Forecasting Monthly Price Spreads at Natural Gas Trading Hubs

by Robert Brooks, Ph.D.

and Ning Lin Ph.D.

Summary/Conclusions:

Since 2020, RBAC, Inc., and Refinitiv, a London Stock Exchange Group (LSEG) Business, have collaborated on the production of an annual sensitivity study of price behavior at three major gas trading hubs: Henry Hub in North America, TTF in Europe, and JKM in Asia. Gas prices in these markets are largely dependent on demand which are driven by weather especially in winter months. The purpose of this on-going annual project is to better forecast gas prices at these three important hubs in spite of this difficulty in predicting weather and, hence, in predicting demand.

The key to the project is not to attempt to make a single point forecast for these prices, but rather to compute a distribution of prices which reflects the behavior of markets under a variety of weather forecasts. In other words, the project uses a sensitivity study approach to forecast monthly price spreads at these hubs.

The major conclusion is that this approach yields credible price spreads for these three hubs over the three-year time horizon of the analysis. Prices during the 2021-2022 winter season will continue to be record-breaking in Europe and Asia and much higher than recent winters in North America. Prices will decline sharply once the winter season is over and will rise modestly in winter 2022-2023. The summer-winter price spreads in 2022 and 2023 are predicted to be much more narrow than what the market has seen in 2021-2022.

Background:

Natural gas is used in several economic sectors: residential, commercial, industrial, electricity generation, and transportation. Because gas is used in space heating, demand for its use is highly dependent on weather, especially temperature. This is particularly true in residences, commercial establishments, and industrial facilities with heavy space heating requirements during winter seasons. Electricity generation can also be weather-dependent in markets having a heavy air-conditioning load. In addition, many markets in advanced economies have two or more means for generating that electricity. In these cases, gas demand in the electricity sector is often price sensitive. The higher the gas price, the lower the demand, all other things being equal.

Liberalization of markets for natural gas began in the 1980’s in North America and has since spread to other markets, most notably countries in Western and Central Europe. A feature of such markets is the creation of natural gas trading hubs for commodities trading and to use as benchmarks in contracting. A number of such price hubs have sprung up in North America, but by far the most important of these has been the Henry Hub. This continues to be true even as North America becomes more integrated in the global gas market. A large percentage of North American LNG export capacity is located on the US Gulf Coast near Henry Hub and many LNG supply contracts include Henry Hub in their pricing terms.

Europe has also spawned many gas trading hubs (called virtual trading points), but only a few of these are liquid. In the past, the primary trading hub was the National Balancing Point (NBP) in the UK. However, more recently, the Dutch Title Transfer Facility (TTF) located in the vicinity of the Gate LNG import terminal in the Netherlands has overtaken NBP to become the favored trading hub for Europe.

Market liberalization has lagged in Asia. China has implemented reforms that might be called “liberalization with Chinese characteristics” but the lack of pipeline-interconnections and cross-border trade has hampered the creation of Asian gas trading hubs. In their absence, the S & P Global Platts Japan-Korea Marker (JKM) has become the de-factor indicator for LNG spot and futures prices in Asia.

Aims:

The principal aim of this work to develop and prove out methodologies for conducting credible and useful sensitivity studies regarding natural gas market prices in a global context using industry-best gas demand forecasts and market simulation tools.

Methods:

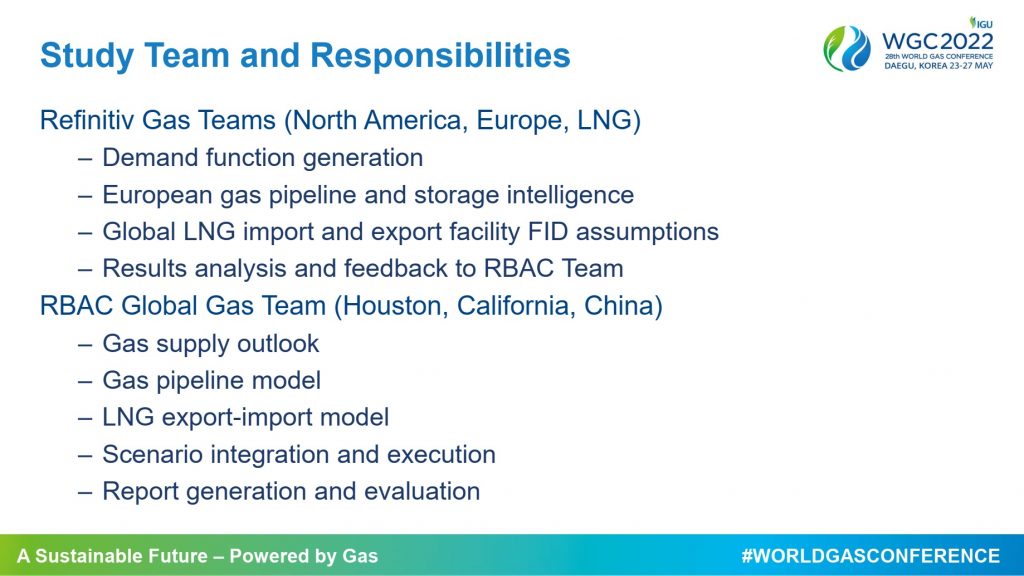

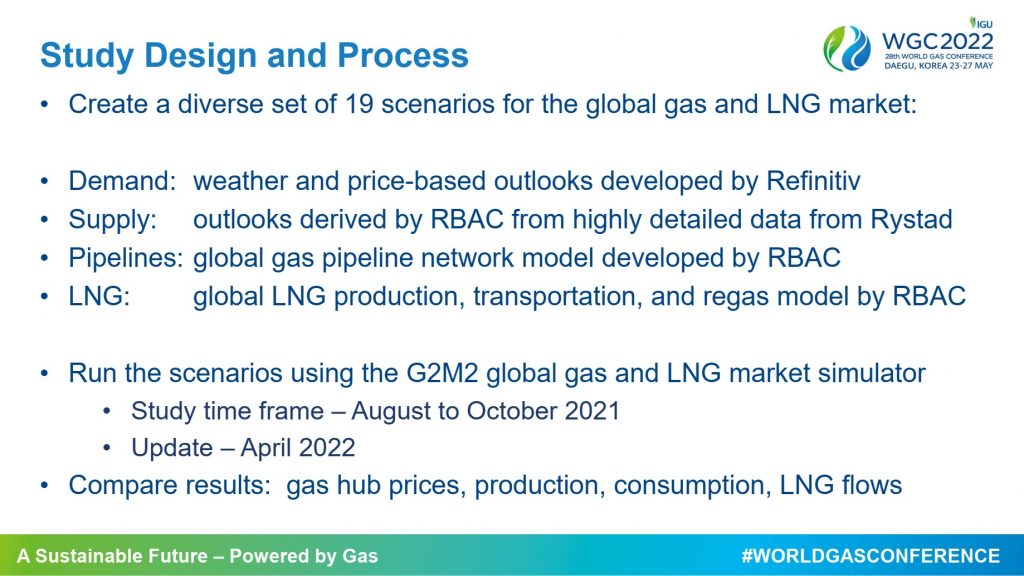

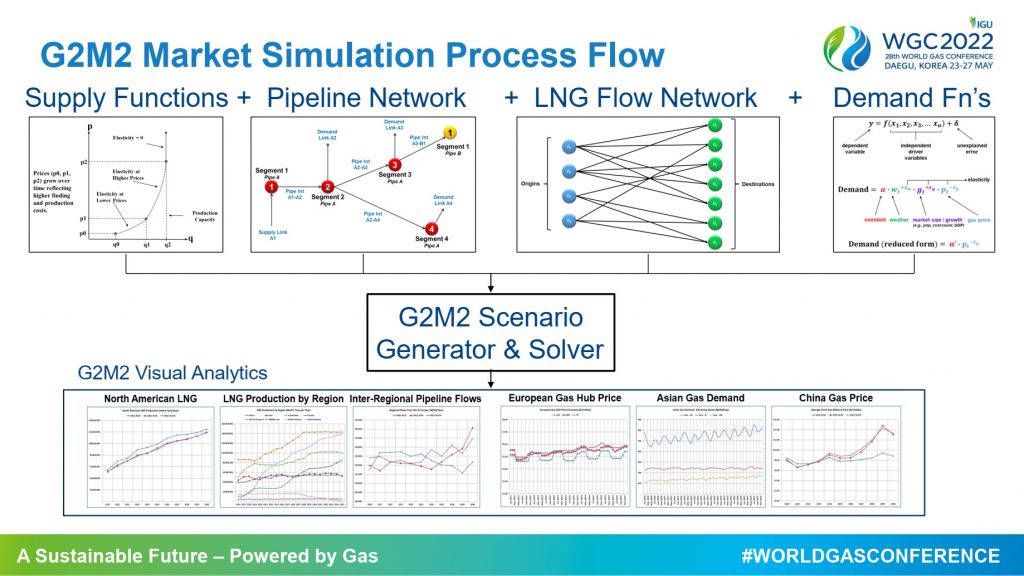

Using 19 sets actual weather conditions in the years 2000-2018, combined with economic drivers and conditions expected for the forecast period 2021-2024, Refinitiv has provided a set of demand outlooks for key countries by electric and non-electric sectors, differentiated by its price elasticities, across three LNG market, Europe, East Asia and North America of a total 16 countries[1].

RBAC incorporated these demand functions into its GPCM North American and G2M2 global gas and LNG market simulators and then generated 19 sets of demand curves. Besides the customized demand, this database comprises several pieces: supply curves for each country for each month of the forecast; a detailed database describing the global gas pipeline grid with capacities, costs, and interconnectors; a detailed database of LNG import and export terminals, LNG tankers, and LNG supply contracts with capacities, costs, and tanker routes; and, finally, a set of demand functions for each country, sector, and month. For this study, we substituted Refinitiv’s 19 demand cases for the one in the RBAC 2021 Quarter 2 case, creating 19 different scenarios.

Using the batch feature we ran these scenarios in parallel to produce 19 sets of results. Scenario output consisted of gas and LNG activities such as production, transport, storage, and consumption, as well as market prices for all countries and at Henry Hub, TTF, and JKM.

Results:

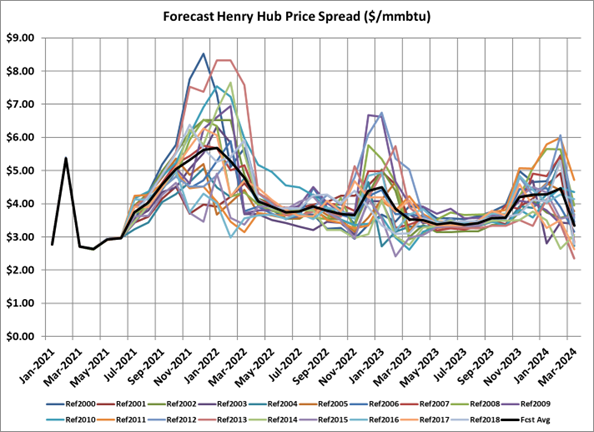

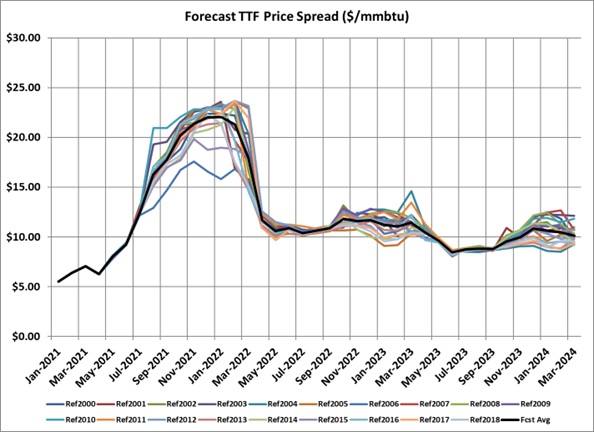

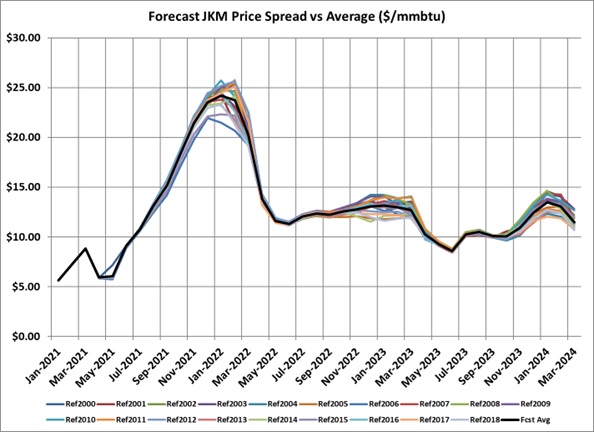

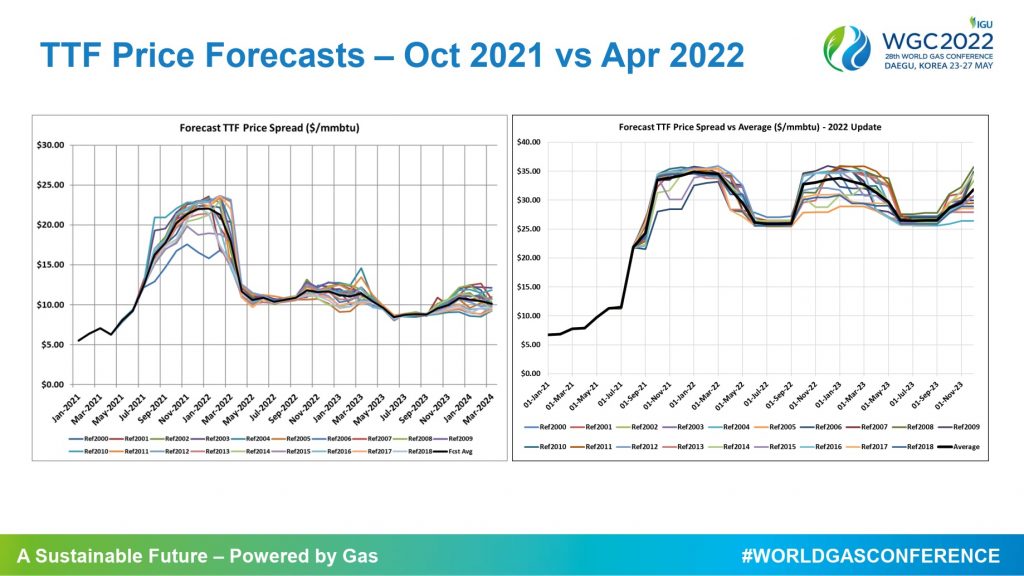

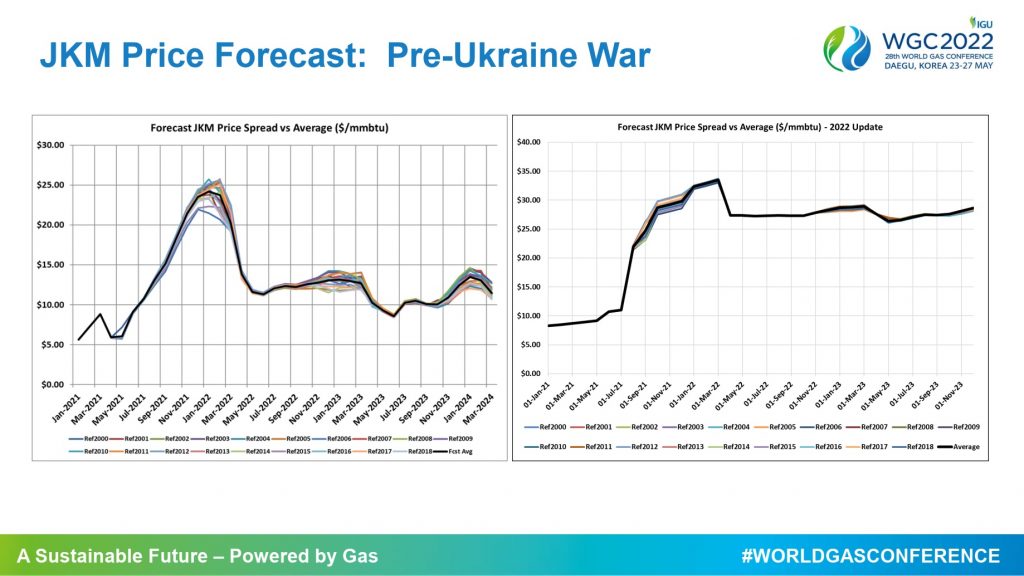

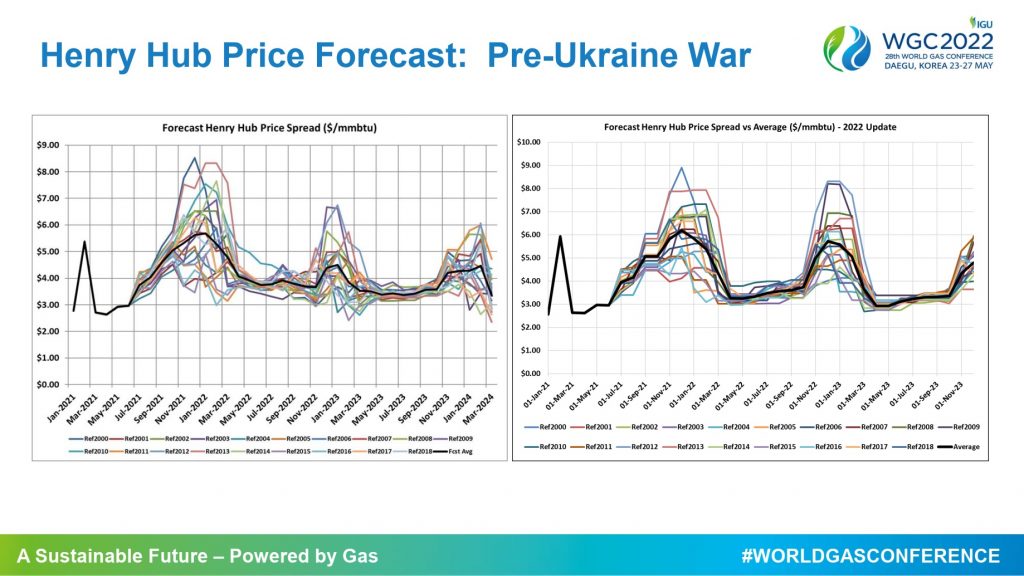

Below find charts containing the principal hub price results from the study.

It is interesting to note that Henry Hub prices appear to be both much lower but also much more sensitive to the weather. The price spread computed using the 19 different demand cases appears to be much wider than that of TTF and JKM. However, this is only true proportionally, not in absolute terms. The spread for Henry Hub is actually about $4 in winter 2021-2022, but it is more than $8 for TTF. The spread for JKM is also about $4, but is much narrower as a percentage than either Henry Hub or TTF. This is probably due to the fact that for Asia the electric power sector is by far the largest consumer of gas. Thus, total demand is much less sensitive to weather and the variance in Asian demand functions is much lower than that for North America and Europe.

Henry Hub

TTF

JKM

[1] Austria, Belgium, Czech Republic, France, Germany, Ireland, Italy, Netherlands, Poland, Slovakia, Spain, United Kingdom, Japan, Korea, United States and Canada.