinant of natural gas prices in Europe?

- Has Russia used all its leverage, or can it do even more?

- Will Russia and Europe ever resume “normal” relations regarding natural gas or does Europe’s decarbonization plans make renormalization irrelevant?

Using RBAC’s GPCM and G2M2 market simulator tools, Dr. Brooks explored these issues to show where gas prices could have gone, and where they likely will go under a variety of scenarios. Interestingly, and underscoring what Dr. Brooks stated on geopolitics, the Nordstream leakage occurred just a few hours before his talk.

Using RBAC’s GPCM and G2M2 market simulator tools, Dr. Brooks explored these issues to show where gas prices could have gone, and where they likely will go under a variety of scenarios. Interestingly, and underscoring what Dr. Brooks stated on geopolitics, the Nordstream leakage occurred just a few hours before his talk.

(If you would like his presentation or more information, please email us at contact@rbac.com.)

So, the energy sphere seems to move at breakneck speeds, and you have to move very fast to keep up. RBAC is here with decision support tools to help you and your analysis so you can be successful and help the energy industry itself deliver up its purpose to power the world.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.