Turkmenistan: Struggles with Emissions but Potentially a Bright Future

Turkmenistan’s Struggles with Emissions This coming November, the annual United Nations Climate Change Conference (COP 28) will be taking place. This conference will be focused on carbon capture, utilization, and storage. Turkmenistan has recently been facing pressure from the international community in regard to its significant contribution to methane emissions and it would not be […]

Global Natural Gas Outlook – Is it too soon to be hopeful?

In three short years, Natural Gas and LNG markets have gone through enormous turmoil: a two-year Covid-19-pandemic-induced natural gas demand slump, a labor and supply chain breakdown, and a demand-rebound energy crisis further exacerbated by Russia’s invasion of Ukraine and the subsequent sanctions placed on Russia, all with varying degrees of impact across the different […]

Bangladesh’s Worst Power Crisis in a Decade

Due to unpredictable weather and a currency that is rapidly declining in value, Bangladesh is experiencing its worst power crisis since 2013. So far in 2023, the country has been forced to cut power for 114 days, compared with 113 days in all of 2022. That’s because of the loss of 2.9 GW of natural […]

Haynesville and Marcellus: A Tale of Two Shales

Over the past two years, the oil and gas industry has seen record profit for producers, geopolitical conflicts, supply chain disruptions, inflationary and ESG pressures and a war to boot. A quote from A Tale of Two Cities comes to mind, and sums up quite nicely our recent circumstances: “It was the best of times, […]

Do Energy Security and Economics “Trump” All?

Back in 2018 at the United Nations General Assembly, then United States President Donald Trump cautioned, “Germany will become totally dependent on Russian energy if it does not immediately change course.” Following that warning diplomats and other foreign leaders were seen laughing at the idea. Kremlin spokesman Dmitry Peskov reportedly said at the time, “Supplies […]

California Energy Prices – When Things Break

Source: Adobe Stock California is certainly a state of extremes. It experienced extreme drought (leading to a low hydro year) and had extensive flooding later in the same year. Winter weather was cold, and parts of California were buried under a 50-year high snow just last week. One should expect some variance in energy prices […]

Could Mexican Natural Gas Infrastructure have prevented the disastrous impacts of Winter Storm Uri?

At the recent Mexico Infrastructure Projects Forum in Monterrey, Mexico, both government and private sector attendees came together to voice their concerns over deficiencies of Mexico’s energy supply chain, using Winter Storm Uri as “Exhibit A” to drive the point home. During Uri, pipeline deliveries of natural gas dropped dramatically, as shown in Figure 1 […]

Natural Gas Prices are Down, But for How Long?

What Goes Up Must Come Down… 2022 was a turbulent time for natural gas prices, not only in Europe, but in North America as well. Monthly Henry Hub prices settled over $8/MMBtu twice, and over $7/MMBtu for five months straight, driven largely by geo-political uncertainty and whipsaw market fundamentals. Prices that had not been seen […]

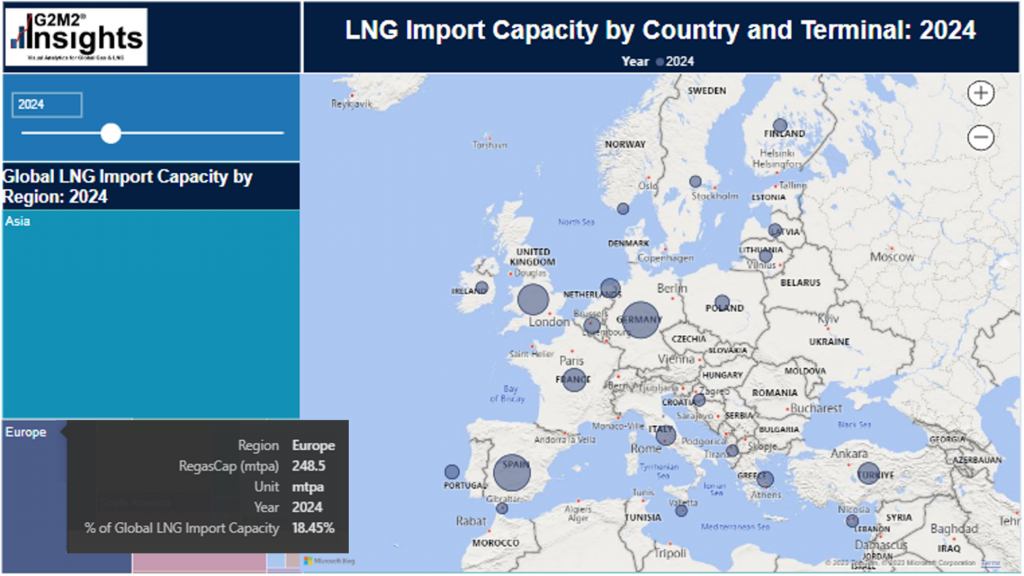

LNG Flow Scenarios Under Energy Transition

The natural gas market has been at a critical moment of change in recent years. This study first highlights the trends, uncertainties, and challenges faced by the global gas market from the LNG value chain to macroeconomics, then further address the question: what will this mean for the global gas market and LNG trade going […]

What do the Cowboys and Lower 48 Natural Gas Production have in Common?

Hard Work. Consistent, diligent, hard work (along with a little help from your friends) makes winning look easy. The American Football Cowboys’ running back tandem, Tony Pollard and Ezekiel Elliot, trampled the 8-1 Vikings, scoring four total touchdowns. Their success was made possible by a terrific offensive line. Similarly natural gas producers in the South-Central […]