All Roads Lead to Galveston

As Gas Market Experts Come Together

With Texas’ best November weather, RBAC’s Annual Gas and User Conference took place in Galveston, Texas last week. It was a great follow up and success to last year’s1 in Austin.

Everyone was happy to see colleagues and energy industry leaders from across the natural gas and LNG industry as well as some new faces who were attending our conference for the first time and were eager to learn the ins and outs of RBAC’s natural gas market simulation tools.

Hot topics at the conference were delivered by seasoned professionals and included Hydrogen to Carbon Markets to Severe Weather Scenarios and Visualization Tools to cut your analysis time in half.

RBAC’s expert analysts and executives, as well as delightful and astute guest speakers gave insightful and entertaining presentations; such as those from Charles Merrick (AFRY2), Jennifer Cogburn (BloombergNEF3), and Hua Fang (Black & Veatch4).

Attendees enjoyed these industry experts’ deep insights on current trends within the energy industry and where they believe the future is headed; moreover, we had outlooks for both the North American and Global markets, the increasing presence of hydrogen, and hands-on demonstrations of how to best utilize GPCM® Market Simulator for North American Gas and LNG™5 to run any potential market scenario.

There were some great takeaways, and we’ll do our best here to summarize this 2 ½ day conference below:

GPCM 23Q3 Forecast

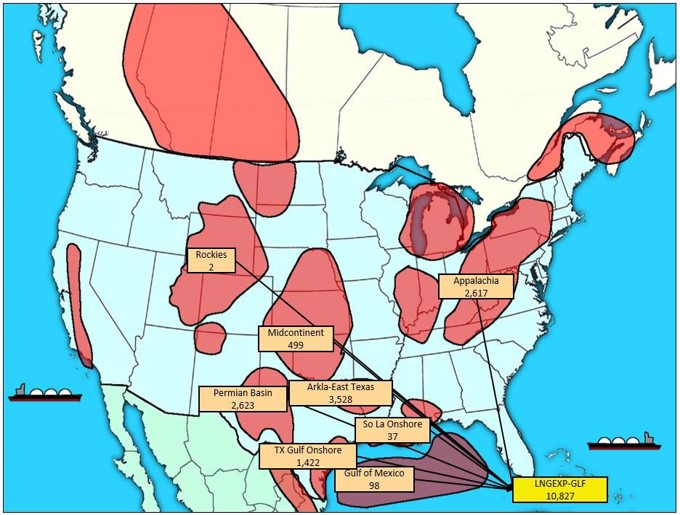

Presenting the GPCM 23Q3 base case, Bethel King and her team forecast due to a mild winter and strong production the US, we see that HH prices in the near term are lower than this time last year, but prices are expected to steadily increase in the mid and long term along with production which will increase steadily in order to meet growing LNG export and gas fired generation demand with shale making up 69% of US production by 2050.

G2M2 23Q3 Forecast

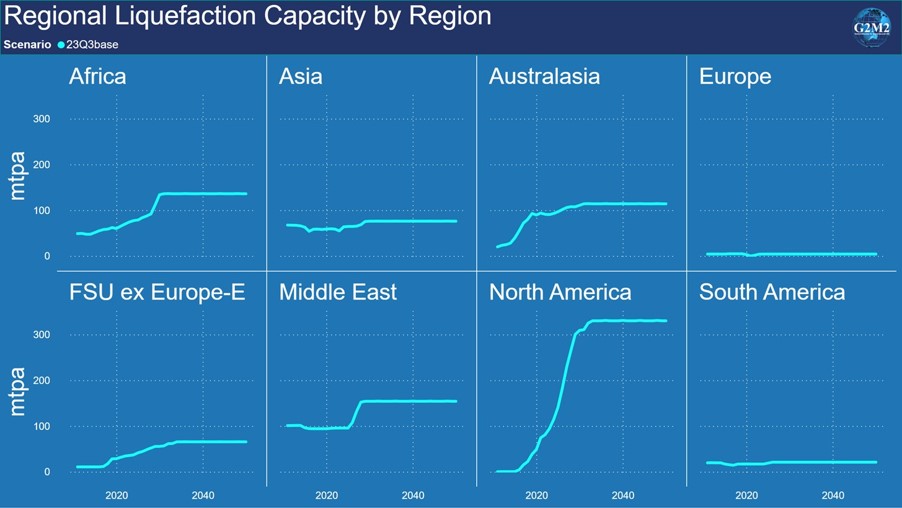

In the G2M2 23Q3 Forecast session, Senior Gas Analyst RBAC Ed O’Toole and Gas Market Researcher Jiaxin Yang showed following a record year for LNG contracts in 2022, already in 2023 is showing strong growth in contracting for new projects and areas coming online. In Asia, China is still the largest growth area for LNG, but new players are entering the market from Southeast Asia6, the second largest growth engine in the world. In Europe, the near-term demand for natural gas is expected to remain relatively flat before declining as energy transition policies go into effect. LNG from North America will be vital to meeting a growing global demand for LNG, with expansions in Qatar and Africa7 also expected to contribute.

Sensitivity Analysis Using GPCM

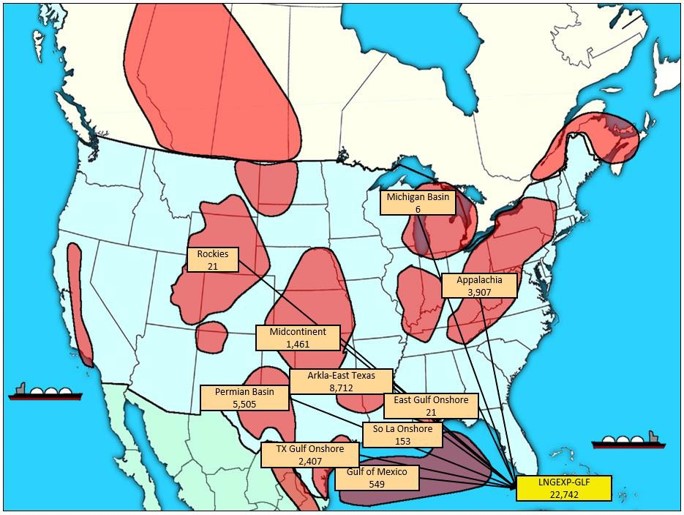

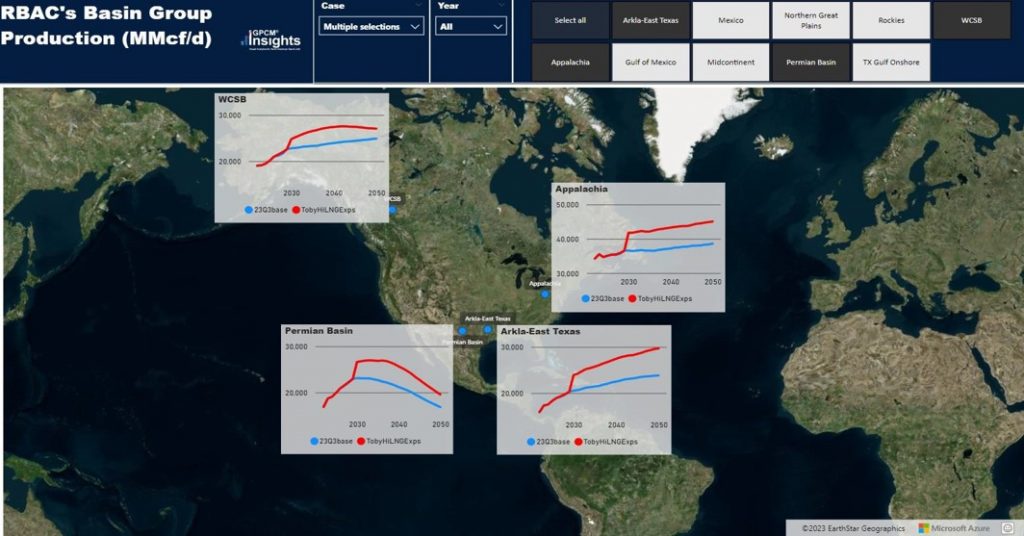

Looking at the ultimate in “What if” scenarios, the presentation by RBAC’s Scott McKenna was quite a treat. It examined how to create different scenarios of varying amounts of North American LNG exports with GPCM including the “Unleash US LNG” case that EQT has been beating a drum for. It’s quite a high LNG Export scenario, so the question immediately asked is, “Can we get there?” The answer is, “Yes, we can—under certain conditions.”

One participant noted that it was, “Great to see how to create scenarios that shock the system and ensuing the expected demand changes actually worked after running the scenarios.”

BNEF’s New Energy Outlook

Bloomberg NEF’s Jennifer Cogburn explored their New Energy Outlook and two energy transition scenarios showcasing integration of the G2M2® Market Simulator for Global Gas and LNG™8 with proprietary data and research (such as renewables penetration, net zero pathways, etc.) to see the effects of various the energy transition policies and goals—including how global gas consumption within power and non-power related industries would be affected and in turn how this would affect LNG and global gas prices. The comparison of various outlooks for gas-fired generation showed views varying from 2,000 to 8,000 TWh globally. Definitely, the ability to run these scenarios with confidence comes in handy!

Future of Emissions Markets in North America

Returning guest speaker Charles Merrick presented AFRY’s view on the ‘Future of Emissions Markets in North America’ and the impact of various efforts to curb emissions such as the Regional Greenhouse Gas Initiative9 , Western Climate Initiative10, and Europe’s Emissions Trading System11. Interestingly, in looking at gas prices going forward, we are seeing the effects of policies, for instance in California, if continuing a decarbonization pathway, they will see prices decline slightly over time, whereas in the northeast, constrained by New York blocking infrastructure to the rest of the area, high-price risk remains great.

Can Hydrogen Win a Significant Role in the US Energy Mix

Hydrogen is quickly gaining momentum as the world moves towards decarbonization. Black & Veatch’s Dr. Hua Fang presented what the potential role of Hydrogen could be in the coming future. Dr. Fang covered the current applications for Hydrogen such as primarily for oil refining and the production of ammonia, it will be interesting to track growth for these industries and how it affects Hydrogen demand. There was also discussion of provisions within the Inflation Reduction Act that are meant to encourage investment into Hydrogen research and infrastructure. Hydrogen is still a fledgling fuel with only a handful of H2 specific facilities scattered across the US, but with growing improvements to infrastructure to support it and being backed by government subsidies, this budding industry is one to watch.

Visualizing GPCM and G2M2 Results with Power BI

To follow up the presentation of GPCM12 and G2M213 Insights that was done last year, Scott McKenna and Ed O’Toole showcased new additions to the available data visualizations for both the North American and Global gas market. There was even a demonstration showcasing how combining data visualization tools with RBAC’s robust market simulators can help improve the speed and efficiency of market analysis.

One participant described the combination of PowerBI and RBAC’s robust gas market simulation tools as, “an incredibly helpful product and so much faster to compute scenarios.”

Extreme Geo-Political Events

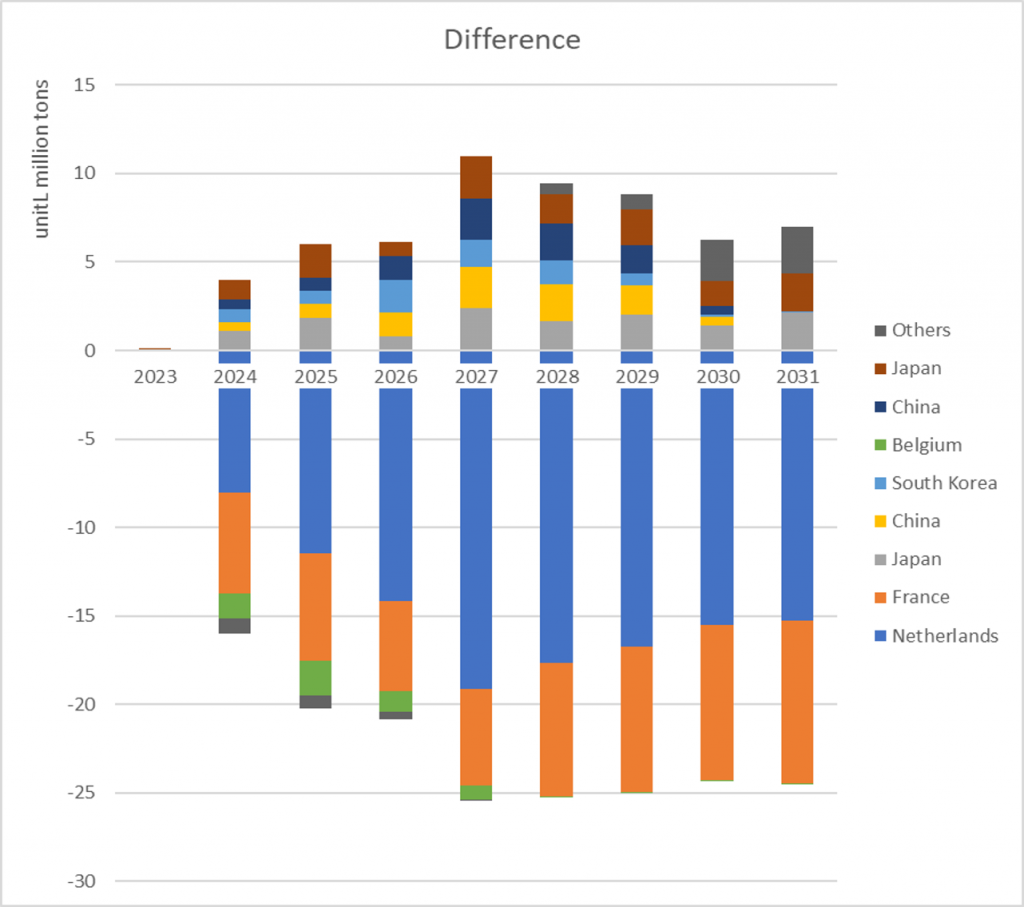

In this presentation led by RBAC’s very own global market analyst, Jiaxin Yang, we looked at the results of scenarios ran with G2M2 covering several potential events such as:

- Russia halting LNG exports to Europe

- the United States stopping LNG exports to China

- Nord Stream 1 and 2 coming back online

Ms. Yang showed what would happen; changes in supply, demand, and prices in each of these scenarios. Interestingly and in the case of Russia cutting off LNG exports to Europe in 2024, we found that it would not affect global gas production nor significantly decrease Russia’s overall LNG exports, in fact the LNG would be sent to Asia in the event Europe was no longer a buyer.

GPCM Workshops

There was a wide variety of hands-on activities, presented by our incredible GPCM team, Bethel King, Scott McKenna, and Robert Kachmar. These workshop sessions included overviews of supply, demand, infrastructure, and scheduling maintenance for LNG facilities. The purpose of the workshops is to help all GPCM users, both experienced and new, sharpen their skills and knowledge of GPCM; ever increasing their mastery to enable robust forecasts and analysis of the natural gas and LNG market, to the end of helping their organization make the very best energy decisions whether in trading, investment or its many other uses.

Future of RBAC Product Development

The future is bright for RBAC’s suite of market simulation tools which are constantly improving to better meet the needs of the industry and to help make informed decisions based on the potential future of the market. Our CEO and Founder, Dr. Robert Brooks discussed recent improvements to GPCM which included enhancements to the storage plan builder and source destination flows. Dr. Brooks also announced new features currently under development which include CO2 and CH4 emissions modeling and reporting, an LNG facility builder, and LNG export modeling.

Conference Summary

Although we could not briefly describe all that occurred in the conference in this short piece, we can say that overall, this conference was just as if not more successful than last year; indeed, RBAC would like to thank all who attended and especially give a special thanks to all of our presenters for providing their valuable insights into the current and future states of the natural gas and LNG market as well as sharing their expertise using GPCM and G2M2 market simulation software.

We hope that those who were already familiar with our market simulation tools and those who were just getting started were able to take advantage of this great learning experience and depart with not only increased knowledge of the global market but of the incredible benefits that RBAC’s market simulation tools offer towards forecasting these volatile markets and helping all make better energy decisions.

And we hope to see you again at our next user conference!

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

[1] RBAC User Conference Recap – RBAC Inc.

[2] Providing leading solutions for generations to come | AFRY

[4] Black & Veatch – Engineering, Procurement, Consulting & Construction Solutions (bv.com)

[5] GPCM Market Simulator for North American Gas and LNG – RBAC Inc.

[7] Africa: The Natural Gas Sleeping Giant – RBAC Inc.

[8] G2M2 Global Gas and LNG Market Simulator by RBAC Inc.

[11] EU Emissions Trading System (EU ETS) (europa.eu)

[12] GPCM Insights Visual Analytics for North American Gas & LNG – RBAC Inc.

[13] G2M2 Insights Visual Analytics for Global Gas & LNG – RBAC Inc.