Natural Gas and LNG Center Stage in 2023

With the end of the pandemic announced and most of the world back into production, natural gas maintained its predominance over the world being the great “balancer”, whether as LNG in making up for lost flows in Europe or in many areas where renewables paired with the firm power provided by natural gas and with less emissions.

Natural gas discoveries dotted the globe with 6% happening in North America, 14% in Latin America and the Carribean and 77% in Asia, including a late find of upwards of 6 TCF off Indonesia.

With COP28 finished and even more of the world in transition, 2024 will be a year to look out for both advances in gas in new areas of the globe, changes in flows and more activity on new energies coming into the mix.

Here at RBAC are excited for the challenges that await us in the new year, our latest newsletter showcases our newest articles from this past month analyzing two different scenarios regarding China’s economy and LNG facilities in the gulf, as well as the state of both Argentina’s and Mexico’s natural gas industry.

In addition to our normal monthly articles, we also have a short commentary highlighting recent sanctions to Russia’s Arctic LNG 2 project. And to celebrate the coming new year, we have selected some of the top articles and highlights from this past year in this newsletter and review.

Enjoy.

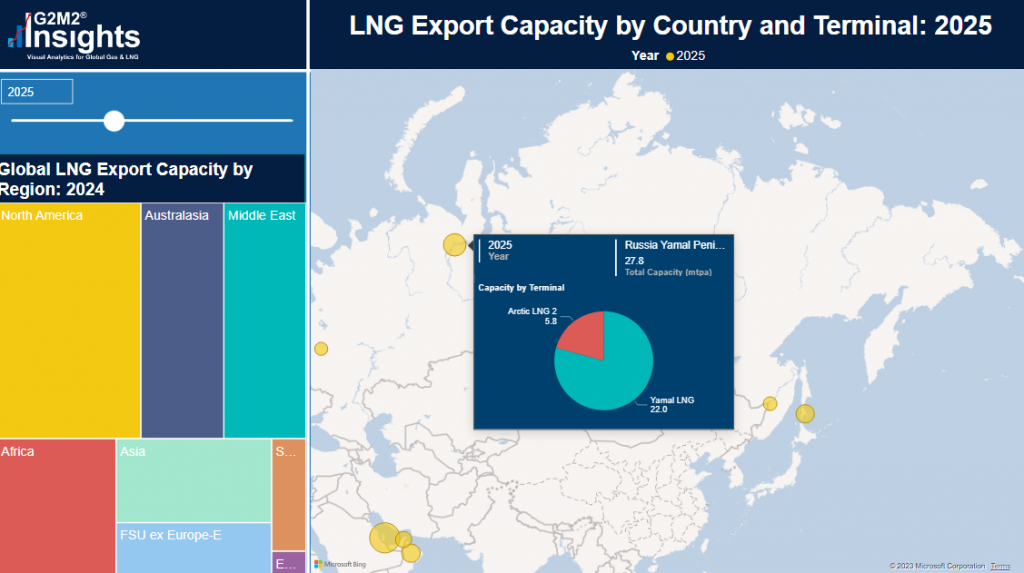

Quick Brief - Russia's Arctic LNG Plans Frozen

Last month the United States imposed new sanctions on Russia which among other provisions, included sanctions to Russia’s energy industry. This includes the Arctic LNG 2 terminal that is currently under construction in Siberia. This project was meant to help offset the loss of pipeline gas exports to Europe and open a new path to markets in Asia.

However, with foreign shareholders suspending their involvement in the project, their is growing uncertainty on how the project will be financed and if it will even be able to fulfill off take contracts. Since the project reached FID in 2021, the cost of the project has ballooned from an intial $10.7 billion USD to $25 billion as of June 2023, an astonishing increase of more than double the initial cost.

The project was planned to consist of 3 trains each with 6.6 mtpa worth of capacity for a combined 19.8 mtpa. Even if the project were to meet the deadlines outlined during planning, delays are being caused by a lack of available LNG tankers which will not finish their construction until 2024.

December Articles & Media

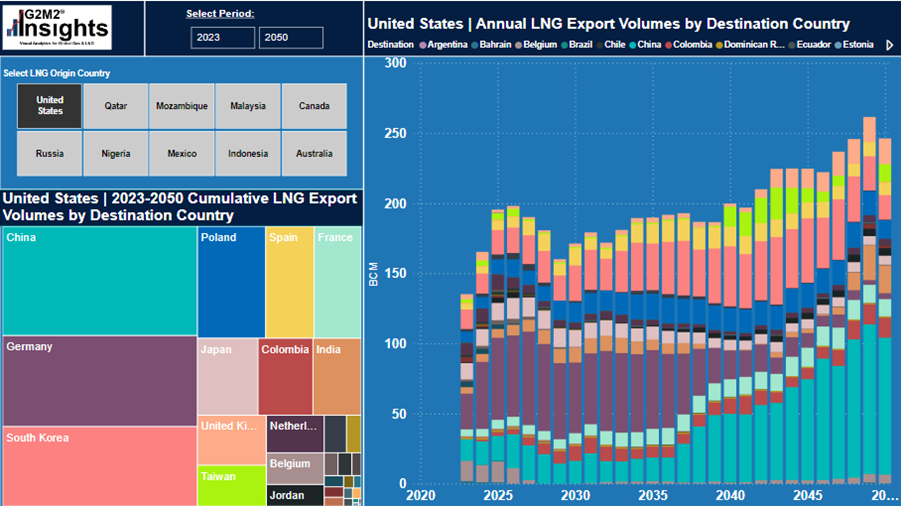

A China Slowdown’s Influence on Global LNG

“The analysis of China’s potential economic slowdown and its cascading effects on the global LNG market reveals intricate and dynamic interdependencies. The most significant finding is the sensitivity of LNG imports to economic conditions, particularly in China, and how these conditions can instigate substantial shifts in global energy flows.”

Read: “Global Waves: Navigating the Ripple Effects of China’s Economic Tide on LNG Markets“

If Hurricanes Strike LNG Terminals

“Three scenarios; simulating a 30-day, 60-day, and 90-day suspension of LNG exports out of the Gulf as well as corresponding reduction in offshore natural gas production from the Gulf. We will look at pricing impacts to major pricing hubs, to production, as well as how storage acts as a buffer.”

Vaca Muerta’s Shale Gas Opportunity

“Argentina has the second largest shale gas reserves in the world; with a new president having to face the dark clouds of rampant inflation and economic chaos, could their natural gas be the silver lining they are looking for?”

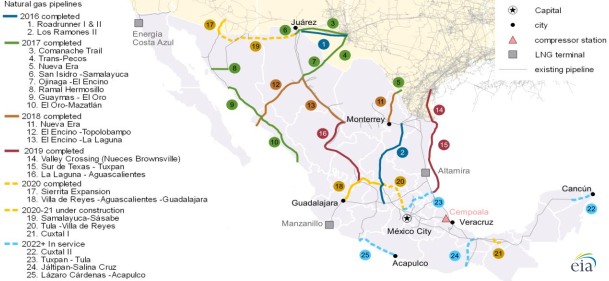

Mexico’s Evolving Gas Industry

“While it is great for Mexico that they have a supplier they have friendly relations with, it is important from an energy security standpoint to not be reliant on a single source for nearly your entire energy supply. We all saw the turmoil and strife that Europe underwent when gas from Russia was cut off.”

Top Stories in 2023

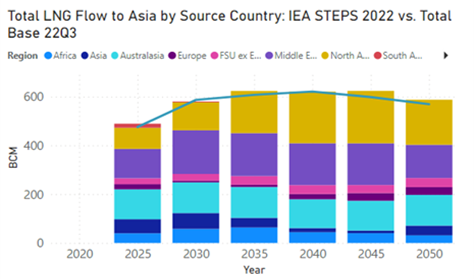

How Will LNG Flow During the Energy Transition?

“Scenario planning is used to identify different implications on LNG trade flows. IEA published the world energy outlook in late October, and this time’s publication presented three scenarios that describe the distinctive pathway of the future energy system.”

A Positive Global Gas Outlook

“There is a lot to be hopeful about in the global gas and LNG markets… Actions taken by the industry as well as some, albeit apprehensive, support by regulatory bodies has led to potential long-term solutions utilizing natural gas and LNG.“

Read “Global Natural Gas Outlook: Is It too soon to be Hopeful?”

LNG Supply Uncertainty in Australia

“What would be the effects of the strike if it was a full work stoppage that lasted for anywhere between a few months to all the long into the winter? We used the G2M2® Market Simulator for Global Gas and LNG™ to estimate the potential effects of the strike and where the countries who relied on Australian LNG would then potentially seek alternative supply.”

The Natural Gas Sleeping Giant

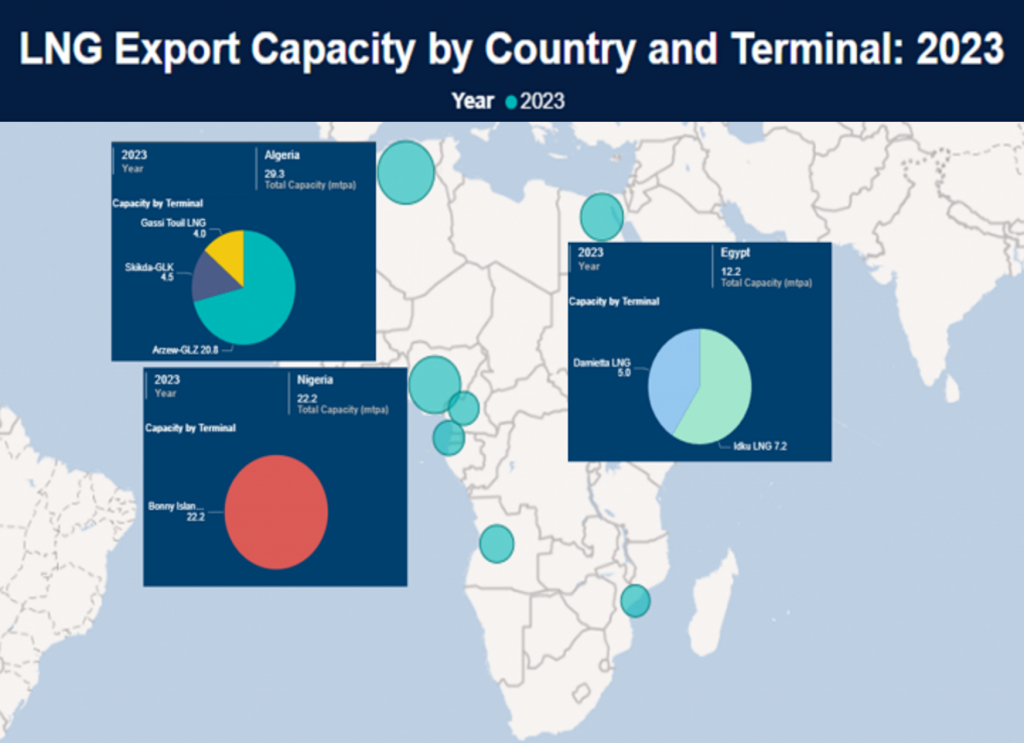

“If Africa can properly develop their natural resources, they will be able to strengthen their position in the global energy supply chain and provide affordable energy not just for their people but to the entire world.”

Is Progress Actually Being Made Towards the Energy Transition?

With Trillions invested in the energy transition, what results are in so far? What has been the effect on demand for fuels such as natural gas and energy access and reliability?

Conferences in 2023

We had the pleasure of attending and speaking at several this year to share knowledge and hear from other experts. We were also pleased to hold our own conference in Galveston this year which was a resounding success.

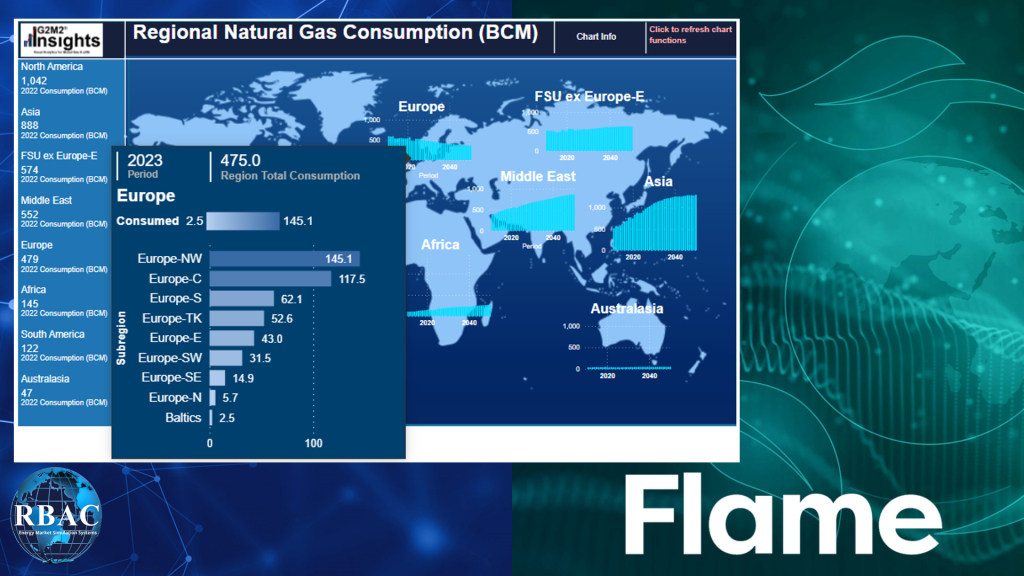

Flame Conference

The conference made it clear that natural gas and LNG will continue to play an important role in the energy transition, but will European companies and governments commit to long-term infrastructure investments or contracts?

Read “Flame Conference 2023”

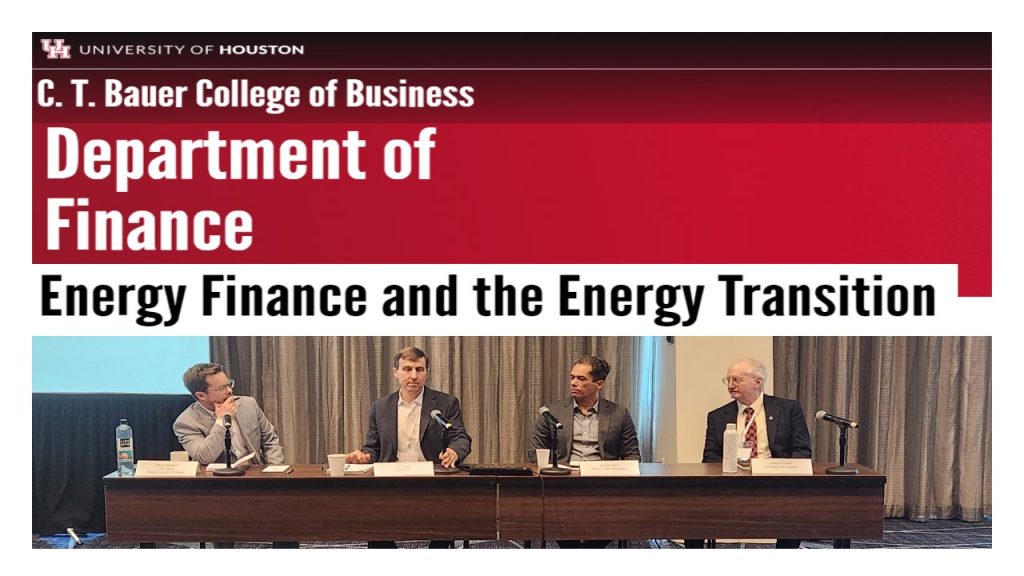

Energy Finance and the Energy Transition

“Energy Industry professionals, Economists and Finance professionals of Academia assembled in Houston… Covering finance, economics, markets and energy, there were some interesting topics for everybody.”

LNG 2023

With LNG playing a pivotal role in global energy security, the world converged on Vancouver, Canada to bring together the movers and shakers of the energy industry to lay the groundwork for the future of LNG. RBAC was on the ground and here are some of the top insights from LNG2023.

Read “LNG2023 Conference Takeaways”

Africa Energy Week

“Africa Energy Week was huge. With thousands of attendees at the 5-day event, and multiple concurrent sessions, here are some takeaways from the continent which is the size of the U.S., Europe and China combined, and which is blessed with abundant oil, natural gas, and minerals.”

2023 RBAC Annual Gas & User Conference

“Everyone was happy to see colleagues and energy industry leaders from across the natural gas and LNG industry as well as some new faces who were attending our conference for the first time and were eager to learn the ins and outs of RBAC’s natural gas market simulation tools.”

Read “2023 User Conference Recap“

RBAC, Inc. is the market leading supplier of global and regional gas and LNG market simulation systems. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used gas market simulation system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ is designed for forecasting gas and LNG production, transportation, storage, and deliveries across the global gas markets. These systems provide industry analysts powerful tools for supporting corporate investment and M&A strategy, achieving environmental and sustainability goals, risk analysis and trading.

© 2023 RBAC, Inc. All rights reserved. GPCM and G2M2 are registered trademarks owned by RT7K, LLC and are used with its permission.