LNG Market Trends and Growth

We are observing remarkable expansion and diversification within the global LNG market. It is projected that the market will grow from 400 million tons in 2023 to over 600 million tons by 2029. By 2032, it is expected to reach a peak of 658 million tons, which will then slightly decline to 613 million tons by 2050, averaging around 636 million tons between 2031 and 2050.

The growth in small-scale LNG applications is particularly promising, as it allows for the direct use of LNG in transportation fuel for tankers and trucks, electricity production, and industrial uses, without the need for regasification. These applications are typically transported in ISO tanks on trucks or in containers on small tankers.

The shift from coal to gas is a significant step towards reducing CO2 emissions, with methane combustion emitting 50% less CO2 compared to coal. However, we must also consider methane emissions within the supply chain.

To further green the LNG supply chain, there is increased focus on the development of Bio-LNG and Low Carbon LNG, as well as efforts to reduce venting and flaring. Additionally, utilizing green electricity for the processing of LNG is also being implemented in some projects.

In response to rapidly increasing LNG production, the industry is both expanding and modernizing the tanker fleet by, for example, replacing older tankers that use medium fuel oil with vessels powered by cleaner LNG or other alternative fuels. Such adoption of newer technology is expected to result in lower operating costs and reduced emissions.

Also Floating Storage Regasification Units (FSRUs) are becoming increasingly in demand. They offer a lower entry cost into the LNG market by eliminating the need for on-site storage and regasification infrastructure. They also enable quicker start-up times, serve as interim solutions while more permanent facilities are constructed, and provide more flexible response to local market demands.

Affordable Energy Leads to Energy Equity

Most will agree on the importance of promoting real energy equity through affordable clean energy access. Natural gas production often yields not only methane but also higher order hydrocarbons like ethane, propane, and butane, collectively known as natural gas liquids (NGLs). By combining propane and butane, one obtains LPG, which is instrumental in replacing traditional energy sources such as wood and dung for indoor heating and cooking. These legacy fuels have been found extremely harmful to respiratory health, particularly affecting women and children in households.

Climate Goals, Reliable Energy and Emerging Economies

The natural gas industry faces headwinds from climate activists who are pushing for an end to all fossil fuel use to achieve the Paris Agreement’s target of limiting global warming to 1.5°C by the end of the century. They are challenging the industry’s own strategy to replace coal with natural gas in power and industrial applications to reduce CO2 emissions. Activists argue that due to methane leakage in the supply chain, gas could be as detrimental as coal. This argument has gained traction with entities like the International Energy Agency (IEA), the European Union, and significant parts of the United States government. The U.S. government has recently paused the permitting of new LNG projects for sale to non-Free Trade Agreement nations, which comprise about 80% of the market. Consequently, these projects are unable to reach a final investment decision, casting doubt on their viability against international competitors.

In response, the industry has pointed to the lack of economically feasible solutions from the activists to address climate change. Proponents of natural gas and LNG point out that an advanced economy relies on dependable electricity and fuel for industry, which cannot be solely provided by renewable energy. Moreover, there is no clear pathway for the development of long-term batteries needed to deliver power during the frequent periods when solar and wind are not available.

At CERA Week in April 2024, a strong consensus emerged that fossil fuels, particularly natural gas and LNG, will be necessary for a more gradual energy transition. The re-emergence of nuclear energy as a key component of a reliable electricity delivery system has also gained acceptance among stakeholders in the discussion on climate.

Furthermore, the developing world, especially Sub-Saharan Africa, has been increasingly assertive in demanding the right to develop and utilize their own fossil fuel resources to grow their economies, rather than being compelled by external forces to adopt renewables. This stance underscores the need for a balanced approach to energy development (and energy finance) that respects the aspirations and rights of emerging economies.

Geopolitics and Disruptions

Since 2022, the geopolitical landscape has been profoundly impacted by the Russian invasion of Ukraine, leading to a significantly changed global natural gas and LNG market. The conflict led to a substantial reduction in Russian natural gas flows to central and western Europe. The previously agreed transit of 40 billion cubic meters (BCM) through Ukraine was slashed to less than 15 BCM. Additionally, Nord Stream 2 pipeline, with a capacity of 55 BCM, was sanctioned and remained unused, and then the Nord Stream 1 pipeline was sabotaged, cutting off another 55 BCM per year from Russia to Europe. In total, Europe has lost at least 80 BCM of Russian natural gas supply annually, and the remaining 15 BCM transiting through Ukraine is expected to cease by the end of 2024.

The conflict between Israel and Hamas has also disrupted the natural gas supply, particularly affecting Egypt’s ability to receive gas from Israel’s offshore fields in the Mediterranean. This has halted the potential for further cooperative development between Israel and Egypt, such as supplying gas for Egyptian LNG export facilities. Consequently, Egypt is experiencing an energy shortfall due to decreased production from its own fields, like the Zohr field, and diminished imports from Israel. Egypt has had to bring back an FSRU to its LNG import facility in Ain-Sokhna to address its unexpected gas shortage. The FSRU will be in Egypt from May 2024 through Feb 2025.

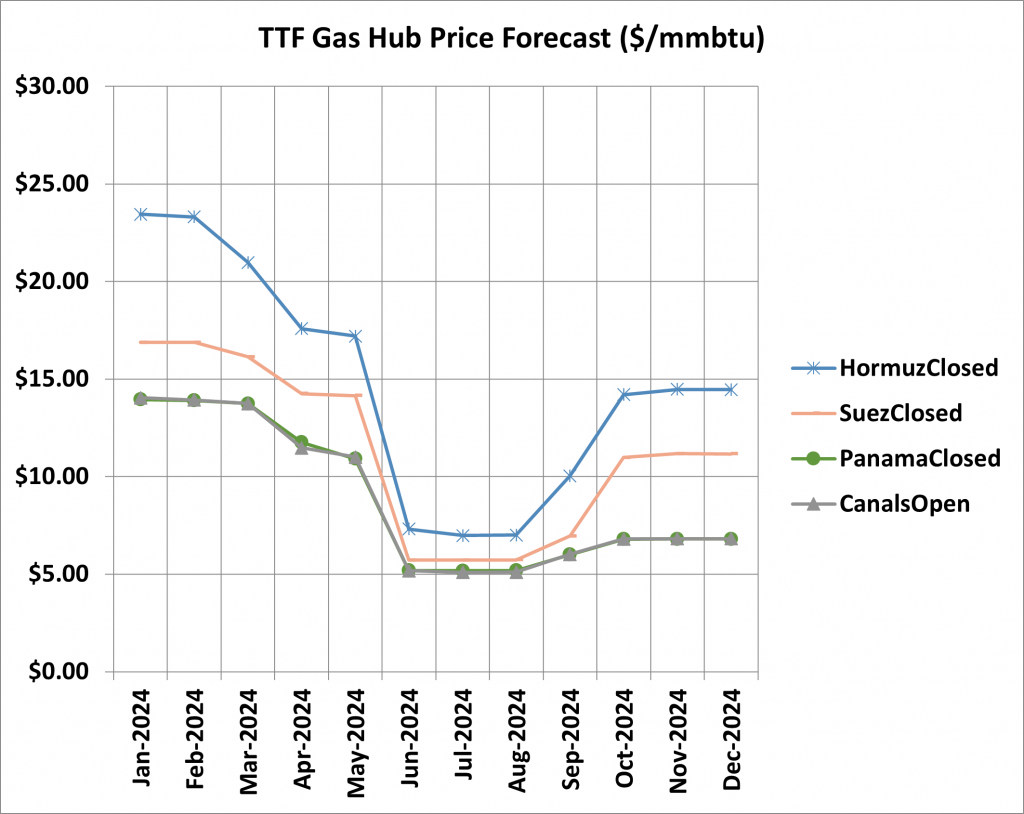

Moreover, Egypt’s revenue from Suez Canal transit fees has plummeted due to attacks on tankers by the Houthis in Yemen. These attacks have forced almost all LNG tanker traffic to be diverted around the Cape of Good Hope instead of risking passage through the Red Sea and Suez Canal. This rerouting increases the maritime distance for routes from Belgium to Shanghai by approximately 75%, significantly affecting both transit time and costs.

In addition, low water levels in Panama have led to longer transit times and fewer crossings between the Atlantic and Pacific Oceans. Some LNG tankers that originated from the US Gulf Coast and previously used the Panama Canal for Asian routes have now been redirected around the Cape of Good Hope. It is important to note that both the Suez Canal and Cape of Good Hope routes from the US Gulf Coast to Asia are considerably shorter than the route around South America via Cape Horn or the Strait of Magellan.

In Summary

The global LNG market is transforming. The projected growth and diversification signal both increased importance in the fuel as well as a need for versatility and increased awareness of environmental impact. Small-scale LNG applications offer a direct and efficient use of resources; the industry’s measures to reduce methane emissions could well demonstrate a commitment to environmental stewardship. Despite challenges from climate activists and geopolitical upheavals, the natural gas sector remains resilient, and modernizing fleets and integrating FSRUs reflect this. Such adaptability and achievement of greater affordability across the globe will not only improve industry longevity but also contribute to the broader goal of energy equity and just economic development in emerging economies everywhere.

As the world navigates complex currents and sometimes tumultuous seas, one thing is clear: natural gas and LNG will continue to play a pivotal role in shaping the global energy future, balancing environmental concerns with the imperatives of economic development and energy security.

RBAC, Inc. is a leader in building market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The G2M2® Global Gas Marketing Modeling System™ is designed for developing scenarios for the converging global gas market. It is a complete system of interrelated models for forecasting natural gas and LNG production, transportation, storage, and deliveries across the global gas markets. For more information visit our website at http://www.rbac.com.

Cyrus Brooks contributed to this report.

1: G2M2 InsightsVisual Analytics for Global Gas & LNG – RBAC Inc.

2: Why Trucks Should Consider Switching To Liquefied Natural Gas – Forbes India Blogs

3: LNG ISO tank: Best guide to types & sizes [+2022 best price] (container-xchange.com)

5: What is bio-LNG and how is it made? – Nordsol

6: Electrification of platforms – Equinor

7: The Outlook for LNG as a Marine Fuel (maritime-executive.com)

8: How FSRU’s are impacting LNG market evolution – Timera Energy (timera-energy.com)

9: Typical Composition of Natural Gas | Download Scientific Diagram (researchgate.net)

10: Household air pollution (who.int)

11: Ibid

12: Has the Energy Transition Been Cancelled? – RBAC Inc.

13: CERAWeek 2024 Takeaways – RBAC Inc.

14: Africa: The Natural Gas Sleeping Giant – RBAC Inc.

15: Nord Stream 2 Gas Pipeline – Global Energy Monitor (gem.wiki)

16: Nord Stream Gas Pipeline – Global Energy Monitor (gem.wiki)

17: 2023 Statistical Review of World Energy – Energy Institute

18: Egypt’s Gas and LNG: Global Challenges and Global Ambitions – RBAC Inc.

19: What Would Happen if a Major Waterway were Closed to LNG tankers? – RBAC Inc.